Goods and Service Tax forms for offline use in pdf formats. Here you can download GST format in pdf only for reference purpose. Further, you may visit our GST offline tool download page to download actual GST forms in Excel format. Taxpayer can generate json file by using these excel formats to upload it on GST portal.

Kindly click on “Download” button to download the necessary format.

| Chapter | Forma Type | Form No. | |

| Chapter II | Composition | CMP 1- Intimation to pay tax under section 10 (composition levy) (Only for persons registered under the existing law migrating on the appointed day) | Download |

| Chapter II | Composition | CMP 2 – Intimation to pay tax under section 10 (composition levy) (For persons registered under the Act) | Download |

| Chapter II | Composition | CMP 3 – Intimation of details of stock on date of opting for composition levy (Only for persons registered under the existing law migrating on the appointed day) | Download |

| Chapter II | Composition | CMP 4 – Intimation/Application for Withdrawal from Composition Levy | Download |

| Chapter II | Composition | CMP 5 – Notice for denial of option to pay tax under section 10 | Download |

| Chapter II | Composition | CMP 6 – Reply to the notice to show cause | Download |

| Chapter II | Composition | CMP 7 – Order for acceptance / rejection of reply to show cause notice | Download |

| Chapter II | Composition | CMP 8 – Statement for payment fo self-assessed tax | Download |

| Chapter III | Registration | REG 1 – Application for Registration | Download |

| Chapter III | Registration | REG 2 – Acknowledgment | Download |

| Chapter III | Registration | REG 3 – Notice for Seeking Additional Information / Clarification / Documents relating to Application for <> | Download |

| Chapter III | Registration | REG 4 – Clarification/additional information/document for <> | Download |

| Chapter III | Registration | REG 5 – Order of Rejection of Application for | Download |

| Chapter III | Registration | REG 6 – Registration Certificate | Download |

| Chapter III | Registration | REG 7 – Application for Registration as Tax Deductor at source (u/s 51) or Tax Collector at source (u/s 52) | Download |

| Chapter III | Registration | REG 8 – Order of Cancellation of Registration as Tax Deductor at source or Tax Collector at source | Download |

| Chapter III | Registration | REG 9 – Application for Registration of Non Resident Taxable Person | Download |

| Chapter III | Registration | REG 10 – Application for registration of person supplying online information and data base access or retrieval services from a place outside India to a person in India, other than a registered person. | Download |

| Chapter III | Registration | REG 11 – Application for extension of registration period by casual / non-resident taxable person | Download |

| Chapter III | Registration | REG 12 – Order of Grant of Temporary Registration/ Suo Moto Registration | Download |

| Chapter III | Registration | REG 13 – Application/Form for grant of Unique Identity Number to UN Bodies / Embassies / others | Download |

| Chapter III | Registration | REG 14 – Application for Amendment in Registration Particulars (For all types of registered persons) | Download |

| Chapter III | Registration | REG 15 – Order of Amendment | Download |

| Chapter III | Registration | REG 16 – Application for Cancellation of Registration | Download |

| Chapter III | Registration | REG 17 – Show Cause Notice for Cancellation of Registration | Download |

| Chapter III | Registration | REG 18 – Reply to the Show Cause Notice issued for cancellation for registration | Download |

| Chapter III | Registration | REG 19 – Order for Cancellation of Registration | Download |

| Chapter III | Registration | REG 20 – Order for dropping the proceedings for cancellation of registration | Download |

| Chapter III | Registration | REG 21 – Application for Revocation of Cancellation of Registration | Download |

| Chapter III | Registration | REG 22 – Order for revocation of cancellation of registration | Download |

| Chapter III | Registration | REG 23 – Show Cause Notice for rejection of application for revocation of cancellation of registration | Download |

| Chapter III | Registration | REG 24 – Reply to the notice for rejection of application for revocation of cancellation of registration | Download |

| Chapter III | Registration | REG 25 – Certificate of Provisional Registration | Download |

| Chapter III | Registration | REG 26 – Application for Enrolment of Existing Taxpayer | Download |

| Chapter III | Registration | REG 27 – Show Cause Notice for cancellation of provisional registration | Download |

| Chapter III | Registration | REG 28 – Order for cancellation of provisional registration | Download |

| Chapter III | Registration | REG 29 – Application for cancellation of provisional registration | Download |

| Chapter III | Registration | REG 30 – Form for Field Visit Report | Download |

| Chapter V | Input Tax Credit | ITC 1 – Declaration for claim of input tax credit under sub-section (1) of section 18 | Download |

| Chapter V | Input Tax Credit | ITC

2 – Declaration for transfer of ITC in case of sale, merger, demerger,

amalgamation, lease or transfer of a business under sub-section (3) of

section 18 | Download |

| Chapter V | Input Tax Credit | ITC 3 – Form GST ITC -03 | Download |

| Chapter V | Input Tax Credit | ITC 04 – Form GST ITC-04 | Download |

| Chapter VI | Tax Invoice, Credit and Debit Notes | INV 1 – Generation of Invoice Reference Number | Download |

| Chapter VII | Accounts and Records | ENR 1 – Application for Enrolment u/s 35 (2) | Download |

| Chapter VII | Returns | GST RET 1 – Monthly / Quarterly (Normal) Return | Download |

| Chapter VII | Returns | GST ANX 1 – Details of outward supplies of goods or services (NEW RETURN) | Download |

| Chapter VIII | Returns | GSTR 1 – Details of outward supplies of goods or services | Download |

| Chapter VIII | Returns | GSTR 1A – Details of auto drafted supplies (From GSTR 2, GSTR 4 or GSTR 6 ) | Download |

| Chapter VIII | Returns | GSTR 2 – Details of inward supplies of goods or services | Download |

| Chapter VIII | Returns | GSTR 2A – Details of auto drafted supplies (From GSTR 1, GSTR 5, GSTR-6, GSTR-7 and GSTR-8) | Download |

| Chapter VIII | Returns | GSTR 3 – Monthly return | Download |

| Chapter VIII | Returns | GSTR 3A – Notice to return defaulter u/s 46 for not filing return | Download |

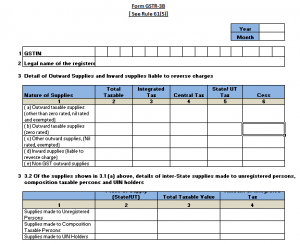

| Chapter VIII | Returns | GSTR 3B – Summary Return | Download |

| Chapter VIII | Returns | GSTR 4 – Quarterly return for registered person opting for composition levy | Download |

| Chapter VIII | Returns | GSTR 4A – Auto-drafted details for registered person opting for composition levy (Auto-drafted from GSTR-1, GSTR-5 and GSTR-7) | Download |

| Chapter VIII | Returns | GSTR 5 – Return for Non-resident taxable person | Download |

| Chapter VIII | Returns | GSTR 5A – Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable persons in India | Download |

| Chapter VIII | Returns | GSTR 6 – Return for input service distributor | Download |

| Chapter VIII | Returns | GSTR 6A – Details of supplies auto-drafted form (Auto-drafted from GSTR-1) | Download |

| Chapter VIII | Returns | GSTR 7 – Return for Tax Deducted at Source | Download |

| Chapter VIII | Returns | GSTR 7A – Tax Deduction at Source Certificate | Download |

| Chapter VIII | Returns | GSTR 8 – Statement for tax collection at source | Download |

| Chapter VIII | Returns | GSTR 9 – Annual Return for Regular Taxpayer | Download |

| Chapter VIII | Returns | GSTR 9A – Annual Return for E-commerce operator | Download |

| Chapter VIII | Returns | GSTR 9C – Annual Return for Turnover more then 2cr. | Download |

| Chapter VIII | Returns | GSTR 11 – Statement of inward supplies by persons having Unique Identification Number (UIN) | Download |

| Chapter VIII | Returns | GSTR 10 – Final Return after Cancellation of GST Registration | Download |

| Chapter IX | Payment of Tax | PCT 1 – Application for Enrolment as Goods and Services Tax Practitioner | Download |

| Chapter IX | Payment of Tax | PCT 2 – Enrolment Certificate of Goods and Services Tax Practitioner | Download |

| Chapter IX | Payment of Tax | PCT 3 – Show Cause Notice for disqualification | Download |

| Chapter IX | Payment of Tax | PCT 4 – Order of rejection of enrolment as GST Practitioner | Download |

| Chapter IX | Payment of Tax | PCT 5 – Authorisation / withdrawal of authorisation for Goods and Services Tax Practitioner | Download |

| Chapter IX | Payment of Tax | PMT 1 – Electronic Liability Register of Registered Person | Download |

| Chapter IX | Payment of Tax | PMT 2 – Electronic Liability Register of Taxable Person | Download |

| Chapter IX | Payment of Tax | PMT 3 – Order for re-credit of the amount to cash or credit ledger on rejection of refund claim | Download |

| Chapter IX | Payment of Tax | PMT 4 – Application for intimation of discrepancy in Electronic Credit Ledger/Cash Ledger/ Liability Register | Download |

| Chapter IX | Payment of Tax | PMT 5 – Electronic Cash Ledger | Download |

| Chapter IX | Payment of Tax | PMT 6 – Challan for deposit of goods and services tax | Download |

| Chapter IX | Payment of Tax | PMT 7 – Application for intimating discrepancy relating to payment | Download |

| Chapter IX | Transfer of payment | PMT 9 – Transfer of amount from one head to another | Download |

| Chapter X | Refund | RFD 1 – Application for Refund | Download |

| Chapter X | Refund | RFD 1A – Acknowledgment | Download |

| Chapter X | Refund | RFD 1B – Outward Supplies | Download |

| Chapter X | Refund | RFD 2 – Acknowledgment | Download |

| Chapter X | Refund | RFD 3 – Deficiency Memo | Download |

| Chapter X | Refund | RFD 4 – Provisional Refund Order | Download |

| Chapter X | Refund | RFD 5 – Payment Advice | Download |

| Chapter X | Refund | RFD 6 – Refund Sanction/Rejection Order | Download |

| Chapter X | Refund | RFD 7 – Order for Complete adjustment of sanctioned Refund | Download |

| Chapter X | Refund | RFD 8 – Notice for rejection of application for refund | Download |

| Chapter X | Refund | RFD 9 – Reply to show cause notice | Download |

| Chapter X | Refund | RFD 10 – Application for Refund by any specialized agency of UN or any Multilateral Financial Institution and Organization, Consulate or Embassy of foreign countries, etc. | Download |

| Chapter X | Refund | RFD 11 – Furnishing of bond or Letter of Undertaking for export of goods or services | Download |

| Chapter XI | Assessment and Audit | ASMT 1 – Application for Provisional Assessment under section 60 | Download |

| Chapter XI | Assessment and Audit | ASMT 2 – Notice for Seeking Additional Information / Clarification / Documents for provisional assessment | Download |

| Chapter XI | Assessment and Audit | ASMT 3 – Reply to the notice seeking additional information | Download |

| Chapter XI | Assessment and Audit | ASMT 4 – Order of Provisional Assessment | Download |

| Chapter XI | Assessment and Audit | ASMT 5 – Furnishing of Security | Download |

| Chapter XI | Assessment and Audit | ASMT 6 – Notice for seeking additional information / clarification / documents for final assessment | Download |

| Chapter XI | Assessment and Audit | ASMT 7 – Final Assessment Order | Download |

| Chapter XI | Assessment and Audit | ASMT 8 – Application for Withdrawal of Security | Download |

| Chapter XI | Assessment and Audit | ASMT 9 – Order for release of security or rejecting the application | Download |

| Chapter XI | Assessment and Audit | ASMT 10 – Notice for intimating discrepancies in the return after scrutiny | Download |

| Chapter XI | Assessment and Audit | ASMT 11 – Reply to the notice issued under section 61 intimating discrepancies in the return | Download |

| Chapter XI | Assessment and Audit | ASMT 12 – Order of acceptance of reply against the notice issued under section 61 | Download |

| Chapter XI | Assessment and Audit | ASMT 13 – Assessment order under section 62 | Download |

| Chapter XI | Assessment and Audit | ASMT 14 – Show Cause Notice for assessment under section 63 | Download |

| Chapter XI | Assessment and Audit | ASMT 15 – Assessment order under section 63 | Download |

| Chapter XI | Assessment and Audit | ASMT 16 – Assessment order under section 64 | Download |

| Chapter XI | Assessment and Audit | ASMT 17 – Application for withdrawal of assessment order issued under section 64 | Download |

| Chapter XI | Assessment and Audit | ASMT 18 – Acceptance or Rejection of application filed under section 64 (2) | Download |

| Chapter XI | Assessment and Audit | ADT 1 – Notice for conducting audit | Download |

| Chapter XI | Assessment and Audit | ADT 2 – Audit Report under section 65(6) | Download |

| Chapter XI | Assessment and Audit | ADT 3 – Communication to the registered person for conduct of special audit under section 66 | Download |

| Chapter XI | Assessment and Audit | ADT 4 – Information of Findings upon Special Audit | Download |

| Chapter XII | Advance Ruling | ARA 1 – Application Form for Advance Ruling | Download |

| Chapter XII | Advance Ruling | ARA 2 – Appeal to the Appellate Authority for Advance Ruling | Download |

| Chapter XII | Advance Ruling | ARA 3 – Appeal to the Appellate Authority for Advance Ruling | Download |

| Chapter XIII | Appeals and Revision | APL 1 – Appeal to Appellate Authority | Download |

| Chapter XIII | Appeals and Revision | APL 2 – Acknowledgment for submission of appeal | Download |

| Chapter XIII | Appeals and Revision | APL 3 – Application to the Appellate Authority under sub-section (2) of Section 107 | Download |

| Chapter XIII | Appeals and Revision | APL 4 – Summary of the demand after issue of order by the Appellate Authority, Tribunal or Court | Download |

| Chapter XIII | Appeals and Revision | APL 5 – Appeal to the Appellate Tribunal | Download |

| Chapter XIII | Appeals and Revision | APL 6 – Cross-objections before the Appellate Tribunal | Download |

| Chapter XIII | Appeals and Revision | APL 7 – Application to the Appellate Tribunal under sub section (3) of Section 112 | Download |

| Chapter XIII | Appeals and Revision | APL 8 – Appeal to the High Court under section 117 | Download |

| Chapter XIV | Transitional Provisions | TRAN 1 – Transitional ITC / Stock Statement | Download |

| Chapter XIV | Transitional Provisions | TRAN 2 – Form GST TRAN – 2 | Download |

| Chapter XVI | E-way | EWB 1 – E – Way Bill | Download |

| Chapter XVI | E-way | EWB 2 – Consolidated E – Way Bill | Download |

| Chapter XVI | E-way | EWB 3 – Verification Report | Download |

| Chapter XVI | E-way | EWB 4 – Report of detention | Download |

| Chapter XVII | Inspection, Search and Seizure | INS 1 – AUTHORISATION FOR INSPECTION OR SEARCH | Download |

| Chapter XVII | Inspection, Search and Seizure | INS 2 – ORDER OF SEIZURE | Download |

| Chapter XVII | Inspection, Search and Seizure | INS 3 – ORDER OF PROHIBITION | Download |

| Chapter XVII | Inspection, Search and Seizure | INS 4 – BOND FOR RELEASE OF GOODS SEIZED | Download |

| Chapter XVII | Inspection, Search and Seizure | INS 5 – FORM GST INS-05 | Download |

| Chapter XVIII | Demands and Recovery | DRC 1 – Summary of Show Cause Notice | Download |

| Chapter XVIII | Demands and Recovery | DRC 2 – Summary of Statement | Download |

| Chapter XVIII | Demands and Recovery | DRC 3 – Intimation of payment made voluntarily or made against the show cause notice (SCN) or statement | Download |

| Chapter XVIII | Demands and Recovery | DRC 4 – Acknowledgement of acceptance of payment made voluntarily | Download |

| Chapter XVIII | Demands and Recovery | DRC 5 – Intimation of conclusion of proceedings | Download |

| Chapter XVIII | Demands and Recovery | DRC 6 – Reply to the Show Cause Notice | Download |

| Chapter XVIII | Demands and Recovery | DRC 7 – Summary of the order | Download |

| Chapter XVIII | Demands and Recovery | DRC 8 – Rectification of Order | Download |

| Chapter XVIII | Demands and Recovery | DRC 9 – Order for recovery through specified officer under section 79 | Download |

| Chapter XVIII | Demands and Recovery | DRC 10 – Notice for Auction of Goods under section 79 (1) (b) of the Act | Download |

| Chapter XVIII | Demands and Recovery | DRC 11 – Notice to successful bidder | Download |

| Chapter XVIII | Demands and Recovery | DRC 12 -Sale Certificate | Download |

| Chapter XVIII | Demands and Recovery | DRC 13 – Notice to a third person under section 79(1) (c) | Download |

| Chapter XVIII | Demands and Recovery | DRC 14 – Certificate of Payment to a Third Person | Download |

| Chapter XVIII | Demands and Recovery | DRC 15 – APPLICATION BEFORE THE CIVIL COURT REQUESTING EXECUTION FOR A DECREE | Download |

| Chapter XVIII | Demands and Recovery | DRC 16 – Notice for attachment and sale of immovable/movable goods/shares under section 79 | Download |

| Chapter XVIII | Demands and Recovery | DRC 17 – Notice for Auction of Immovable/Movable Property under section 79(1) (d) | Download |

| Chapter XVIII | Demands and Recovery | DRC 18 – Certificate action under clause (e) of sub-section (1) section 79 | Download |

| Chapter XVIII | Demands and Recovery | DRC 19 – Application to the Magistrate for Recovery as Fine | Download |

| Chapter XVIII | Demands and Recovery | DRC 20 – Application for Deferred Payment/ Payment in Instalments | Download |

| Chapter XVIII | Demands and Recovery | DRC 21 – Order for acceptance/rejection of application for deferred payment / payment in instalments | Download |

| Chapter XVIII | Demands and Recovery | DRC 22 – Provisional attachment of property under section 83 | Download |

| Chapter XVIII | Demands and Recovery | DRC 23 – Restoration of provisionally attached property / bank account under section 83 | Download |

| Chapter XVIII | Demands and Recovery | DRC 24 – Intimation to Liquidator for recovery of amount | Download |

| Chapter XVIII | Demands and Recovery | DRC 25 – Continuation of Recovery Proceedings | Download |

| Chapter XIX | Offences and Penalties | CPD 1 – Application for Compounding of Offence | Download |

| Chapter XIX | Offences and Penalties | CPD 2 – Order for rejection / allowance of compounding of offence | Download |

| Deemed Export Supply | Intimation for procurement of supplies from the registered person (Form-A) | Form A | Download |

| Deemed Export Supply | Form to be maintained by EOU/EHTP/STP/BTP unit (Form-B) | Form B | Download |

Above GST forms are available for offline use. These forms are as per GST Rules in India. One may download and use it for offline use as and where needed. These offline GST forms are helpful for preparation of offline content by GST practitioners, consultants or Software developers.

Download GST invoice format, GSTR 9C format, GSTR 3B format in pdf, etc. Similarly, you may download GSTR 1, GST audit format and All gst return formats. Further, you can download gst challan format in pdf, GSTR 10 format, GST CMP 08 and GSTR 7 format in pdf.

GST ALL RETURNS TOO MUCH COMPLICATED AND INCORRECT KNOWLEDGE IN FORMS SO I REQUEST SINGLE RETURS IS BEST WAY AND ESAY TO GET TAXES AND ALL TAX AUDIT REPORTS RAISE THE TURNOVER UP TO 10 CRORE