Out of 100 taxpayers, 90 must have paid their GST in the wrong head at some point of time in the past. Thus, it is a common question among the taxpayers, whether the GST is paid under the wrong head can be adjusted?. Well, in the past there was only one option i.e to ask for a Refund. However, in the month of April 2020, the GSTN has enabled the PMT 09 online application, wherein the taxpayer can transfer or shift the wrongly paid amount to the correct head. Thus, in this article, you will learn everything you want to know about the application on the GST portal. Further, the GST Council has assured the taxpayers to bring necessary changes in the system, to facilitate the taxpayers. Thus, we think that the introduction of this facility is one of them.

Quick Navigation

- Introduction

- Why Transfer Wong paid GST?

- Meaning >> Format >> Applicability

- Rules >> How to file online >> After filing >> FAQ

Why Transfer the Wrong paid GST?

There were various situations when the taxpayers deposited the tax in wrong head. Here are some of the possibilities of this error.

- Technical Glitches on portal

- Taxpayers not fully familiar with different heads for payments.

- Confusion in filling details in Challan while making payment

- Wrong assessment of tax liability like CGST, SGST and IGST

Therefore, once the tax gets credit in the wrong head, the only option remains is to ask for GST Refund through RFD 01 application. However, the refund may take a long time and thus the taxpayer’s money gets block till the receipt of this refund. Also, the taxpayer can not utilize the balance for tax payment which is transferred to the wrong head. For eg. the interest payment must be credited in the interest head only. The taxpayer can not use the CGST/IGST/SGST credit amount to setoff the interest portion. Thus, the PMT 09 is the best alternative for speedy adjustment and transfer them in the correct head.

What is PMT 09 in GST?

The PMT 09 is an online application enables the taxpayer to make intra-head or inter-head transfer of amount available in the Electronic Cash Ledger. Thus, a taxpayer can file the GST PMT-09 online for transfer below type of payments from Major to Major or minor heads.

- Any amount of tax

- Interest

- Penalty

- Fee

- Any other available under one major or minor head

Further, the challan provides flexibility to taxpayers to make multiple transfers from more than one Major/Minor head to another Major/Minor head. However, this is applicable only for the amount available in the Electronic Cash Ledger only. Thus, the taxpayer now can rectify the wrong payment using this challan/application by transferring the amount from one head to the another one.

PMT 09 Format(pdf)

You can download the Format of PMT-09 in pdf by clicking on the below button. The PMT-09 format contains minor and major heads fields. Therefore, the taxpayer can specify the tax amount which he wants to transfer from one head to another.

However, the amount can be transferred only, if the balance is available in that particular head at the time of transfer application. Thus, a taxpayer can provide his GSTIN and fill the details online in Table 5. The taxpayer shall fill in the details of the amount to be transferred from one account head to another in this form.

Applicability of PMT 09

Any GST Registered taxpayer is eligible to transfer the balance credit amount available in the electronic cash ledger. The online facility to use PMT 09 was made live on the GST Portal in the month of April 2020. After, login, the taxpayer can find this option under the electronic cash ledger tab.

Further, the rules related to this application came into force from 21st April 2020 having CGST notification reference no. 37/2020 – Central Tax dt.28.04.2020.

PMT 09 Rules in GST

The sub-Section 10 & 11(49) of CGST ACT 2017 defines the provisions of PMT 09. Here how it reads:

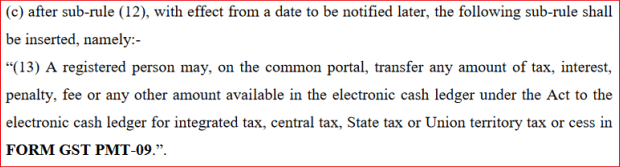

Similarly, the rule 13 of 87 of Central Goods and Service Tax Rules defines how to use PMPT 09. Here is the screenshot of the said rule inserted vide Notification No. 31/2019 –Central Tax dt.28.06.2019.

How to file PMT 09 in GST portal?

Follow the simple process for filing PMP 09 application to transfer electronic cash balance from one head to another one. Here is the step by step guide.

1.Got to GST portal (Click to go)

2. Login with your user id and password

3. Go to Services > Ledgers > Electronic Cash Ledger option

4. Click on the File GST PMT-09 For Transfer of Amount option

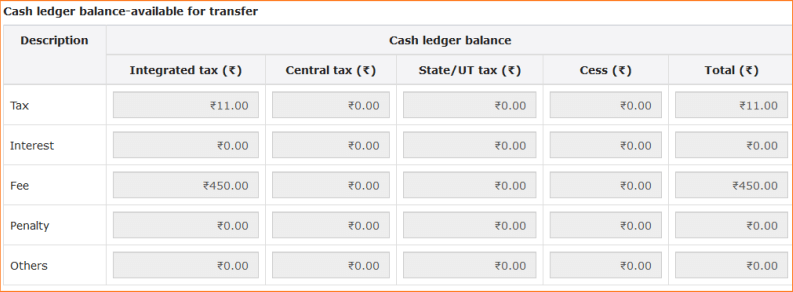

5. You will see the available balance in your electronic cash ledger.

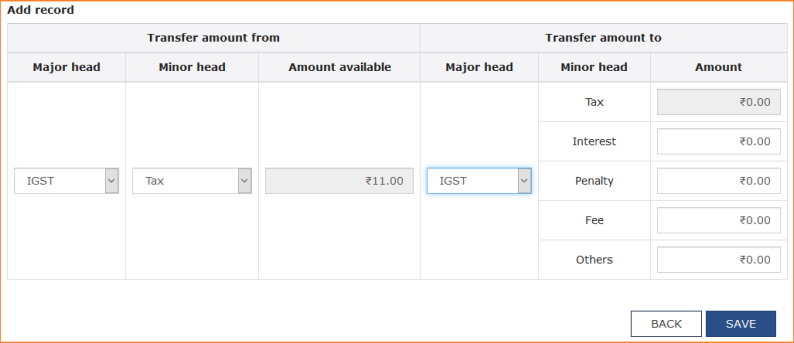

6. Click to ad record and enter the details in “Transfer Amount from” to “Transfer Amount to” field.

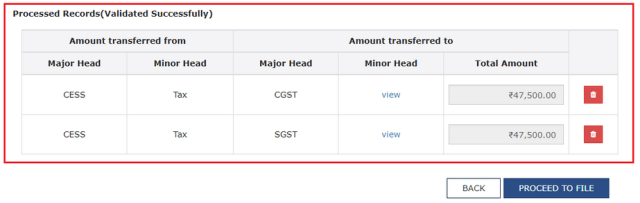

7. Click on Save. Select again to ad more records.

8. you will see the “processed records” window with added records.

9. Click on “Proceed to File” button.

10. File the application with DSC or EVC.

11. After successful filing of an application, you may also view the filed application.

12. To view the filed application, Go to Services > Ledgers > Electronic Cash Ledger option >>Click View Filed GST PMT-09 option.

Procedure after filing PMT 09

As soon as the taxpayer files the PMT 09, the ARN will be generated in the form of acknowledgment. Thereafter, the system will send an SMS and an email to the taxpayer on his registered mobile and email id.

Further, in due course of time, the system will update the electronic Cash ledger with necessary changes. Similarly, the taxpayer will able to download the filed form in PMT-09 in PDF format. That’s it and the taxpayers can utilize the tax payment for the correct head as soon as the system updates the electronic cash ledger. The best thing about this process is, it is completely online and the taxpayer need not have to visit any office to submit an application.

Frequently Asked Questions

The taxpayer can transfer the cash balance from one head to another.

Yes

The major heads consist of Central Tax, State/UT tax, Integrated Tax and Cess.

The Minor heads includes Tax, Interest, Penalty, Fee and others.

Go to Services > Ledgers > Electronic Cash Ledger > View Filed GST PMT-09 > DOWNLOAD GST PMT-09(PDF) on the GST portal.