Since the enrollment application went live, many issues, one particular issue that has been reported in significant numbers was pertaining to PAN validation error while applying for GST registration. After submitting the application user gets the below email from the GST portal:

This is in reference to the Application for Enrolment of Existing Taxpayers submitted at the GST portal. It is observed that the details of the following PANs are not matched with the CBDT database. Kindly fill in the details as per PAN details and resubmit the Form. Details of the PANs are as under:

1. (mismatched PAN)

2. (mismatched PAN)

In view of the above discrepancies, the Form is considered incomplete. Please resubmit the Form with the correct details.

In short, it says the PAN card data that you have entered on the GST portal does not match with the CBDT(Central Board of Direct Taxes) database. whereas the user says they have entered the data as per the PAN card only.

What is CBDT Database?

The CBDT database means the “Central Board of Direct Taxes” database. Thus, the CBDT database’s full form is “Central Board of Direct Taxes”. This is the database where every individual PAN card details are stored in the Income-tax records.

Thus, whenever any website connects to an income tax database for verification of PAN card details, the Income-tax site checks its record to know, whether the details received are matching with its existing records or not. If the details do not match then the website where you entered the details will say CBDT database pan mismatch, PAN does not exist, and CBDT database mismatch.

PAN not matched with CBDT database – Solution:

We are providing herewith a simple solution to this problem. It is possible that the name that appears on your pan card is slightly different than on the income tax database site. Therefore first try to find out what is there in the database:

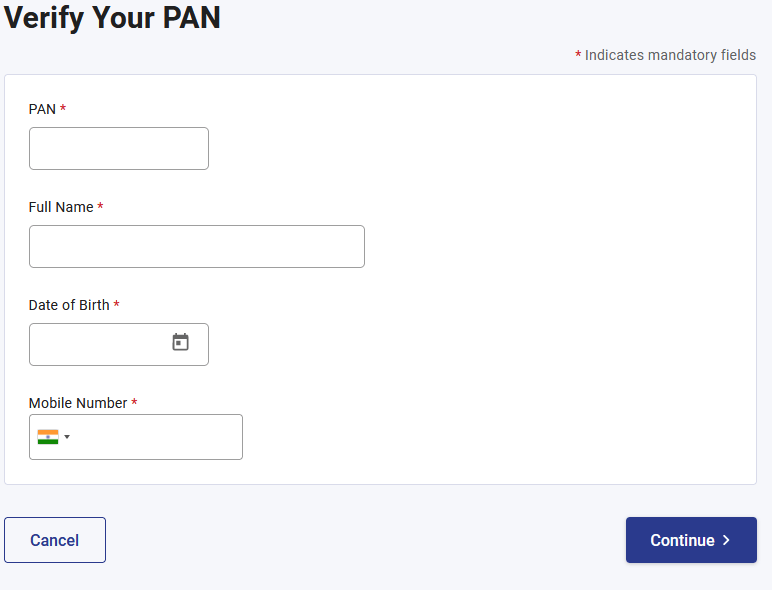

1. Go to the Income-tax e-filing site (Click here)

2. Click on “Verify your PAN details” (click here)

3. Enter your PAN Number, Full Name, Date of Birth, and Mobile Number and Click on Continue.

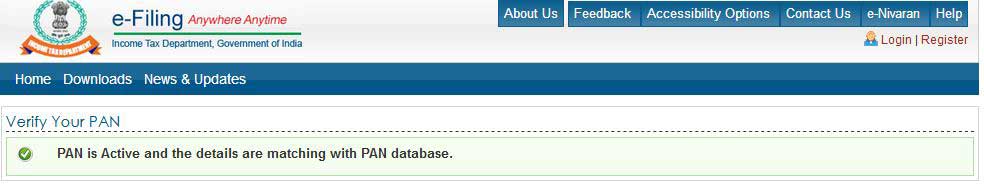

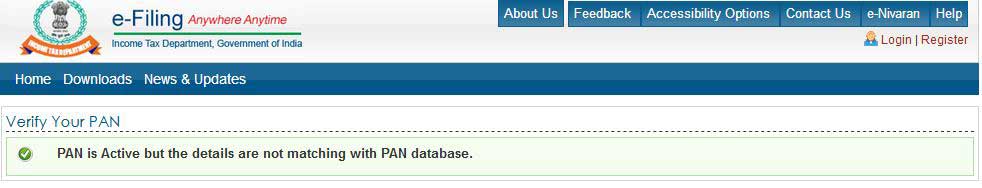

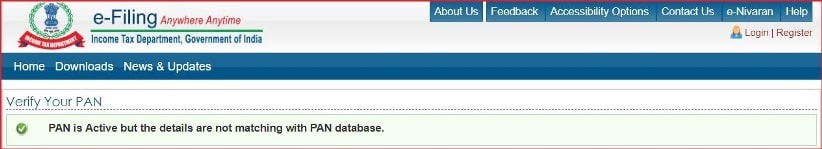

4. If the details entered above are matching with the income tax database, then you will see a “PAN is Active and the details are matching with PAN database“. On the other hand if not matched, then you will see a message saying Not matching.

How to write full Name?

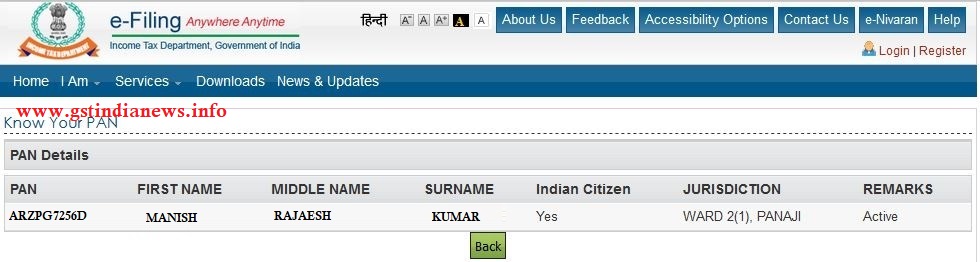

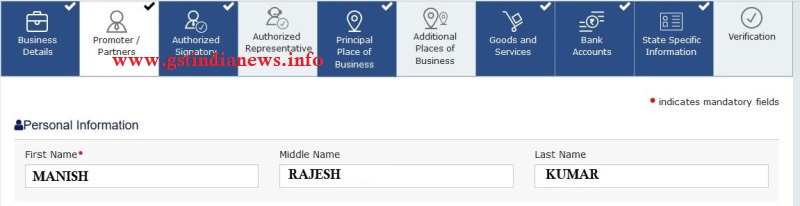

Ans: Please see the below format for entering the full name. You must enter the first name in the first place, the middle name in the second place, and the surname and the third place. For eg. in the below scenario, the Full name is Manish Rajesh Kumar.

Therefore if your PAN card is printed with all three names then you should enter them in the same sequence. In case your PAN does not contain a middle name then do not enter it on the website.

5. Enter the date of birth, Status, and Captcha code, and hit the submit button.

6. If you have entered the correct details, you will see the below screen which states your data matches with the income tax database. Therefore you should enter these details in the same sequence on the GST portal.

7. If you see the below message then it is clear that you are not entering the details as per the database of income tax. Therefore try entering the correct details till you see the above message.

The above details are stored in the income tax database in the following manner. However, the income tax site does not display this data in the following manner. Therefore the only way is to verify the PAN details as explained above.

8. Above details exist in the CBDT database. Now check your information entered on the GST portal. kindly ensure that the data entered on the GST portal must match exactly as above in the CBDT database like First name, Middle Name, and Surname. For eg., if the middle name is blank on CBDT then you should keep the middle name blank on the GST portal also.

Once you match your data as per the CBDT, a PAN error should not arise on the GST portal. If you are still facing the same issue then contact your PAN card center and request them to verify the details. It might be possible that your PAN card did not print all details as in the income tax database.

Please write in comments if still, the problem persists. we will try to resolve if any further issues arise related to this article.

PAN is active but the details are not matching

If you ever come across the error “pan is active but details are not matching with income-tax database” then follow the below steps.

Time needed: 5 minutes

- Open your filed income tax return(ITR) of the previous period.

- Check how the Full name is printed on the front page of the ITR

- Check the mobile number and date of birth printed on this return

- Enter the details accordingly on the GST portal

We tried to find a possible solution for this error. We found that there is nothing you can do, beyond this from your end. Therefore we request you to call on the below customer service number of NSDL or write an email to them. Kindly provide the PAN/15 digit Acknowledgement number, whenever you coordinate with them. We hope that after receipt of your query they will resolve it from their end.

| Helpline No. 020-27218080 | Email: customerservice@nsdl.co.in / tininfo@nsdl.co.in |

PAN Details Not Matching CIN/DIN With MCA Database

You may face the below error in 2024 on the GST portal.

PAN details are not matching with income-tax database or cin/din not matching with mca database or aadhaar not matching with aadhaar database. email sent with details of error. please rectify and re-submit form on portal.

The above error occurs because now the GST portal verifies your GST registration Data with MCA, Income Tax, and UIDAI portals also. Therefore, you must ensure that the details entered are the same on all these portals. In case there is a variation of details on any portal, you will have to amend and update your details, so that whenever the GST system communicates these details with the above portals, the data can match.

Similarly, you may also face the error “seems cbdt services are unavailable for pan validation, request you to please try after sometime. if the problem persists, please contact helpdesk.”

This may happen because the system may be busy or the server is down currently. Hence you need to wait until the problem is resolved. Please note that you can not expect that the portal will flash the message that the income tax server is down or the MCA site is down. However, it is a known fact that such errors occur due to server issues.

Important Links

Unable to connect to the installed emsigner

Resolve common errors like “unable to connect to the installed emsigner” . The system asks the taxpayer to close any other application running on the following ports 1585, 2095, 2568, 2868, 4587. Also, it says to restart the system and try again. more

Emsigner download

Know how to download emsigner for MCA, GST, and Traces to use with DSC signing. The emsigner utility is completely free. Hence, it can be downloaded without paying any fees. more

GST No Search

The GST Portal has provided a free online utility to search the GST number of any taxpayer registered under GST. The utility allows searching the GST number by entering the PAN details of the customer. more

Calculate GST Tax with Formula

Check out the GST calculation formula in the excel sheet. You may also download the excel file to compute tax liability. The utility allows entering ITC and tax details. more

GST Payment online process and status

Learn how to check the GST payment status online. Know how to generate an online challan for payment. more

About “PAN not matched with CBDT” error

This article will resolve the cbdt database validation error on the GST portal. You may search this article by typing “cbdt database GST”, “how to validate pan in cbdt database”, “cbdt database pan verification” or “cbdt database pan details” from search option. Learn how to validate pan and legal name in cbdt database or pan and legal name validating with cbdt database solution.

Subscribe to our latest post to receive GST updates as of the date in your inbox.

Very useful article. This helped me to resolve my issue. Thanks very much.

please check data entered in compulsory fields matches with PAN card details. Above article should resolve your issue. I suggest you to go again thoroughly through this article.

Dear Sir,

We are facing an issue with miss match in enrollment of existing taxpayer submitted at GST portal. it is observed that details of the PAN are not matched with CBDT database.

Give me suggestion for the above said.

Thank You,

Shilpa

CHECKED AS PER INSTRUCTIION

FISRT NAME – NOTHING IS THERE

MIDDLE NAME – NOTHING IS THERE

SURNAME – KNDILEEP

ACTUAL NAME K N DILEEP

WHAT TO DO PLEASE ADVISE

please email above both screen shots of “your information” at admin@gstindianews.info

regards

Admin

I HAVE CORRECTLY ENTERED ALL THE DETAILS AS PER PAN ….BUT STILL IT IS SHOWING VALIDATION ERROR….PLEASE HELP

Please note that PAN validation services with Income-tax database may get affected due to peak filing period of Income-tax return resulting in delay or validation errors while filing registration application.

notmacth

Thank you! It’s working for me. I was enter firstname firstletter of middle name and last name as per mentioned in PAN card. For ex. AYSHA M BHATT. It’s not working. So I have gone know your PAN and enter details and I got my detail. There was full name of middle name{father name). For Ex. AYSHA MANISHBHAI BHATT. So, I have entered fullname in ‘Legal Name of the Business (As mentioned in PAN)’ field and it’s working.

Hi! I could have sworn I’ve visited this website before but after looking at a few of the articles I realized

it’s new to me. Anyways, I’m certainly happy I came

across it and I’ll be bookmarking it and checking back regularly!

I am facing valitation error, already checked in e-filling its correct and match with gst but valitation error came

Only sure: PALANI & No first, midle, and last name.what i do next pls help me…

Greate pieces. Keep posting such kind of info on your site.

Im really impressed by your site.

Hi there, You’ve done an incredible job. I’ll certainly

digg it and individually recommend to my friends. I’m

confident they will be benefited from this site.

DEAR SIR

I GOT EMAIL FROM GST PORTAL

PAN MISMATCH ERROR WHILE I CHECHKED CBDT & INCOME TAX INDIA SITE (KHOW YOUR PAN) CHECK DATA IT SHOWS THAT NAME

MILANBHAI JETHABHAI BHUVA (AS PER IT SITE)

MILANBHAI JETHABHAI BHUVA (AS PER PANCARD)

NAME ENROLLED IN GST PORTAL

MILANBHAI JETHABHAI BHUVA ALL NAME SAME

EVENTHOUGH I RECEIVED MAIL PANMISMATCH ERRO ASKED FOR RESUBMIT APPLICATION.

WHEN I PROCESSED THE APPLICATION AS ASKED AS PER MAIL. CHECK & CORRECTED APPLICATION

APPLICATION COULD NOT PROCCES AND SHOWS ERROR,

UNABLE TO SUBMIT FORM . PLEASE TRY AGAIN.

PLEASE GUIDE ME HOW TO RESOLVED THIS ERROR

I APPRICATE YOUR WORD

THANK & REGARDS,

MILANBHAI BHUVA

MO-9824919561

MB.BHUVA777@GMAIL.COM

DEAR SIR

MY SELF MILANBHAI J BHUVA

I AM FACING SAME ERROR AS DESCRIBED ABOVE

WHEN I RESUBMIT MY APPLICATION FORM THERE ARE OCCURING ERROR

UNABLE TO SUBMIT FORM. PLEASE TRY AGAIN

LAST ONE WEEK I COULD NOT RESUBMIT MY APPLICATION

WOULD YOU HELP ME, WHAT SHOULD I DO ?

TO COME OUT THE ERROR

THANKS REGARDS

MILANBHAI JETHABHAI BHUVA

MO.9824919561

Email me the below details at admin@gstindianews.info

– screen shot of error displayed

– screen shot of name entered on gst portal

– screen shot of name on income site

I HAVE A SUBIMTE FOR THE GST PRACTITIONERS CORRECTLY ENTERED ALL THE DETAILS AS PER PAN ….BUT STILL IT IS SHOWING . Aadhaar Number: 766246903290 : Name does not match PLEASE CONFIRM THE LEGAL SOLUTIONS THANK U TANK U SO MUCH

Email me the below details at admin@gstindianews.info

– screen shot of error displayed on gst portal

– screen shot of name entered on gst portal

– screen shot of name on income site

Dear Team,

i am trying to do GST registration but it showing that PAN and Legal Name is not matching with CBDT database- Solutions. I have check with your above steps given know your PAN deatails and all is correct as per PAN Card, but my legal name of business is not matched there obviously.

what i can do for “PAN and Legal Name is not matching with CBDT database- Solutions this” this error.

Plzz call asap to 8600483002 or email me.

Divya, please mail screenshot of name appearing on income tax site and the name you are entering on gst portal.

mail to: admin@gstindianews.info

I am migreted proprietor from tin when i was fill the 26 form 100% and submited but status is validation error then i will again submited the application according to CBDT Data base but still status is validation error!

please solve my problem

if you can message us your login id and password we can check it.. send message at our FB page below,

https://www.facebook.com/gstindianews/

Hi, I found my CBDT database name and created GSTIN with that legal name, now I want know that if I changed Legal name in GST portal should it affect CBDT database name?

Thanks in advance.

No, It will not. you need to change your PAN CARD accordingly from Income tax site.

Sir,

the problem still persisted PANs are not matched with CBDT database .

send me error screen shot at admin@gstindianews.info

HOW TO KNOW PAN CARD DETAILS?THAT OPTION IS NOT DISPLAYED ON E-FILLING WEBSITE SIR PLEASE HELP ME TO KNOW PAN DETAILS FOR GST LEGAL ERROR

Hello Akshay

Thanks for writing. we have re-checked our article and found that few things are changed on income tax site. Therefore this article could not resolve the issue. We have now modified the article with the possible solutions. Hence, we request you to go thorough this article once again and follow the process. We hope this will resolve your problem.

Please suggest solution for the following error while GST registration.

“PAN 4th Character not matched”

Hello Mr. Sahay

It clearly says name 4th character mentioned on PAN is not matching with the data entered on GST portal. kindly check the 4th character of First name, middle name or Last name. Also, ensure that there is no blank space at the end of name entered.

1) PAN and Legal Name is not matching with CBDT database. Please submit PAN and Legal Name after validating with CBDT database

After go to e-filing

2)PAN Is active but details are not matching with DATABASE.

Hi Jayanthi

Please be Ensure that “Legal Name of Business” is exactly matching with the income tax site as shown in above process. Do not confuse with the name printed on the PAN card. The GST system validates the details entered exactly with the income tax site. Therefore, first name should be exactly in the first field only and like wise middle name and surname. If there are any mismatches, you will have to either change the details on GST site or change your income tax details.

Regards

hello sir.when iam trying to verify the pan details..it is showing pan details not matching with pan database even though i entered correct name.i dont understand where is it going wrong.please respond sir.

Hi Kusuma

I believe you have verified PAN details on income tax filing website as explained above. After verification kindly note that you see a message “PAN is active and matching with PAN database”. If you see message “PAN is active but the details are not matching with PAN database” then you should try to enter your full name in vise versa way, until you see matching message on the income tax site.

Whenever there is a match you should note, what you have entered and same way you need to enter on gst site later. Please note Full name on income tax site = First name + middle name + last name. You may also get in touch with your nearest income tax dept. and get it confirmed.

Regards

DEAR SIR

I GOT EMAIL FROM GST PORTAL

PAN 4TH CHARACTER MISMATCH ERROR WHILE I CHECHKED CBDT & INCOME TAX INDIA SITE (KHOW YOUR PAN)

ALL DETAILS ARE CORRECT THEY SHOW ME AGAIN PLEASE TRY TO RESUBMIT THE APPLICATION OF GST REGISTRATION MY PAN NO IS “AAWFK7372H”

PLEASE GIVE ME A SOLUTION HOW TO CORRECT THE PAN 4TH CHARACTER IN TRN NO.

THANKS AND REGARDS

AERAJ ALI KHAN

9866241644

Hello

The fourth character “F” stands for Firm/ Limited Liability Partnership. Please see the type of gst registration you are trying to make is matching with the PAN allotted to you.

Here are the details of 4th character in PAN.

“P” stands for Individual

“C” stands for Company

“H” stands for Hindu Undivided Family (HUF)

“A” standsfor Association of Persons (AOP)

“B” stands for Body of Individuals (BOI)

“G” stands for Government Agency

“J” stands for Artificial Juridical Person

“L” stands for Local Authority

“F” stands for Firm/ Limited Liability Partnership

“T” stands for Trust

If its correct, i suggest you talk to their help desk.

regards

HELLO

I WILL CREATE MY OWN NEW GST REGISTRATION NO. BUT I WANT TO FOUND ERROR LIKE THIS

PAN and Legal Name is not matching with CBDT database. Please submit PAN and Legal Name after validating with CBDT database

PLEASE GIVE ME SUGESSION ABOUT THAT

THANKS

MR. KAILAS AVARKAR

Hi Mr. Avarkar

Check the name appearing on the income tax site as per above steps. First name, second name, last name must be exactly matching on the income tax site and on the gst portal.

regards

Sir while applying Proprietorship GST registration, As per CBDT database Pan name is Guzzar Naveen Vidya

But as per adhar it’s Vidya GN

If I mention Vidya GN under promoter name and authorise person name showing error Name not as per PAN ,

if I put Guzzar Naveen Vidya, Aadhar authentication is failing due to name not as per adhar

What to do?

Hello, For registration application, the name must be as per CBDT database/PAN. For aadhar authentication, the system will send an authentication link on mobile number & email (as given in registration application on GST Portal), of Promotor/Partner, and Primary Authorized Signatory which are selected upon submission of registration application.

The aadhar authentication process does not check the name details. Hence, if you face such issue, kindly raise a ticket on the GST portal. Also, you can get in touch with your jurisdiction superintendent.

regards

Mohit: My Company Legal Name is CHANDRABALI COMMERIAL [I] PRIVATE LIMITED.The same is mentioned in CBDT database.While registering for GST in the legal name of business tab first bracket [] is not allowed.It say special character not allowed.If i donot use first bracket it say legal name not matching with CBDT database.Please suggest how to register..???

It looks your PAN Card data is saved as “CHANDRABALI COMMERIAL [I] PRIVATE LIMITED” with bracket and i see that income tax site accepts it where as GST portal does not accepts brackets or special characters. I will suggest two options:

First send an email to helpdesk@gst.gov.in and ask for solution.

You may apply online/offline for correction of pan card and change it to “CHANDRABALI COMMERCIAL INDIA PRIVATE LIMITED”

hello sir i have issue my pan mismatch cbdt database, i have apply my new gst registration but i have facing this problem, my name pan name not match my pan details, so please give me advise and suggestion how to do correct mt name and matching with cbdt database.

Hi,

Enter your first, middle and last name as appearing in the income tax return.

regards

This is in reference to Application for New Registration submitted at GST portal.It is observed that details of following PANs are not matched with CBDT database.Kindly fill the details as per PAN details and resubmit the Form. Details of the PANs are as under:

1. BSQPS7653Q : Name does not match for Authorized Signatory

2. BSQPS7653Q : Name does not match for Promoter

GST HOW WILL CHANGE

Hi

Please refer to the income tax return filed and check how the first, middle, and last name is printed. Write it accordingly on the GST portal.

regards

i am naveen

i got PAN Not Matched With CBDT,error while filing GST Application

i did everything given on above

contact e mail ids are not working

what can i do now

HI

Download your latest filed ITR 1/2/3. Check your name details under personal information i.e First name, middle name, last name. Enter exactly same on the GST portal. Let me know if this helps.

regards