Completing the GST login process for your business can seem daunting, but it doesn’t have to be. In this comprehensive guide, you’ll find all the necessary resources to understand and complete the GST login process so you can get started on your business.

Create an Account on the GST Portal.

The first step in the GST login process is to create an account on the GST Portal. This will give you access to all the resources and services you need within the portal. You’ll need to provide basic information such as name, address, and phone number, plus additional contact information such as a valid email address. Once your account has been created, you can log into the portal using your username and password.

Once you’ve logged in, you’ll be able to access the GST portal dashboard. From here, you can file returns and apply for refunds, find product information, and much more. All your relevant tax-related information is available on the GST portal, so keeping organized is easy. It’s also possible to track your progress with your current filing schedule through the dashboard, meaning that filing quickly and efficiently is made simpler with the help of this platform.

Fill Out the Registration Form and Submit It.

The second step in the GST login process is to fill out the registration form and submit it. You’ll need to provide detailed information about your business such as its name, address, type of business, etc. It’s important to fill out the form accurately and completely, as this information will be used by the GST Portal to generate the relevant tax forms. Once you’ve submitted the form, you’ll then be directed to a confirmation page where you can review your details before submitting them for processing.

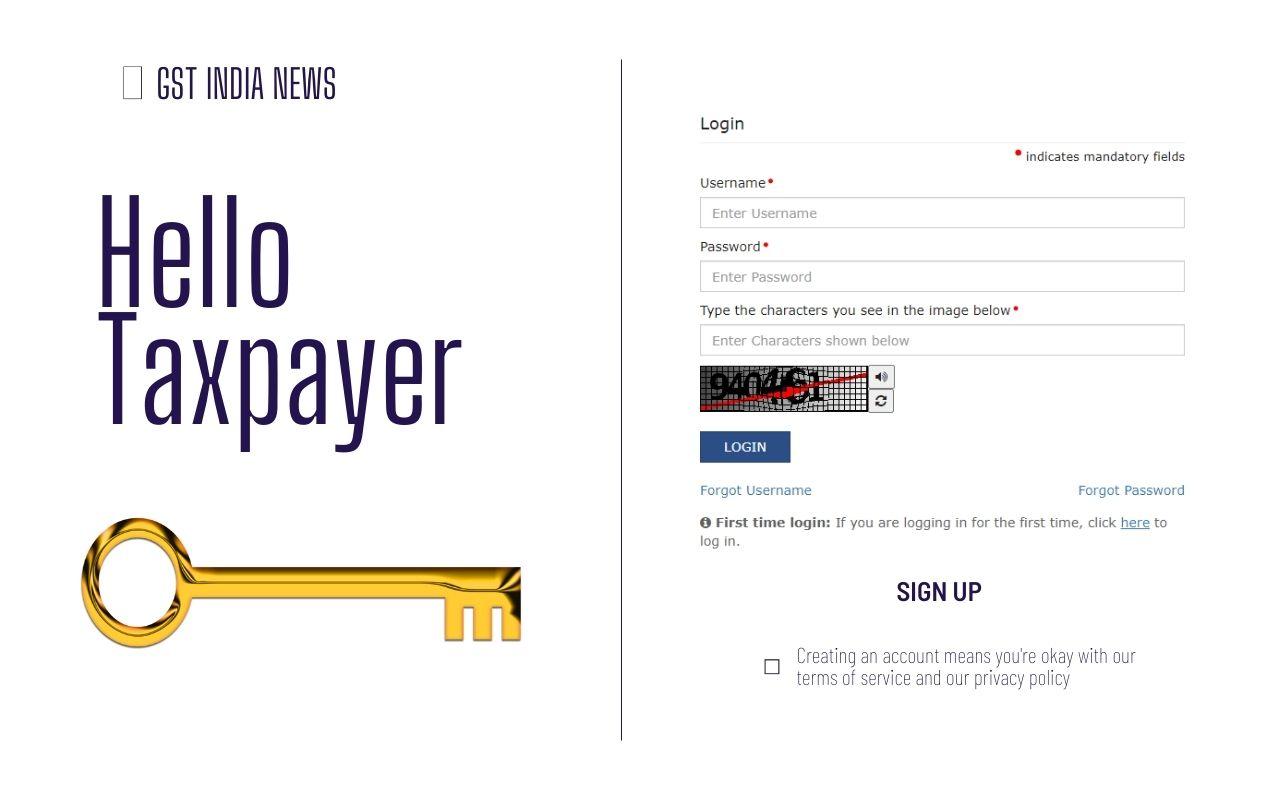

After you’ve reviewed your details and submitted the GST registration form, it will be time to complete the login process. You’ll need to enter your username and password on the portal’s homepage, then click “Login” to enter the dashboard. From there, you can access all of the various tools and features such as filing returns and tracking payments. The GST Portal also allows you to access resources such as a detailed list of registered taxpayers and tax credits available for businesses. With a few clicks, you’ll be ready to start managing your taxes efficiently with the GST Portal.

Check your Email for Confirmation of Registration and Login Details.

After submitting the registration form, you’ll usually receive a confirmation email containing your login information in a few minutes. The email will contain directions to the GST Portal where you can access your account and manage your business’s GST taxes and returns. Prior to logging in, make sure that all of your information is correct, otherwise, it may take longer for your account to be verified. Once everything is confirmed and verified, you’re now ready to log in.

Log in to the GST Portal with Your Credentials.

Once you have all your information ready, it’s time to log in to the GST Portal. Using the login credentials provided in the confirmation email, access the GST website and proceed with your login process. Before logging in, make sure all of your business data is in order and up to date. Once logged in, you will be able to view all your account information, manage tax and return filings, and pay taxes due every month.

Access Different Services on the Portal After Successful Login.

After you log in to the portal successfully, you can access various services for managing taxes and returns. These services include filing of tax returns and its subsequent processing, payment of GST liabilities, refund claims management, applying for registration or amendment thereof, and much more. Take a moment to explore the various sections on the portal to become familiar with what each section offers.