28.12.2021: A total of 4,67,45,249 #ITRs have been filed until 27.12.2021 including 15,49,831 #ITRs filed on the day itself.

The department has approached the taxpayers to file their ITR for AY 2021-22 within the extended due date of 31st December 2021.

On the other hand, the Digital Signature (DSC) registration of non-residents has been enabled on the new portal. Therefore, more than 4.87 lakh DSCs have been registered. In the easy-to-use process of DSC registration, any individual has to register his DSC only once, and then he/she can use it across any entity where the individual is a partner, director, etc without having to re-register again against each other entity or role.

As far as the issue of E-PAN Cards is concerned, the department has issued more than 21.40 lakh e-PANs have been allotted online. The e-pan cards are provided completely free of cost to the applicants.

Further, The IT Department strongly urges all taxpayers to view their Form 26AS through the e-filing portal to verify the accuracy of the TDS and Tax Payments and avail of pre-filling of ITRs. Also, all taxpayers who are yet to file their Income Tax returns for AY 2021-22 are requested to file their returns at the earliest.

Launch Date of www.incometax.gov.in

The government has launched the new income tax portal on 7th June 2021 having an internet address of www.incometax.gov.in. Thus, it is the New e-filing Portal for the Income Tax In India. In this regard, the Income Tax department sent the messages to the taxpayers with the tagline “Dear taxpayer, The Income Tax Department is happy to inform the launch of its new e-filing portal www.incometax.gov.in on 7th June 2021“.

Also, the tweet said “We are as excited about the new portal as our users! We are at the final stages in the roll-out of the new portal and it will be available shortly. We appreciate your patience as we work towards making it operational soon.

Similarly, the new income tax login portal will now provide a convenient, modern, and seamless experience to Indian taxpayers. Here is the official tweet from the Ministry of Finance. Check out below the latest updates of this portal.

What is the New E-filing portal?

The Indian Taxpayers use the Income Tax E filing portal to file their individual returns(ITR). Also, it is used to file business returns by corporate taxpayers. Similarly, the IT department makes use of this e-filing portal to send income tax refunds to the taxpayers.

On the other hand, www.incometax.gov.in is used to issue notices, accept responses, and provide solutions to the queries raised by the taxpayers. Thus, work-related assessments, online appeals, and penalties are carried out through this online portal.

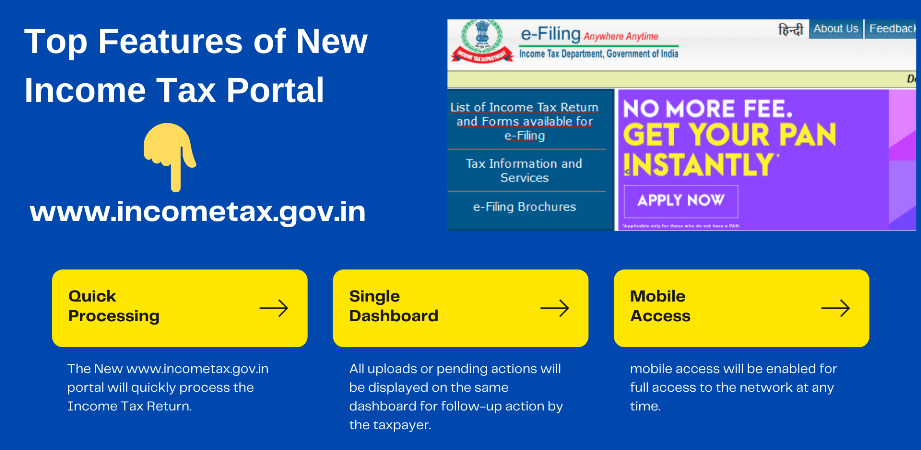

Top 6 Features of www.incometax.gov.in

Below are some of the top features of the new income tax portal that will be experienced by the taxpayers.

1. Quick Processing: The New www.incometax.gov.in portal will quickly process the Income Tax Returns. Therefore, it will enable the department to issue faster refunds to the taxpayers.

2. Single Dashboard: All uploads or pending actions will be displayed on the same dashboard for follow-up action by the taxpayer.

3. Free ITR Preparation Software: To reduce data entry effort, free ITR generating software is available to help taxpayers to file their ITRs without any tax information. Also, this will be available for offline preparation with interactive questions.

4. New Call Center: A new call center will be available to help taxpayers which will provide quick answers to common questions with tutorials, videos, and chatbots / live agents.

5. Mobile Access: All key functions of the income tax portal that are available on the desktop will also be available on the mobile app. Thus, mobile access will be enabled for full access to the network at any time.

6. More payment options: The new online tax payment system will enable multiple new payment options using NetBanking, UPI, Credit Card, and RTGS / NEFT from any bank of the taxpayer.

What you should know?

The current income tax portal i.e www.incometaxindiaefiling.gov.in will not be available for taxpayers for a period of 6 days i.e. from 1st June 2021 to 6th June 2021. Therefore, the government will not keep any compliance dates on these days.

Similarly, the income tax department has informed Banks, MCA, GSTN, DPIIT, CBIC, GeM, and DGFT to take necessary steps, who are availing PAN Verification services from the portal.

Further, the department has encouraged the taxpayers to finish their urgent tasks like submission, upload, or downloads before 1st June 2021. This is to avoid any difficulty during the blackout period.

Home page of www.incometax.gov.in

The home page of www.incometax.gov.in has come with a simple horizontal menu. The menu contains tabs like Home, Individual/HUF, Company, Non-company, Tax professionals & Others, Downloads, and Help.

Similarly, the bottom menu has links to our services, our success enablers, News & e-campaigns, How it works, and Our committed taxpayers and taxpayer voices.

How to log in at www.incometax.gov.in?

Time needed: 1 minute

Follow the below steps to log in:

- Open an internet browser (Firefox, Google Chrome, Microsoft Edge)

You may find this icon on your desktop

- Type www.incometax.gov.in

Hit enter after entering the above URL

- Click on the “Login” button on the right-hand side

To enter the portal

- Click on the “Register” button if already not registered

For Registration process

Download Form 26AS

Here is the step-by-step guide to downloading the Form 26AS of FY 2020-21. The consolidated form contains all tax-related information of the taxpayer like TDS, advance tax, etc. The taxpayers can now download Form 26AS on their desktop/laptops and even on mobile phones. Follow the below steps and download your statement.

1. Visit www.incometax.gov.in and log in with your username and password.

2. Click the “E file” link on the Menu

3. Click on View Form 26 AS (Tax Credit)

4. Click to confirm “Disclaimer”

Note: Once you click on the ‘Confirm’ button of disclaimer, the system will redirect you to the TDS-CPC website.

5. On the TDS-CPC website, Click to agree to the acceptance of usages and click on the ‘Proceed’ option

6. Then click on the ‘View Tax Credit (Form 26AS)’ option

7. Select the Assessment year

8. Select the ‘View Type’ you want(HTML, Text, or PDF)

9. Click on ‘View/Download

10. You will see the Form 26As computer screen. Now you can download and save the Form 26 AS.

Previous Updates

23.08.2021: The Finance Minister today met with Mr. Salil Parekh MD&CEO @Infosys to discuss the glitches of the Income-tax portal. The Minister conveyed the deep disappointment & concerns of the Govt & taxpayers about continuing glitches in the new e-filing portal of IT Deptt. Thus, after seeking an explanation from Infosys, FM demanded that the issues be fixed by 15th September 2021.

On the other hand, Mr. Parekh explained that he and his team are doing almost everything to ensure the smooth functioning of the new portal. Further, He said that more than 750 team members are working on this project and Mr. Pravin Rao COO of Infosys, is personally overseeing this project. Similarly, he also assured that Infosys is working expeditiously to ensure a glitch-free experience for the taxpayers on the portal.

Earlier on 23.08.2021, the Ministry of Finance summoned Shri. Salil Parekh, to explain to hon’ble FM as to why even after 2.5 months glitches in the portal have not been resolved. In fact, the new portal was not working, since 21/08/2021. However, it is known that the portal started working before having a meeting with FM.

18.06.2021: The top officer from the Ministry of finance is going to hold a meeting with Infosys on issues with the income tax portal. The meeting will be held on 22nd June 2021. The team is going to discuss issues/glitches in the recently launched e-filing portal of the Income Tax Department.

Further, other stakeholders like members of ICAI, auditors, consultants, and taxpayers will attend this meeting. Recently is it noted that the new portal is giving several technical glitches/issues leading to taxpayer inconvenience. Thus, written representations of the major problems faced in the portal have also been invited from the stakeholders.

The representatives from the Infosys team will answer the queries and will clarify issues. Also, they will receive inputs from the stakeholders on the working of the portal. Thus, it will help them to remove the glitches and sort out issues faced by the taxpayers.

08.06.2021: The new e-filing portal www.incometax.gov.in has been launched on 07.06.2021 at 20.45hrs. However, today on 08.06.2021 the portal is not accessible. Therefore, it is known that the site is down due to some server-related issues. Hence a taxpayer may see an error of a new income tax website not working while looking on the search engines.

Further, immediately after launching the portal, few taxpayers noticed some glitches in the new income tax site. Therefore, the IT department has a lot to do now on this new project, so that it meets the taxpayer’s requirements. Here are some of the recent queries raised on Twitter.

Statistics as of 08.09.2021

- More than 8.83 crore unique taxpayers have logged in till 7th September 2021

- The ITR filing has increased to 3.2 lakh daily in September 2021 and 1.19 crore ITRs for AY 2021-22 have been filed

- 76.2 lakh taxpayers have used the online utility to file the returns

- More than 94.88 lakh ITRs have also been e-verified

- 7.07 lakh ITRs have been processed

- Taxpayers view more than 8.74 lakh Notices issued by the Department under the Faceless Assessment/Appeal/Penalty proceedings

- Over 2.61 lakh responses have been filed

- An average of 8,285 Notices for e-proceedings are being issued

- 5,889 responses are being filed in September 2021 on a daily basis

- Over 10.60 lakh Statutory Forms have been submitted

- Aadhaar with PAN linking has been done by 66.44 lakh taxpayers

- Over 14.59 lakh e-PAN have been allotted

Income Tax-payment System on New E filing Portal

On 05th June 2021, the Income-tax department issued a press release to clarify the tax payment system on the new portal. Thus, the press release says the department will launch the new tax payment system on 18th June 2021. Therefore, it will be available only after the advance tax installment date to avoid any taxpayer inconvenience.

Similarly, the mobile app will also be available on the initial launch of the portal, to enable taxpayers to get familiar with the various features. However, the familiarization with the new system may take some time, so, the Department requests the patience of all taxpayers & stakeholders for the initial period after the launch of the portal. Since it is a major transition, it will take some time to become normal function properly.

Similar Related Articles

Latest Income tax updates

The Central Govt. has extended certain Taxation Timelines in the month of April 2021. This includes a time Limit for sending intimation of processing of Equalization. more

Things to know about Directorate of Income Tax

Learn everything about the directorate of income tax in India. Also, know how to log in to the income tax portal and more.

Income Tax Raids

The IT departments did conduct search operations in Delhi Region on 29.12.2020. Thus, the search action was taken place on hawala operators engaged in the activities of routing and handling of unaccounted cash. more

www.gst.gov.in – A GST Portal

Read to know how to log in at the GST portal in India. Similarly, know what are functions available on the official portal of GST. Download the offline tools and prepare the GST return. more

VERY USEFUL AND COMFORTABLE FEATURES

SIR, I HAVE SUBMIT ITR FOR THE YEAR 2020-21 ON 05 AUG 2020 AND SAME HAS BEEN E VERIFIED BUT TILL DATE NO REFUND RELEASE/PROCESS FOR THE SAME, MY E-ACKNOWLEDGEMENT NUMBER -443507260050820

Hello Mr. Singh

please call on below income tax customer service number and lodge your query.

1800 103 0025 (or)

1800 419 0025

+91-80-46122000

+91-80-61464700

regards

How can I know the quantum of TDS deducted from Interest on Term Deposits at source? I am one Retired person and usually get Refund from the I.T.Authorities on submission of Annual Return. Please guide me in this regard.

Hello Mr. Sinha

You can ask your bank to provide you the TDS certificate in respect of tax deducted by them. Also, you can check Form 26AS from your e-filing account at https://incometaxindiaefiling.gov.in (Now https://incometax.gov.in)

regards

We are not able to re-register DSC-Filing ITR for the employees-Form 24 & Form 26 (TAN based)

Message showing Mismatch in profile and PAN data base (there is only 1 PAN for the Company and different TAN for all the units)- How to proceed if any body can advise

Hello,

The new portal throws this error and asking to update the details either in PAN or in the profile details. you may call their help desk and see if you need to change the details in PAN OR AADHAR, or they are going to fix it from their end.

regards

how does one know the status whether my pan number is linked with aadhar.

Hello,

you can find the easy steps here..https://gstindianews.info/a/aadhar-link-to-pan-card-status/

regards

Inadvertantly I have filled in IT Return for the AY 22-23 and certain details of income have not been taken into account. Pl guide me as to whether I can revise my Return. The return HAS BEEN FILED ON 10th June,2022. Regards PAN BIUPA1587R

yes, you can revise your filed return