MSME Registration helps to acquire government tenders easily for a business. So, if you are looking for how to apply for MSME Registration Online, I will tell you all you should know.

Firstly, for MSME Registration, you should go for company registration online. As a result, you cannot get many benefits in terms of taxes and credit facilities.

MSME is a definition set by the government.

There are mainly two types of industries under MSME.

- Service sector

- Manufacturing sector.

Here is the Revised Classification applicable w.e.f 1st July 2020 for Micro, Small, and Medium Enterprises.

Micro – Investment in Plant and Machinery or Equipment: Not more than Rs.1 crore and Annual Turnover should not be more than Rs. 5 crores.

Small – Investment in Plant and Machinery or Equipment: Not more than Rs.10 crore and Annual Turnover should not be more than Rs. 50 crore.

Medium – Investment in Plant and Machinery or Equipment: Not more than Rs.50 crore and Annual Turnover should not be more than Rs. 250 crores.

Service Sector under MSME

The service sector serves the customers directly with their services.

Meaning, that when any organization, company, person, or factory does any work for an individual or a group, it is called service.

Therefore, under MSME, we keep those service industries whose annual turnover is up to Rs 100 crore. Also, it is the limit of the medium enterprise as per the new rule of MSME implemented by the government in June 2020.

Manufacturing Industry under MSME.

As the name suggests, it refers to the creation of something. This industry is indeed related to sector construction only.

It constructs everything from needles to airplanes. But under MSME, those same industries are called manufacturing industries.

Manufacturing enterprises whose annual turnover is up to Rs 100 crore, according to the new definition of MSME implemented by the government, the limit of the medium industry as per June 2020).

Steps to apply for MSME registration online

Businesses that want to take advantage of the benefits announced by the government for MSMEs will have to register their business on the Udyog Aadhaar Memorandum (UAM) Portal.

The enrollment procedure is easy and free of cost for every candidate.

Follow the given process for online registration:

Time needed: 15 minutes

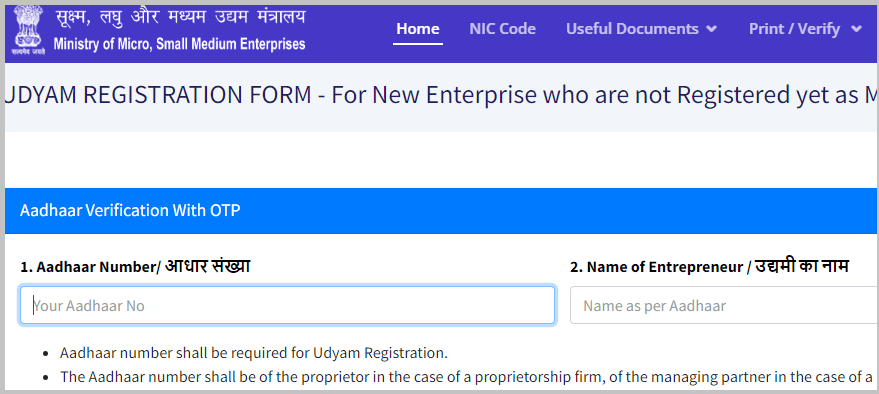

- Firstly, go to the UAM gateway, where you have to fill out a form

- Secondly, enter the details of the candidate who are registering their business as MSME

- After that, tap on the primary link on the page or click here to open the form

- Now fill in the Aadhaar number and applicant name, and tap on Validate & Generate OTP

- Once the verification is complete, you need to enter the PAN details. If you do not have a PAN card yet, you can select the No option

- Next, you need to fill in the form with field numbers 5-24

- At the end of the form, you will again receive an OTP to your phone

- Fill one-time password and confirmation code to apply successfully

- After successful registration, a “Thank you” message will appear with the registration number. Keep that number with you

Once the application form is submitted, approval and registration might take 2-3 days to finish. If the request is accepted, registration will be complete and, the MSME authorization will transfer to you through the mail.

What are the mandatory documents to apply for MSME registration online?

- Aadhar number

- PAN number

- Business address

- Bank account number

- Investment Details (Plant/Equipment Details)

- Turnover details (as per new MSME definition)

- Partnership deed Sales and Purchase Bill

- Copies of the license and bill of machinery purchased

Here are some benefits of MSME registration:

- Lowest interest rates on bank loan

- Avail customized tax exemption

- Priority in buying government tenders

- Interest rate reduction from banks

- Free cost government tenders

- Stamp Duty and Octopi Benefits

- Concession in electricity bill

- Reservation Policies for Manufacturing/Production Sector Enterprises

- Reimbursement of ISO Certification Expenses

- Excise Duty Exemption Scheme

To sum up, the economic development of any country depends not only on its large industries and multinational organizations but also on medium-scale industries, small-scale industries, and cottage industries instead.

Small and medium enterprises act like oxygen for a developing country like India.

It is all you need to know about how to apply for MSME registration online.

Author

Geeteshree Singh Panwar

Latest News on MSME

24.06.2023 UDYAMI BHARAT, The MSME DAY’ will be celebrated at Vigyan Bhawan on 27th JUNE, 2023. To celebrate International MSME Day, the Ministry of MSME is hosting an event called ‘Udyami Bharat-MSME Day’ on June 27, 2023, at Vigyan Bhawan in New Delhi. The event will be attended by the Union Minister for MSME, Shri Narayan Rane, as the Chief Guest, and the Union Minister of State (MSME), Shri Bhanu Pratap Singh Verma, as the Guest of Honour. This event aims to recognize and celebrate the contributions of MSMEs to the Indian economy.

During this program, the Ministry of MSME will launch various initiatives for the growth and development of MSMEs such as the CHAMPIONS 2.0 Portal and Mobile App for Geo-tagging of Cluster Projects and Technology Centers. During the program results for ‘MSME Idea Hackathon 2.0’ will be declared and ‘MSME Idea Hackathon 3.0’ for Women Entrepreneurs will be launched. Further, this program will include certificate distribution to Gold and Silver ZED-certified MSMEs, and digital transfer of Rs. 400 crore, and Margin Money subsidy to 10,075 PMEGP beneficiaries. This program shall also include the signing of MoUs among various organizations of Govt. of India.

The Ministry of Micro, Small, and Medium Enterprises (MSME) is set to launch several initiatives aimed at promoting the growth and development of MSMEs. These initiatives include the CHAMPIONS 2.0 Portal and Mobile App for Geo-tagging of Cluster Projects and Technology Centers. Additionally, the results of the ‘MSME Idea Hackathon 2.0’ will be announced, and the ‘MSME Idea Hackathon 3.0’ for Women Entrepreneurs will be launched during the program. The event will also feature the distribution of certificates to Gold and Silver ZED-certified MSMEs, and the digital transfer of Rs. 400 crore as Margin Money subsidy to 10,075 PMEGP beneficiaries. Furthermore, the program will witness the signing of MoUs among various organizations of the Government of India.

Important Articles on Registration

Online GST Registration process

Read to know how to apply for new GST registration in India. Also, read frequently asked questions on GST registration.

How to apply for e way billl Registration?

The taxpayer and the transporter need to register on the e way bill portal. Learn the simple steps to apply for e way bill registration.

Turnover limit for GST Registration

Know the various limits for applying for registration under GST. Also, see who can register for GST with limitations.

GST registration documents

Read to know what are the different types of documents required for applying for the new registration in GST. Also, you may download the list of documents for GST in pdf.