Here is the simple guide explaining e way bill registration for GST registered person and Transporter.

However, if you are looking for e way bill registration for unregistered dealer than see our article on e way bill for citizens. Thus, through this option you can register for e way bill, if not registered under GST. E way bill for citizen is available for any one who do not have GST registration.

Similarly, any individual citizen/driver of the vehicle carrying goods can register himself and generate e way bill. This option is helpful when the supplier does not provide an e way bill to the carrier/transporter.

About E way Bill Registration Process

First of all there are four participants who have some participation in the movement of the goods starting from one place to another. These participants are namely called Suppliers, Recipients, Transporters and Tax officers.

Therefore suppliers, Recipients and Transporters wants to see the movement of consignment from one place to another without any hurdle in between. While at the same time tax officers wants to know the consignment is moving is accounted by the supplier or not. Hence to track all these movements, the eway bill system came into existence. Also the new Eway Bill Registration Procedure is very easy and simple.

Things to keep handy before proceeding

1.GSTIN number issued by the GST system

2. Registered mobile number should be with the user

3. User name should be of at least 8 characters with alphabets, numerals and special characters.

4. The password should be of at least 8 characters.

Registration Procedure for GST Registered Taxpayer

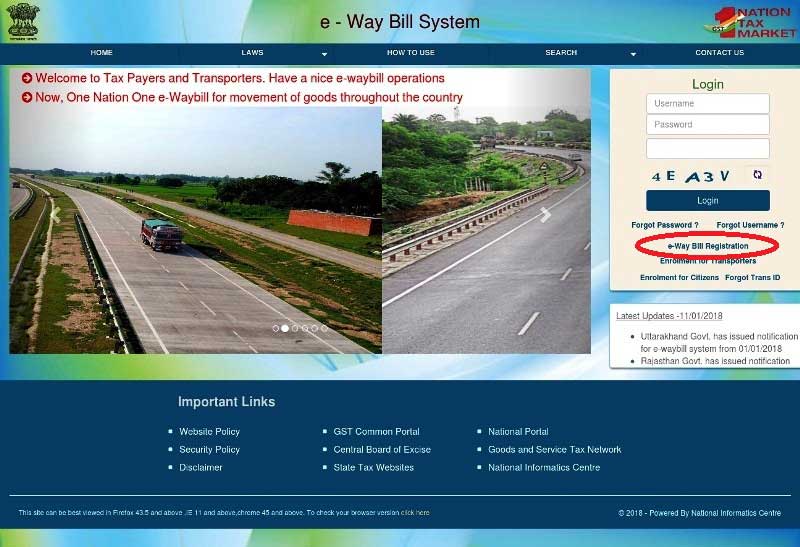

1.Furthermore visit eway bill Portal > www.ewaybill.nic.in in your browser

2.Once the e-Way Bill portal opens, Click on ‘e-way bill Registration‘

3.Thereafter another window will open called “e-Way Bill Registration Form“

4.Enter your GSTIN number and click ‘Go‘. You will be automatically redirected to detail registration form. If you are already registered under GST system then Applicant name, Trade name, Address and Mobile Number will be auto populated.

5.Click on ‘Send OTP’ to get the OTP on the registered mobile

6.Enter the OTP received and click on “Verify OTP” to validate

In addition the user needs to choose username and password as per his/her choice.

Finally the eway bill registration framework approves the entered data after submitting the request. As a result if entered username and password is correct then system accepts these values and registers the taxpayers in eway bill system.

E way bill Registration for Transporter

The e way bill registration for transporter is mandatory to carry the goods. Therefore, every transporter carrying goods must register himself on E way bill portal to generate e way bill.

No transporter can generate e way bill without registering himself on E way bill portal. Thus, online e way bill generation is the exclusive facility available for generating e way bill in India. Similarly, transporter can not buy/obtain ready made e way bill from any third person.

Steps for E way bill Registration

1. Visit https://ewaybillgst.gov.in/ website

2. Click on “Enrollment for Transporter” option as shown below

3. Fill in below details on the screen

4. Select the State and Enter legal name as in the PAN Card. Enter PAN Number.

5. Click on validate to verify the details.

6. Select the type of enrolment and constitution of business (Partnership, Proprietorship, Public/Private Limited etc.)

7. Enter business details and contact details.

8. upload the Address and ID proofs by clicking on respective ‘Upload’ buttons.

9. Create username and password of your choice

10. provide the declaration regarding the correctness of the given information by clicking on the checkbox.

11. Once you click the ‘Save’ button, the system generates the 15 digits TRANS ID and will show to you. E way bill Registration for Transporter is complete.

Provide this TRANS ID to the clients to enter in the e-way bill. This will enable the transporter to enter the vehicle number for movements of goods.

E way Bill Registration Charges

E way bill registration is completely free on E way bill portal. Thus, one can register himself on e way bill portal by following above simple steps.

However, if the registrant ask third party like Chartered account, Tax professional or any other service provider to make registration on his behalf than such service providers may charge their fees.

Search Tags: Know how to e way bill registration online kaise kare. Also, read the registration charges for transporter and for unregistered dealer. Beside this you will learn how to do e way bill registration without gst.

Important Links

E way bill format pdf download

Are you looking to download the pdf format of e way bill print?. Here is how you can download the pdf file format of e waybill print from the portal. more

e way bill Login

In order to generate e way bill from the e-way bill portal, you have to login into the system. learn everything you want to know about the new system of e waybill. more

How to Generate e way bill?

Read to know how you can Generate e way Bill in GST Portal. our Guide explains the e way bill generation process to print an e way bill generated on the E way bill portal. more

How to register on E way bill portal?

If you are already registered under GST, then the registration on E way bill portal is very easy. You have to follow the simple steps to get it done. more