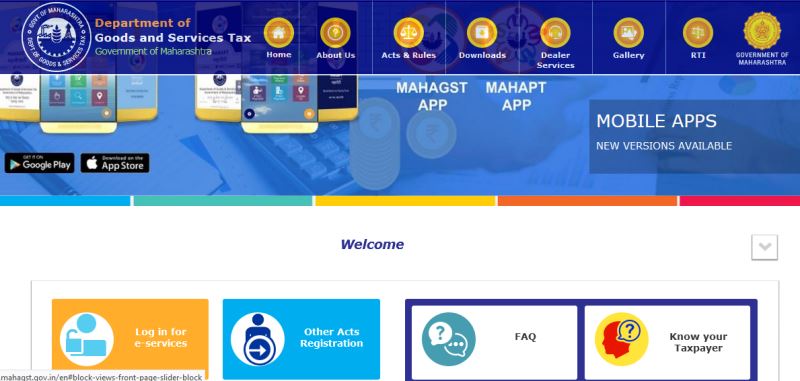

Www.mahagst.gov.in is an official website of the Maharashtra State Government. You can perform various GST and vat related activities after signing in at the mahagst login website. However, you can perform only limited activities related to GST on this portal. The activities include VAT e-payment, registration, download registration certificate, etc. Similarly, if you want to log in to the gst portal, you need to visit below Central government portal of GST.

Related: www.gst.gov.in Central Government GST Website

About Mahagst.gov.in Portal

The MAHAGST.GOV.IN website was launched for the benefit of the GST taxpayer based in Maharashtra state. This is an initiative taken under the digital India platform by the Maharashtra government for the taxpayer. Thus, taxpayers in Maharashtra can use the mahagst.gov.in website or app for using the available e-services.

Registration at Mahagst Login

Learn how to make a registration of a New dealer at the Mahagst login website. A taxpayer can also make a TCS and TDS type of registration on www.mahagst.gov.in. Here are the steps for registration.

Time needed: 15 minutes

- Open the website www.mahagst.gov.in

This will display the home page of the Mahagst.gov.in website

- Scroll down the website and click on “Other Acts Registration”

- Click on “New Dealer Registration”

- Now click on New Registration under various acts

The process list will display on the screen as to how to make the registration.

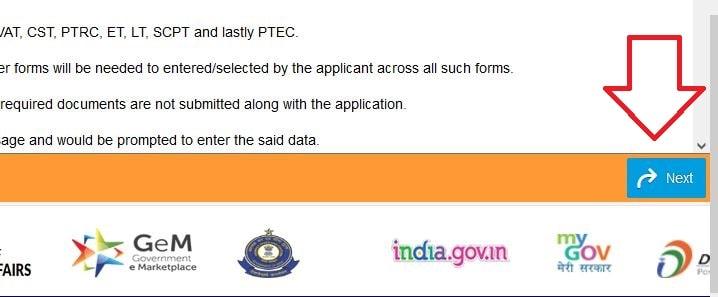

- Scroll down below till you see the “Next” button. Now Click on Next as shown below.

- Click on New Dealer >> Next

- Follow the Registration process that appears on the next screen.

How to Create Profile for New system?

1. You can create your profile by clicking on “Log in for e-services” and then by “Profile for Registered dealers” from the home page.

Note: Click on ‘Registered Active Dealer‘ if you have an active registration certificate under at least one of the acts administered by MSTD. If you have only an active registration certificate under PTEC and not under any of the other acts administered by MSTD then Please visit ‘https://mahagst.gov.in’ and click on ‘New Dealer Registration’. Also, if your PAN is not allowed there for the creation of a temporary profile, then go through ‘Registered Dealer’.

Further, if your registration is not active or canceled, then you may click on “Registered In-Active / Cancelled Dealer” to follow the steps and create the profile.

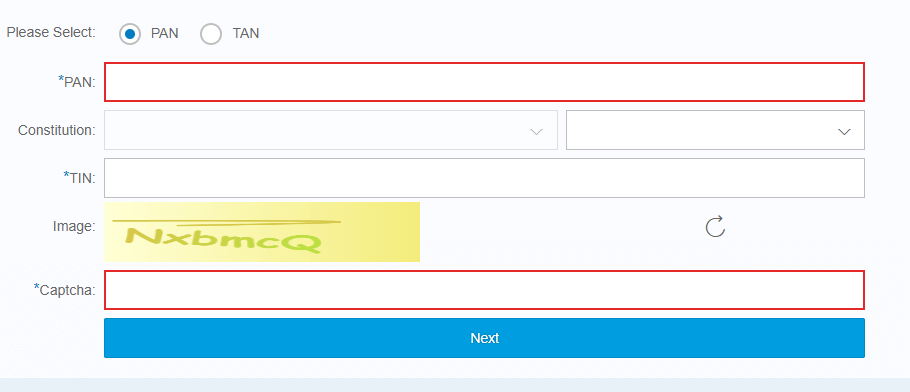

2. Next step is to enter the below details and follow the next process to complete the profile creation.

Profile Creation Issues and solutions

Q. 1 – Profile Activation Link is not received or doesn’t work:

Answer 1: All mails are in sent status from MGSTD. You will receive the link. If the link doesn’t work then click on the link received through the mail. Alternatively, you can copy the entire link correctly and paste it into the internet browser. This will resolve the issue.

Q. 2 – Mismatch of PAN & TIN combination

Answer 2: Enter your PAN and TIN correctly. If the PAN was not submitted earlier, now you can submit your PAN details to create your SAP User Id and Password.

Q. 3- Profile already exists in the system

Answer 3. If you get the above error, then use your existing user id and password and there is no need to create a profile again. However, If you have forgotten the password then use the functionality of resetting the password.

Q. 4- My Password doesn’t work:

Answer 4. If the password doesn’t work, then please clear your internet browser cache and try again. If you still face the password error, then use forgot password utility and reset the password by entering answers to security questions.

Q. 5- Can not Reset the Password

Answer 5. Follow the steps given to create the temporary password which needs to be replaced with your own existing Password.

Q. 6- I Forgot the Security Answers

Answer: 6

- Make a call to the Helpdesk number 1800 225 900.

- Take the new Service Request Ticket Number.

- The system will send the temporary password on the e-mail Id given by you while raising the Service Request Ticket Number/registered e-mail Id.

- You will be required to replace the temporary password with the password you want to use.

GST Login for Maharashtra State

Since www.gst.gov.in is central govt. website for all the states, you need to visit this website. For eg., you need to register for GST through this website and thereafter you need to file GST returns also through this website only. You can not make GST registration and file returns on the maha gst gov in website.

Therefore, a taxpayer will find the register link on mahagst.gov.in. Thus, a taxpayer will get a user id and password after registration from the link given on mahagst.gov.in.

Read: How to login & check status at GST portal?

What is the Maharashtra GST code?

The state code of Maharashtra State is 27. Therefore, the GST registration number of Maharashtra starts from digit 27. For eg. If x has made registration on the GST portal, his GST number will start from 27 and will look like this 27AABCC2947D1Z4.

Related: Complete List of GST state code in India.

You may explore more features of this website by visiting the actual website.

How to make e-payments at www.mahagst.gov.in?

Follow the below steps to make the e-payments of CST and VAT related on the mahagst login website.

1. Visit the website at www.mahagst.gov.in.

2. Click on an e-payments tile

3. Now select the appropriate option from the list as stated below.

- e-Payment – Returns

- Return/Order Dues

- e-Payment – Assessment Order

- PTEC OTPT Payment

4. Follow the online steps on the next window by entering the details.

Read more: Profession Tax in Maharashtra

FAQ On Mahagst Login

www.ewaybillgst.gov.in is the website for generating e waybill.

www.mahagst.gov.in is the official website of the Maharashtra State govt.

Go to www.mahagst.gov.in website >> Acts & Rules >> Goods and Service Tax

Go to www.mahagst.gov.in >> E-payments >> Select type of payment

Call: 1800 225 900. You may also visit the website >> About us >> Click on “Contact us”

Related Articles

GST Login id & Password at GST portal

The taxpayer must log in to the GST portal to access certain features. Therefore, one needs to have a valid username and password. The user id and password can be obtained by registering on GST Portal. more

einvoice1.gst.gov.in

www.einvoice1.gst.gov.in is the official website of the government for generating e-invoice. Read to know how to register on the e-invoice portal for generating online invoices. more

Online GST Registration guide

The online GST registration is completely free of charge. The applicant needs a computer and working internet connection to initiate the online application filing process. more

GST Return filing on GST portal

The regular taxpayer needs to file GSTR 1 and GSTR 3b on monthly basis. Subsequently, he needs to file an annual return and reconciliation statement online. more