The Income Tax department has launched its new e filing portal 2.0 on 07th June 2021. Therefore, now the new internet address of the Income Tax website is https://incometax.gov.in. Also, now there is a change in process of DSC registration. Thus, here is the step-by-step process on how to register DSC on the new income tax website.

After going through this article you will able to:

- Register DSC(Digital Signature Certificate.

- Re-register when registered DSC is expired

- Make Re-registration when DSC is not expired

- DSC registration of Principal Contact

Prerequisites for DSC Registration

- You must register yourself on the e-filing portal

- DSC token need to be class 2 or class 3 certificate

- DSC token should be active and not expired

- Ensure the DSC is not invoked

8 Steps for DSC Registration

Follow the below steps to register DSC on new income tax website.

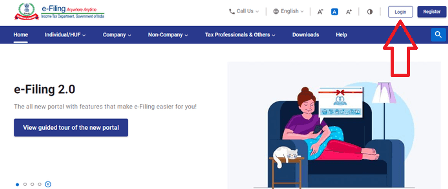

1. Visit the e-filing portal at www.incometax.gov.in

2. Login with user name and password

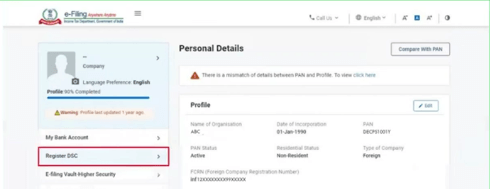

3. Click on My profile

4. Click on the option to “Register DSC”

5. Enter the email id associated with DSC token

6. Click on Continue

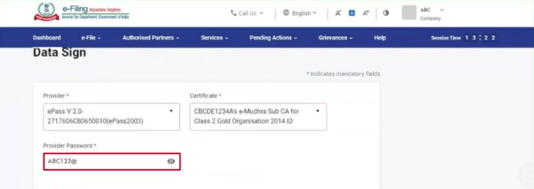

7. Enter the provider, Certificate, and provider password in the given boxes.

8. Click on “Sign” button

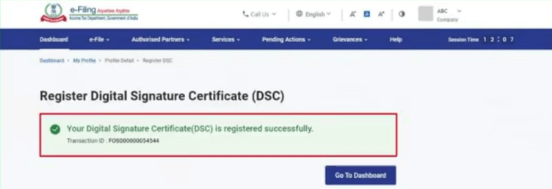

You will see a success message on your screen, confirming the DSC registration on e filing portal of Income Tax.

Note: You must download and install the emsigner utility before initiating the registration process. You can download the same by clicking the help link at the bottom of the Register Digital Signature Certificate page.

Frequently Asked Questions

Log in and follow the DSC registration steps

You will see the message saying the DSC is expired when you enter the details in above DSC Registration steps

You will see the message, you have already registered your DSC. You may click the view option to see the details and update option to modify.

Enter the registered email id of principal contact registered on e filing portal.

DSC Related Articles

Emsigner for GST and Traces

Download the emsigner offline utility and install it on your computer to digitally sign your online applications on the GST portal. Learn more about the GST em-signer tool.

Resolve DSC error on GST portal

Learn how to resolve the “failed to establish a connection to the server” error while signing the online documents and returns on the GST portal. Thus, here is the solution for the https://127.0.0.1:1585 port error.

New Income Tax Login Portal

Explorer the new features of the www.incometax.gov.in website launched in 2021. Thus, file your ITR on the new e-filing portal in India.

GST Notifications of June 2021

The Central Board of Direct and Indirect Taxes issues various GST notifications from time to time. Read and download the latest GST notifications in India.

Thanks for the valuable post. This informative Write-up has helped me to understand the Digital Signature very closely. I’d like to bring this under your notice that Capricorn CA is the most preferred Licensed Certifying Authority in India registered under CCA to issue the digital signature certificate.