What is GSTR 2b?

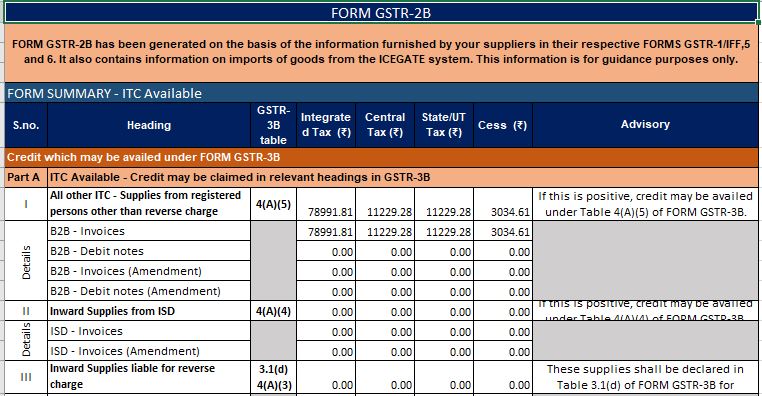

Answer: The GSTR-2B is an automatic system-generated draft of the input tax credit(ITC) statement. The GSTR 2B bifurcates the ITC available and the invoices on which ITC is not available.

W.E.F 01.01.2022, the government has made it compulsory to avail input tax credit only on the invoices and debit notes that are appearing in GSTR 2B. Refer to CGST Notification No. 40/2021 – Central Tax Dt.29.12.2021.

However, the restriction is not applicable for availing ITC on the GST paid on imports and Reverse charge. It is clarified in circular no. Circular No. 123/42/2019– GST dt. 11.11.2019.

The GST system generates GSTR 2b for every registered person on the basis of outward supplies details filed by the suppliers. The supplier uploads such details in their GSTR-1 & GSTR-5 returns. It also includes ITC received through GSTR-6 return.

The GSTR 2B statement indicates the availability of Input Tax Credit to the registered person. This is against each document filed by his/her suppliers and the Input Service Distributor (ISD).

Further, the GSTR-2B contains information on the import of goods from the ICEGATE system. Similarly, it also includes inward supplies of goods received from SEZ Units / Developers.

What is the difference between GSTR 2a and 2b?

Answer: In GSTR 2a, you can see all the transactions of outward supplies declared by the supplier. Thus, the taxpayer can not make out, whether the input tax credit is available to him/her or not.

On the other hand, in GSTR 2B, the taxpayer can see how much credit is available to him/her. Thus, there will be 2 different sheets containing the ITC Available and ITC not available.

How to Download GSTR 2b in Excel?

Answer: Log in to the GST portal. Click on Services> Returns > Returns Dashboard > File Returns > GSTR 2B Tile. Click on the “Download button”. on the download screen, click on “Generate excel file to download“.

How to File GSTR 2b Return?

Since GSTR 2b is a system-generated statement, you need not have to file this return.

Latest News update on GSTR 2B

15.05.2022: Due to some technical issues at the GST portal, certain records are not reflected in the GSTR-2B statement for the period of April 2022. However, these records are visible in the GSTR-2A of such recipients.

Thus, the technical team is working to resolve these issues for the impacted taxpayers and generate fresh GSTR-2B at the earliest. Therefore, as an interim measure, affected taxpayers interested in filing GSTR-3B are requested to file the return on a self-assessment basis using GSTR-2A. The GSTN team has conveyed the inconvenience caused in this regard is deeply regretted.

Related Articles

What is GSTR 2a return?

The GSTR 2A is a system-generated draft Report of Inward Supplies for a receiver. Thus, GSTR 2A is an auto-populated statement. more

GSTR 3B Due Date of 2021

The GSTR 3B due date for February 2021 is the 20th of March 2021. However, few states can file it on the 22and 23rd of March 2021. more

How to file IFF in GST?

- Login to the GST portal and Navigate to the IFF page

- Enter the Details in Various Tables and Generate the GSTR-1/ IFF Summary. more

All about QRMP Scheme in GST

The Quarterly return & monthly payment scheme is introduced for small taxpayers. It aims to make the payments and upload invoices on the monthly basis. more