According to Rule 138E (a) and (b) of CGST Rules, 2017 the waybill generation can be restricted. Therefore, those taxpayers who fail to file their GSTR 3B and CMP 08 for two or more consecutive periods will not be able to generate their e waybills.

Thus, from 1st December 2020, onwards, the blocking of the EWB generation facility will be applicable to all the taxpayers. This is irrespective of their Aggregate Annual Turnover (AATO)). Also, this is in terms of Rule 138 E (a) and (b) of the CGST Rules, 2017, on the EWB portal.

Accordingly, on 1st December 2020, the GST System will check the status of returns filed in Form GSTR-3B or GST CMP-08. This will be for the class of taxpayers to whom it applies, and restrict the generation of EWB in case of:

- Non-filing of two or more GSTR 3b returns for the months up to October 2020; and

- Non-filing of 2 or more statements of CMP-08 for the quarters up to July to September 2020

Therefore, this blocking will take place periodically from 1st December 2020 onwards.

Hence, in order to avail of continuous EWB generation facility on EWB Portal, taxpayers are advised to file their pending GSTR 3B returns/GST CMP-08 statements immediately.

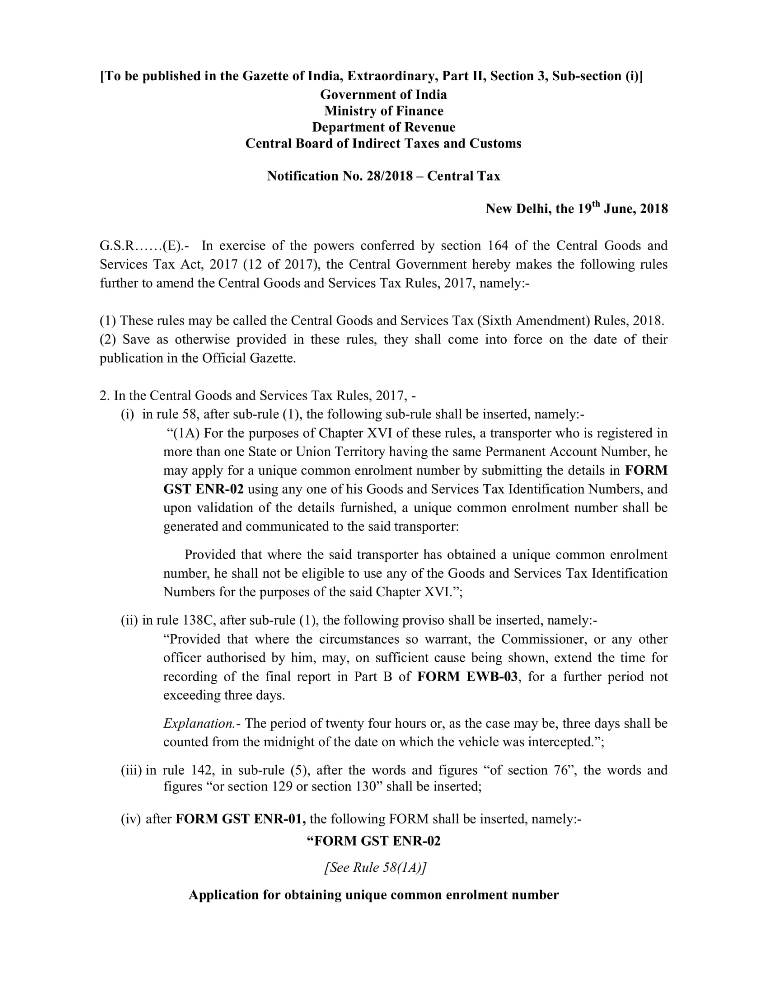

E Way Bill Rules Amendment

27.06.2018: The Government recently issued a notification regarding changes in CGST rules. These changes are related to the E way bill, where some sub-rules has been added.

Summary of Major Changes in E Way Bill Rules

- Notifies the common unique enrollment number for transporter with registration in more than one state. There will be more than one GSTIN for the transporter registering in more than one state.

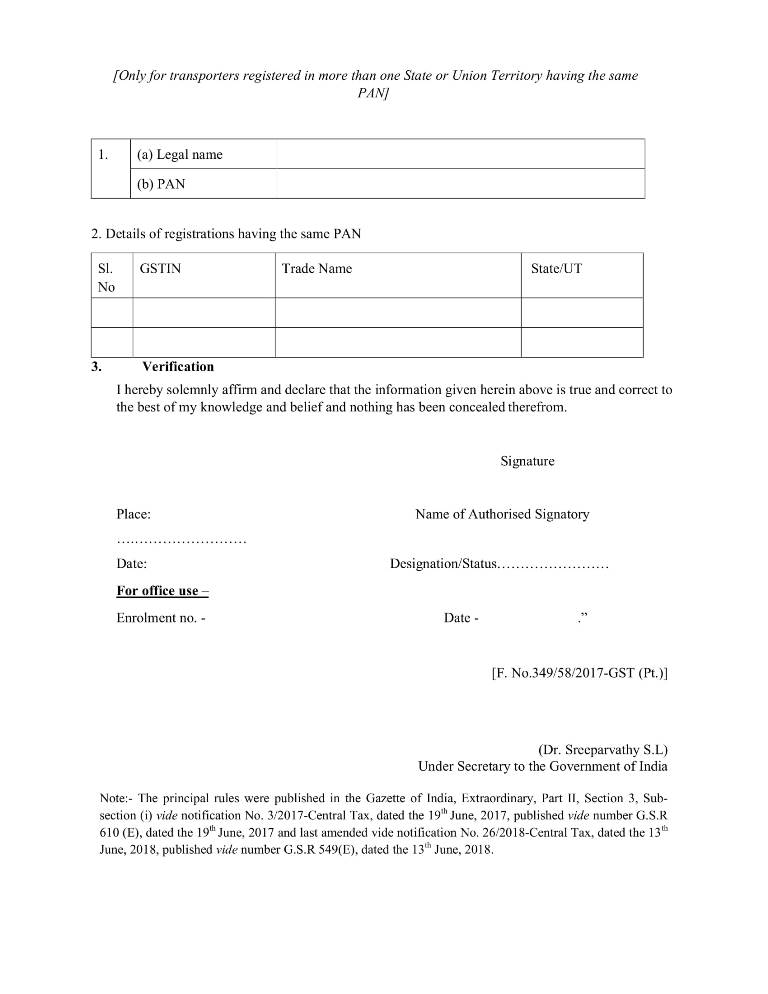

- GST ENR-02 (Application for obtaining Unique General Enrollment Number) has been inserted.

- A transporter who is registered in more than one state with the same pan, can submit an application in GST ENR-02 and apply for a unique common enrolment number by using any of his GSTIN.

- On verification of the details submitted, a unique common enrolment number will be generated and the transporter will be informed.

- Once the transporter has obtained a unique common enrolment number, then he will not be able to use any GSTIN for the purposes of e-bill (Chapter XVI).

- Increased deadline for filing of the final report by the appropriate officer of vehicle checking. The Commissioner (or any officer authorized by him) has the power to extend the duration of 3 days to the final report by another 3 days by the appropriate officer.

- Rule 142 (5) revised. Now the summary of the order passed under section 129 (Detention/seizure of goods and vehicles in transit) or Section 130 (Confiscation of goods or vehicles and fines) is to be uploaded in Form GST DRC-07.

The said notification has reference no. 28/2018 – Central Tax dt.19.06.2018. you can read the detailed notification below. We have also updated our complete CGST rules pages with these changes. you may download the complete list in pdf file by clicking on below download button.