Every taxpayer who needs to make payment to the Government has to fill in the details in the GST Challan format. Thereafter, on the basis of details filled in the challan, he has to make the payment. The GST payment has to be made compulsory through online mode. Therefore, the taxpayer needs to generate the GST challan payment online on the GST portal.

Similarly, you may download the GST delivery challan format from here. Also, you may download the GST job work challan from this link. Here you can find everything you want to know about GST challan for payment purpose. Let us see them one by one.

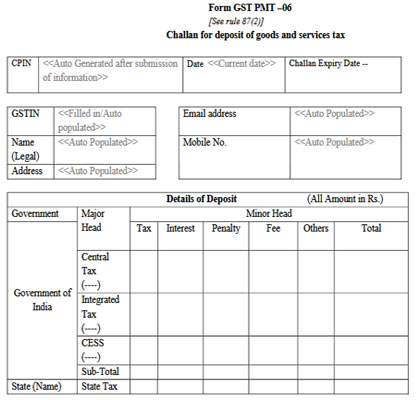

GST Challan format

Here is the GST payment challan format as per CGST rule 87(2). you can download the pdf format of this challan for offline use. The GST challan format is said to be Form GST PMT 06 under GST. Thus, this challan contains details like CPIN number, GSTIN of the taxpayer, details of payment, etc.

Download GST challan

If you are looking to download the GST challan format for payment then you can download it from the above button. However, if you want to know how to download the GST challan which you have already generated on the GST portal then you may go through this paragraph.

GST Saved Challans

Many times you may need to retrieve your saved challan to modify it. Saved GST Challan is not the generated one challan. you must log in to access saved Challan.

Please note that you can edit the saved challan within 7 days from the date of its creation. After 7 days the challan gets deleted automatically from the system. Also, you can save a maximum of 10 challans at any point in time.

Follow below-given steps to access GST saved challans.

- visit www.gst.gov.in Portal

- Login to the portal

- Click Services > Payments > My Saved Challans

- The Saved Challans will be displayed in chronological order (most recently saved challan is shown first in the list )

- Under the Action column, click the Edit button to edit the saved challan.

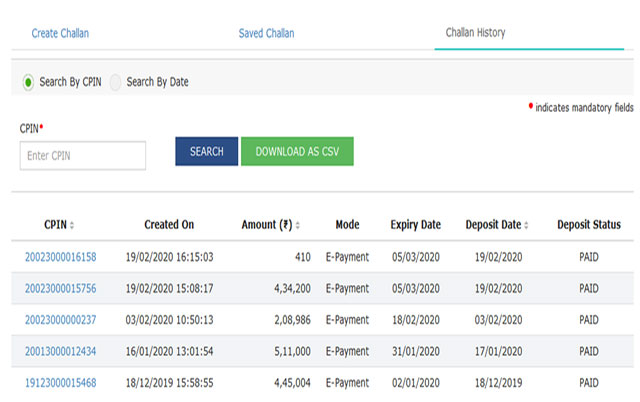

GST Paid Challans

In order, to download the paid challans you can follow the below steps.

- Go to GST portal >> Services >> Payment >> Challan History

- Click on the CPIN number

- The challan will be displayed on the screen

- Click on the “Download” button at the bottom of challan

- This will download the pdf format of GST paid challan

You may also search the paid GST challans by typing its CPIN number or search by the date of challan. Thus, it is very useful if you have lot of challans on the list.

Q&A on GST Challan

It is a document that contains the details of payment to be made under GST.

1. See the challan history in the above section of “GST challan paid”

2. Check the “Deposit status”

3. If it is paid it will show as “paid” otherwise not paid.

You can refer our GST payment process steps to make the GST challan payment online.

you can not cancel the GST challan after its generation. You can easily generate new challan instead of canceling the previous one.

1. Go to “Saved challan”

2. Go to Action column, click the Edit button to modify the saved challan

If you want to pay late fees of any late GST return filed then you need to enter such late fees amount in the fee field.