The Centre has decided to relax the timeline provision under which the e-way bill generated by GSTN for 20 days for goods traveling more than 1,000 km. Earlier, it was for 15 days only.

As per the provision, GSTN will generate e-way bills that will be valid for 1-20 days, depending on the distance to be traveled — one day for 200 km & an additional 1 day for every 200 km or part thereof.

The GST Commissioner may extend the validity period of the e-way bill for certain categories of goods, depending upon the types of goods.

“We hope the e-way bill can be implemented in three months’ time as by then, we hope to develop the infrastructure for the consolidated e-way bill,” official sources said.

Although the Goods and Services Tax (GST) has been rolled out from July 1, a centralized e-way bill could not be implemented as the rules and forms were not ready.

Future plans of eway bill

“The e-way bill rules may be taken up at the next meeting of the GST Council on August 5. After the rules are in place, the NIC and GSTN would develop an all-India platform for a consolidated system,” another official source said.

Since states like West Bengal, Kerala, Bihar, Odisha, and Andhra Pradesh already had a robust e-way bill system, the GST Council in its meeting last month has allowed the states to have e-way bill rules to continue with the existing form till a central format is built.

Originally, GSTN was to develop the e-way bill platform, but last month only the GST Council decided to rope in NIC to develop it since it was felt that in the initial days of GST rollout, GSTN would be busy with other works like solving issues like registration and invoice generation.

The draft of e-way bill rules, which was made public in April, provided that the person-in-charge of conveyance will be required to carry the invoice or bill of supply or delivery challan, and a copy of the e-way bill or the e-way bill number, either physically or mapped to a Radio Frequency Identification Device (RFID) embedded onto the conveyance.

The rules authorize the tax commissioner or an officer empowered by him on his behalf to intercept any conveyance to verify the e-way bill or the number in physical form for all interstate and intra-state movement of goods.

Physical verification of conveyances can be carried out on specific information of evasion of tax, as per the rules.

The GST Tax officers will be required to submit a summary report of every inspection of goods in transit within 24 hours and the final report within three days of inspection of said consignment.

Related Articles

GST e way bill login System

https://ewaybillgst.gov.in is the official website of the GST e way bill system. The taxpayer and transporters can visit the portal, register their business and generate an electronic waybill. more

how to activate e way bill in excel

By using the bulk e way bill generation excel file, you can enter the details of all e waybills in the excel file. Later, you can generate the JSON file in excel itself and upload the file on the e way bill portal to generate e waybill. more

Consolidated E way bill

The Consolidated e waybill is a combination of various e waybills. Thus, it is a combination of many e way bills generated by the supplier of goods. more

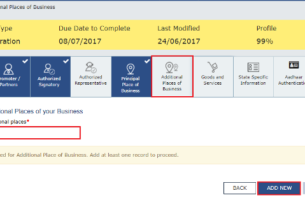

e way bill registration with Procedure

In order to register for eway bill generation, keep the required documentation ready. Thereafter, visit eway bill Portal > www.ewaybill.nic.in in your browser. Later click on ‘e-way bill Registration‘. more