What is DRC 03

DRC 03 is a form used to make the tax payment, interest and penalty on a voluntary basis. Thus, a taxpayer can make any type of taxes mentioned above on a voluntary basis before receiving notice from the department. Also, He can make the payment against show cause notice within 30 days of its receipt.

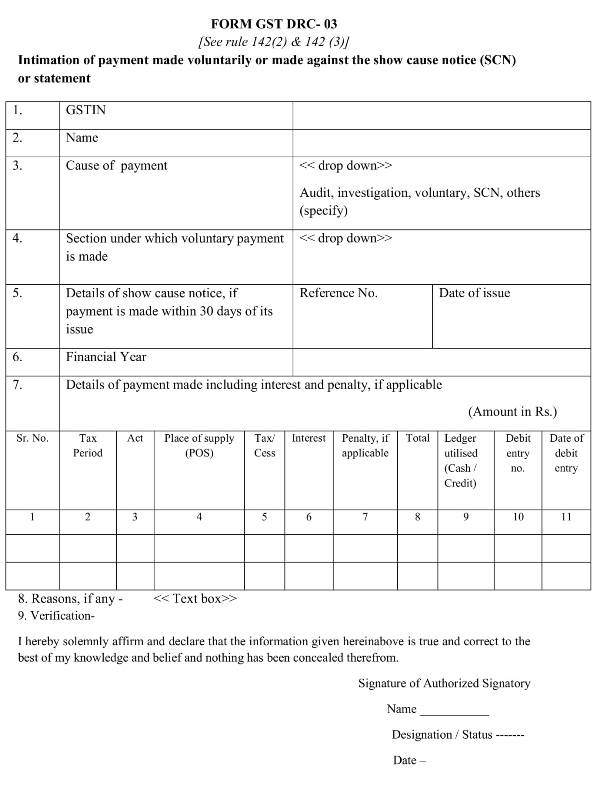

Format of DRC 03

Below is the format of DRC 03. One can use this format for offline use. However, for making payment taxpayers needs to fill this form online on the GST portal. You may also download the pdf format by clicking the download button.

How to file DRC 03 in GST?

The DRC 03 filing process is very easy. Here is the step by step procedure explaining how to create DRC 03 challan for making payment.

1. Open your Internet browser >> Type www.gst.gov.in >> Enter

2. Login to the GST Portal with your valid credentials.

3. Click on the Services > User Services > My Applications command.

4. Select the “Intimation of Voluntary Payment – DRC – 03″ from the Application Type drop-down list.

5. Click on Create Application

6. Select the Cause of Payment from the drop-down list.

In Case of show cause notice(SCN): Select Manual Entry from the SCN Reference Number drop-down list. Further, Select the SCN Issue Date using the calendar. Please note that the SCN Issue date should be within t

h e last 30 days.

7. Select the particular section no. against payment has to be made

8. Select the Financial Year from the drop-down list.

9. Select the From date and To Date for Overall tax Period from the drop-down list.

10. Enter the Details of payment made including interest, penalty, and others.

Note: You make the DRC 03 payment through ITC i.e from the credit ledger. Balance payment of liabilities shall be paid through cash including interest and penalty.

11. Click the PROCEED TO PAY button.

The liability page will be displayed. Also, you will see the available cash and credit ledger balance. Please note that you can not utilize the input tax credit for making payments of Interest and penalty if any.

12. Enter the payment details and Click on SET OFF button. Please note that you can make drc 03 payment through ITC.

13. A payment confirmation message is displayed. Click the OK button. A success message is displayed. Payment Reference Number (PRN) is displayed on the screen. Click the OK button.

14. Verify the details and proceed to file the Application through “DSC or EVC”.

Frequently Asked Questions

The full form of DRC 03 is Demands and Recovery Form under GST

NO,

Voluntary payment is making payment before you receive a

Rule 142(2) and 142(3) of the CGST Rules, 2017 define the procedure to be followed for DRC 03.

Payments of GST Audit, Investigation, Voluntary Payment, Show cause notice, Annual Return, Reconciliation Statement or Others can be done through DRC 03 challan.

Important Links

- Failed to Establish Connection to the Server. Kindly Restart the Emsigner

- Emsigner for GST, MCA and Traces error | Latest version download

- GST No Search by PAN Number | Check and Verify Online

- Calculate GST Online | Learn How to calculate with Formula

- GST Payment online process and status checking with due date