The ASMT 10 stands for Notice for intimating discrepancies in the GST return. Whereas, ASMT 11 stands for Reply to the notice issued under section 61 intimating discrepancies in the return. Thus, if you are looking for ASMT 10 format and looking to file a reply, you can find it here.

As a GST taxpayer and if you receive the ASMT 10 notice, you must file it on time to avoid further notices and actions from the department. Therefore, kindly go through the below process and submit your reply to the notice in form ASTMT 11.

What is Scrutiny of GST Returns?

The scrutiny of GST returns is the process of verifying the filed returns by the registered taxpayer as per the GST law. Under GST, the filed returns are scrutinized as per CGST section 61. Thus, if there are no discrepancies are found then, there is no need of taking further action.

However, in case any discrepancy is found in the filed GST returns, the proper officer shall issue a notice to the taxpayer in form GST ASMT 10. The officer will seek an explanation from the taxpayer on the discrepancies found. Also, the officer may specify the quantum of tax, interest, and other amounts payable in the said notice.

After receipt of the said notice, the registered person shall submit the reply by paying the tax, if any. Thereafter, the officer shall check whether the reply given is acceptable as per CGST Rule 2. Also, if found satisfactory, the officer shall inform the taxpayer accordingly in form ASMT 12.

Read The Assessment and Audit rules of GST

ASMT-11 Reply Format in pdf

You can download the ASMT-11 format in pdf form here for your offline use. Also, you can convert the format to Word or Excel by using an online pdf converter.

GST ASMT-10 Reply Format in word

To create a reply format for GST ASMT-10 in Microsoft Word, you can follow these steps:

- Open Microsoft Word: Open Microsoft Word on your computer.

- Set Page Layout: Set the page layout according to your preferences. Typically, for official documents, you may use standard settings such as A4 size paper with margins of 1 inch on all sides.

- Header: Create a header section by double-clicking at the top of the page. In the header, you can include details such as your company’s name, address, and contact information.

- Title: Type “Reply to GST ASMT-10” as the title of the document. You can format this text to make it bold and centered for better visibility.

- Date and Reference Number: Beneath the title, add the current date and reference number if applicable. You may align these details to the right side of the page.

- Recipient Details: Add the recipient’s details, such as their name, title, department, and address, if known. Align these details to the left side of the page.

- Salutation: Begin the letter with a formal salutation, such as “Dear [Recipient’s Name],”.

- Body: Write the body of the reply, addressing the concerns or queries raised in the GST ASMT-10. Be concise, clear, and polite in your response. You may want to refer to specific sections or points from the ASMT-10 for clarity.

- Closing: Conclude the letter with a professional closing, such as “Sincerely,” or “Best regards,” followed by your name and signature if required.

- Review and Edit: Review the document for any errors in grammar, spelling, or formatting. Make necessary edits to ensure clarity and professionalism.

- Save and Print: Once you are satisfied with the document, save it to your desired location on your computer. You can also print a copy for your records or for mailing.

By following these steps, you can create a professional reply format for GST ASMT-10 in Microsoft Word. Adjust the formatting and content according to your specific requirements and organizational guidelines. you may download the ready-made gst asmt-10 reply format in Word by clicking on the below button.

ASMT-11 Reply Sample

By Clicking on the below button you can download one of the latest ASMT 11 reply sample. A similar letter was recently submitted to the GST office by one of the taxpayer. Therefore, you can download the format and use it as a reference to reply to the ASMT 10. Kindly reply only to the questions asked to you in the notice and delete the unwanted things in the reply sample.

Why & When ASMT 10 is issued?

The GST officer issues ASMT 10 notice to the taxpayer, in case there are discrepancies in the GST returns. Thus, a taxpayer can expect a notice in case there is a shortfall of tax paid, clarification on input tax credit availed, incorrect filing, etc.

After receipt of the notice, a person may either accept such discrepancies and pay tax, interest, and penalty and inform the tax Official or furnish an explanation in ASMT 11.

Further, if the explanation is satisfactory, the Tax Official may issue an order of acceptance of the reply. However, if the reply is not satisfactory the Tax Official may conduct an audit, special audit, or even issue an order of search and seizure.

How to reply to ASMT-10 online?

The reply to the notice in ASMT 10 shall be filed through ASMT 11 format. This can be submitted online on the GST portal of the Government of India. Here are the quick easy steps to fill out ASMT 11 and submit it.

1. Visit the GST portal

- Visit and log in to the GST portal at www.gst.gov.in. After that go to Services > User Services > View Additional Notices/Orders option.

- Click on the View link to open the notice.

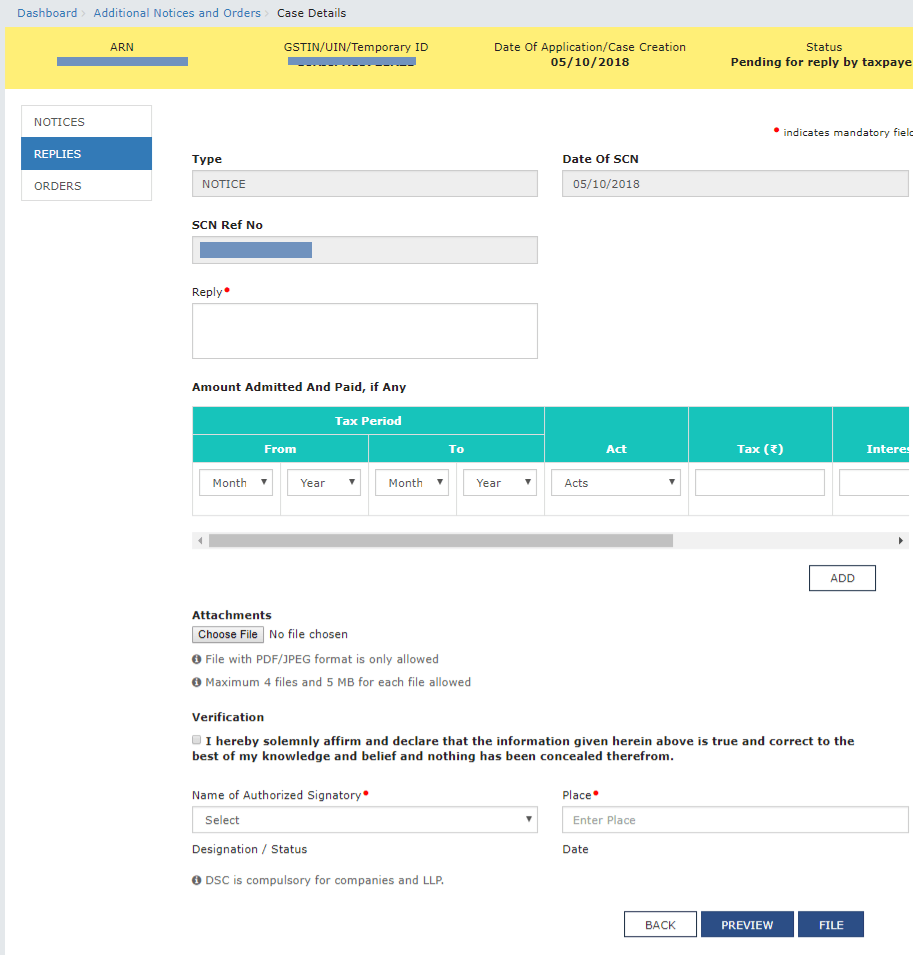

2. Filling Reply

- Select the REPLIES tab on the case details page. This tab will display the replies you will have to file against the Notices issued.

- To add a reply, click on NOTICE

- Fill in your response in the reply field.

- Fill in the Amount admitted and paid details, if any.

- You may scroll to the right using the scroll bar to enter more details

3. Upload Supporting documents

- If you want to upload any supporting documents to your reply, click Choose File to upload your reply and upload.

- Click on the Verification check-box and choose authorized signatory

- Enter the name of the place where the form is filed

- Click on PREVIEW to download and review your reply

4. File the ASMT 11

- After verifying the reply in preview mode, you may now initiate filing your reply in ASMT 11

- Click on the “File” button to submit your reply

- You can file your reply by using your DSC or EVC as applicable to your registration.

- You will see the success message and will receive the reference number for your reply. By using this reference number, you can later re-visit the portal and check the order status.

Frequently Asked Questions

In case, discrepancies are found in the filed GST return, the GST officer issued ASMT 10 to the taxpayer.

The taxpayer can submit the reply on the GST portal.

Within 30 days, a taxpayer needs to submit the reply.

The taxpayer shall use ASMT 11 format to reply to the notice.

The department may take action as per section 65,66,67 or proceed to recover tax as per section 73 or section 74.

Important Links on Assessment and Returns

Recent GST News and Updates

Explore the latest GST news and updates of August 2021. Read to know the latest happening in GST.

GSTR 1 Filing Guide

Read to know GSTR 1 return filing online. Download the offline tool and formats. Know more about GSTR 1 filing process.

GSTR 3B Filing Guide

Know how to file GSTR 3b return with format updates. Read more about GSTR 3b summary filing.

Annual GST Return Filing

Know who has to file GST Annual return every year. Also, read when the GSTR 9 annual fling is due.

IGST CGST SGST me input excess claim hai to usi ke regarding payment karna hai sir please reply

If i understand correctly, you are trying to say you have taken excess input tax then what is actually available. yes, in this case you have to pay the excess/wrong ITC taken with interest of 24%. read more here https://gstindianews.info/gst-late-fees-returns-payments-wrong-itc-reversal-notifications/#itcreversal