The Form 26AS is an Annual Information statement under Income Tax. The Form 26AS shows various data details like Tax Deducted and Collected at Source, Advance Tax, and Self – Assessment Tax. Similarly, it also displays the specified financial transactions like demand, Refund Pending, and completed Proceedings for a taxpayer’s PAN as per the Income-tax database.

A taxpayer may pay tax in the form of Tax Deducted at Source (TDS), Tax Collected at Source (TCS), or Advance Tax or Self-Assessment Tax. Therefore, it becomes necessary to go through form 26as before initiating filing your income tax return.

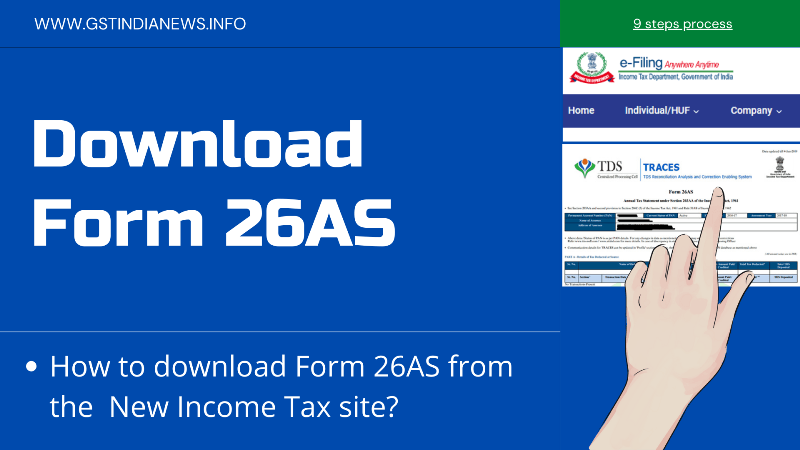

How to download Form 26AS from the Income Tax site?

In order, to download the form 26as from the new income tax site, follow the below steps.

Time needed: 5 minutes

- Visit www.incometax.gov.in

- Log in with your user-id

You can enter PAN, Aadhaar number, or Other User ID. You may need to register, if already not registered.

- Enter your password on the next screen

- Click on “e-file” >> Income Tax Return >> View form 26AS

You will get to see this menu once you reach your dashboard after successful login.

- Read the Disclaimer and click on “Confirm” to visit the TRACES portal

After clicking on the confirm, the system will take you to the TDS-CPC Portal.

- In the TDS-CPC Portal, Click on Agree to the acceptance of usage. Click ‘Proceed

In the TDS-CPC Portal, Click on Agree to accept the usage. Click ‘Proceed

- Click the View Tax Credit (Form 26AS)’ link

You will find this link at the bottom of the page

- Select the ‘Assessment Year’ and ‘View type’ (HTML, Text, or PDF)

- Click ‘View / Download’

To export the form 26as in PDF, view it as HTML > click on ‘Export as PDF’.

You may also, see the below video taken from youtube and download your form 26as as shown in the above steps.

Income Tax Related Links

New Income Tax site www.incometax.gov.in

Read to know about the new income tax portal for filing your income tax returns of AY 2021-22. Read more about the income tax website.

Latest News on Income Tax

Know the latest news and updates from income tax in India. Return filing extensions and much on income tax updates.

DSC registration in Income Tax site

Follow the 8 steps guide to register your DSC on the new income tax portal. Read more about the requirements of DSC registration.

PAN not Matching with income tax database

While registering for GST, you may see the error “PAN not matched with CBDT database”. Follow the steps to resolve the issue of PAN not matching.