If you are a salaried person earning an income from salary or practicing a profession such as chartered accountant, company secretary, lawyer, doctor, etc. then you are liable to make payment of profession tax. However, this is state-specific, which means if you are in the below list of states, then profession tax is applicable to you.

List of States Collecting Profession Tax

As of 01.03.2022, Punjab, Uttar Pradesh, Karnataka, Bihar, West Bengal, South Delhi, Andhra Pradesh, Telangana collects the profession tax. Similarly, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, Jharkhand, and Sikkim also collect tax on the profession.

Profession Tax in Maharashtra

The Profession Tax in Maharashtra is managed by the Maharashtra State Tax Authority. Thus, the Government of Maharashtra collects the professional tax as per the Employment Act, 1975. The said ACT came into effect on 1st April 1975. Therefore, according to this act, profession tax is applicable for both individuals and companies.

Read >> Mahagst Login Website

Who Pays Profession Tax in Maharashtra?

In the case of employees, an employer is responsible to deduct and pay professional tax. Also, the employer needs to register and obtain both a professional tax registration certificate and a professional tax enrolment certificate to be able to deduct the tax from his employees and pay.

Profession Tax slab For FY 2021-22

Below are the Profession Tax slabs for the state of Maharashtra. These rates are applicable for FY 2020-21 and FY 2021-22.

| Monthly Salary | Profession Tax Payable in Rs. |

| Up to Rs.7500 | Nil |

| Rs. 7,501 to Rs.10000 | Rs. 175 per month |

| Above Rs. 10000 | Rs. 200 per month except for the month of February. For the month of February, it’s Rs. 300. |

Women earing up to Rs.10,000 per month | Exempted |

How to Pay Professional Tax online?

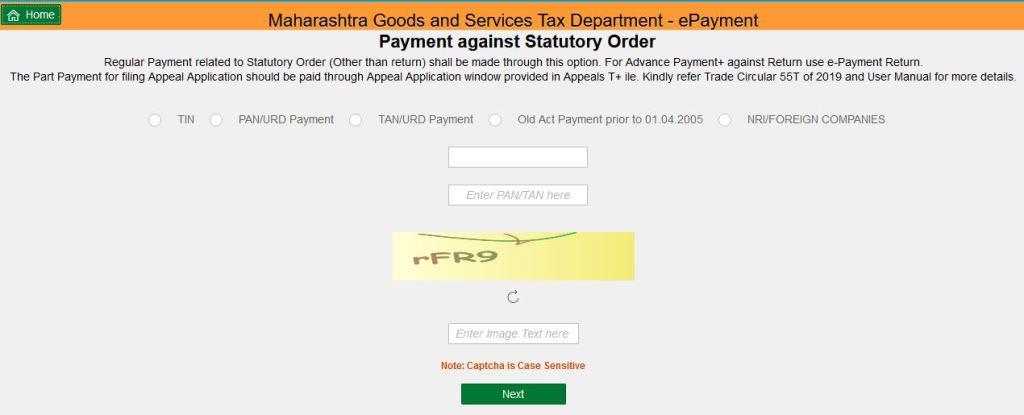

Follow the below steps to make the payment of professional tax in the state of Maharashtra.

- Visit – https://mahagst.gov.in/en/payments

- Select TIN No. – Type your PT Number, fill in necessary details for PTRC payment

- Proceed for Payment of Profession Tax ( PTRC ), select bank details, and proceed

- The webpage will take you to the next page

- Now select your Bank

- Make the payment using net banking.

Profession Tax in Karnataka

The Profession tax is levied by the Karnataka State Government. It applies to salaried employees and individuals. However, the employees working in an organization like a factory will also have to go through the professional tax registration process.

In Karnataka, Profession tax registration is mandatory within 30 days from the date of appointment of employees and within 30 days from the commencement of practice for business and professionals.

Tax Slab for Karnataka

The Karnataka State Tax on Professions, Trades, Callings and Employment Act 1976 charges professional tax as per the below slabs:

| Monthly Salary | Tax Payable in Rs. |

| Up to Rs.14,999 | Nil |

| More than Rs. 15,000 | Rs. 200 per month |

Further, working Professionals like Corporations, Hindu undivided families (HUF), Firms, companies, and other Corporate bodies with a monthly income of above Rs.1000 need to pay professional Tax.

However, the professional earning less than Rs.10000 need not require to pay professional tax to the Karnataka Government. Thus, a maximum amount of Rs.2400 is payable as professional tax in Karnataka.

It is a Direct tax collected by the State Governments on salaries and professions like chartered accountants.

yes

In the first year of registration within 1 month, thereafter 30th June of every year.

Interest is 1.25% of the tax payable and the penalty is 10% of the tax due.

Similar Links

How to make GST Payments?

The GST registered person must do the online payment of GST due by the 20th of Next month. Read to know how to make GST payments online?