The government has recently, been notified to implement a new quarterly filing of GST returns and a monthly payment of Tax called the QRMP Scheme. Thus, here are the Salient features of quarterly return filing and monthly payment scheme of GST returns w.e.f 01.01.2021.

Who can Apply for the QRMP Scheme?

The following registered person(RP) under GST can file quarterly returns and pay tax on a monthly basis from 01st January 2021:

- An RP who is required to file Form GSTR 3B with Aggregate Annual Turnover(AATO) of up to Rs 5 Cr. in the previous financial year is eligible. However, if AATO crosses Rs 5 Cr. even during a qtr., RP will become ineligible for the Scheme from the next quarter.

- Any person obtaining a new GST registration or opting out of the Composition Scheme can also opt for the QRMP Scheme.

- The option to avail of the QRMP scheme can be availed on the basis of GST number-wise. Therefore, few GSTINs for that PAN can opt for the QRMP Scheme, and the remaining GSTINs can remain out of the Scheme.

Related: Join for GST Webinar on QRMP Scheme

What Changes will be carried out on the GST Portal?

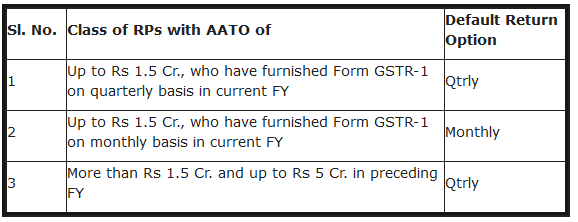

For qtr. Jan. 2021 to March 2021, all GST registered persons whose AATO for the FY 2019-20 is up to Rs 5 Cr. will be migrated by default in the GST system in the following manner. Simultaneously, it is applicable for those who have filed GSTR-3B returns for the month of October 2020 by 30th 2020.

When to apply for this scheme?

The facility can be availed throughout the year, in any quarter. However, the option for the QRMP Scheme, once exercised, will continue till the registered person revises the option or his AATO exceeds Rs 5 Cr.

Further, the registered persons migrated by default can choose to remain out of the scheme by exercising their option from 5th December 2020 till 31st Jan. 2021. Similarly, the RPs applying for this scheme can avail the facility of the Invoice Furnishing Facility (IFF). This is to enable the outward supplies to registered persons to be reflected in their Form GSTR 2A & 2B.

Read How to file IFF on GST portal?

QRMP scheme payment due date

The payment due date under the QRMP scheme is the 25th of the next month. For eg. The payment of January 2021 has to be deposited on or before 25th February 2021. Thus, 25th is the last date to deposit the payment.

How to opt out of qrmp scheme?

You can change from qrmp to monthly filing of GSTR 3b. Below are the timelines, when you can change this option.

| S.No. | For Quarter | QRMP Scheme can be switched in or out during: |

| 1 | Q1 (April – May – June) | 1st February’ to 30th April’ |

| 2 | Q2 (July – August – September) | 1st May’ to 31st July’ |

| 3 | Q3 (October – November – December) | 1st August’ to 31st October’ |

| 4 | Q4 (January – February – March) | 1st November’ to 31st January of next year |

To switch from QRMP to monthly filing, follow the below steps.

- Go to Services after login into the GST portal

- Click on returns

- Click on Opt-in for the Quarterly Return option to opt in or opt out of the QRMP scheme.

How to make the payment?

The payment of this new return filing system can be made in the following manner.

- RPs need to pay the tax due in each of the first two months (by 25th of next month) in the Qtr. This can be done by selecting “Monthly payment for the quarterly taxpayer” as a reason for generating Challan.

- The RPs can either use the Fixed Sum Method (pre-filled challan) or the Self-Assessment Method (actual tax due), for the monthly payment of tax for the first two months, after adjusting ITC.

- No tax deposit is required for the month if there is a nil tax liability.

- Tax deposited for the first 02 months can be used for adjusting liability for the qtr. in Form GSTR-3B. However, it can’t be used for any other purpose till the filing of return for the qtr.

Read more about Payment method under QRMP Scheme.

Read – Notifications & Circulars implementing QRMP scheme.

How to file Return under QRMP Scheme?

Under the QRMP scheme taxpayer needs to file GSTR 1 on a quarterly basis. However, they can upload the invoices for the 1st and 2nd months of the said quarter. This is called Invoice Furnishing Facility(IFF ).

The taxpayer can enter the invoice details in online mode. Also, they can use the GSTR 1 offline tool to generate JSON file and upload the bulk invoices in one go. The taxpayer needs to submit and file the IFF return so that it can appear in GSTR 2A of the recipient. Thus, once filed records can not be modified later.

When to upload Invoices?

The taxpayers under this scheme need to upload the invoices by the 13th of next month. However, this is not mandatory. IFF is similar to GSTR 1 return.

Therefore, the taxpayer needs to file this return, so that such invoices can appear in GSTR-2A and GSTR-2B of the recipient. There is no late fee for filing these invoices at the quarter-end through GSTR 1.

GSTR 3B Filing under QRMP System

The GSTR 3b shall be filed on a quarterly basis under this scheme. Thus, it will be a summary of payments made in the 1st, 2nd, and 3rd month. It will also include the input tax credit availed for all three months.

Video on QRMP by GSTN

Here is the official video of GSTN on QRMP scheme in Hindi language.

Video in English Language

Latest Update on QRMP

07.07.2021: The GST portal has recently made few changes related to Quarterly Return filing and monthly payment scheme. The portal has notified these changes in the month of July 2021. Here are the brief details of such changes.

1. Auto population of Liabilities

As you must be aware of the taxpayer can declare their liability through optional IFF for Month 1 and Month 2 of a quarter & GSTR-1 for Month 3 of that quarter. Thus, the declaration of liability in these returns now will get auto-populate in their GSTR-3B (Quarterly) for that quarter. This will be based on the filed GSTR-1 return and IFF.

Further, these fields are editable, so that the taxpayer can revise their values upwards or downwards. Also, the system will highlight changes in red color and the taxpayer will see a warning message. However, the GST portal system will not prevent taxpayers from filing GSTR-3B with edited values.

2. Nil filing of GSTR 1 Return

The Nil return filing in GSTR-1 (Qtrly) through SMS has been enabled for taxpayers under QRMP Scheme. Therefore, the taxpayers can now file it by sending a message in the specified format to 14409. The SMS format of the message is <NIL>space<Return Type (R1)> space<GSTIN> space < Return Period (mmyyyy)>. Here is the example: NIL R1 07XXXXX1234H8Z6 062020 (where the return period must be the last month of the quarter).

It is to note that, NIL filing of GSTR 1 through SMS can’t be done in the following scenarios:

•If IFF for Month 1 or 2 of a quarter is on the Submit stage and not Filed.

•If the uploaded invoices are in the Saved condition in IFF for Month 1 or 2 of a quarter, which never submitted or filed by the due date.

3. Cancellation of QRMP Impact on filing

If the taxpayer cancels his registration for filing under QRMP Scheme after any date, after the 1st day of Month 1 of a quarter, they need to file GSTR-1 return for the complete quarter. Let us understand this below with an example.

a) If the taxpayer cancels his QRMP registration w.e.f. 1st of April, he/she need not require to file GSTR-1 for the Apr-June quarter. Thus GSTR-1 for Jan-Mar Quarter shall become the last QRMP applicable return.

However, if he/she cancels registration on a later date during the quarter, the taxpayer requires to file GSTR-1 for the Apr-June quarter. Therefore, In such cases, the filing will become open on the 1st of the month following the month with the cancellation date. This means if the cancellation has taken place on 20th May, then the taxpayer can file the GSTR-1 for Quarter Apr-June at any time on or after 1st of June.

Frequently Asked Questions

QRMP stands for Quarterly Return and Monthly Payment.

No. it is optional.

Click the Services > Returns > Opt-in for Quarterly Return option.

It is implemented to give more relaxation in filing GST returns for small taxpayers.

The Scheme is single but it can be used for all 4 quarters of the year.

Related Articles

What is GST Return and Types?

Every GST-registered person under GST must submit the statement of outward supplies and inward supplies to the government through online mode. more

GST Return Due Dates

See the latest return filing due dates in GST. It includes due dates of GSTR 1, GSTR 3B, GSTR 4, GSTR 9, etc. more

How to File GSTR 1 offline?

Here is the step-by-step guide to filing GSTR 1 offline on the GST portal. This can be done by using the GSTR 1 offline uploader tool. more

How to File GSTR 3B in GST?

Open your internet browser and visit www.gst.gov.in website > Login with your registered user name and password. more

Please clarify the confusion

In Gstr1/iff only b2b details need to provide

My confusion is – in 3b for tax calculation only b2b is considered or b2c also considered in table 3.1 (a) ?

Is there doubling of details in 3.1a and 3.2 in case of interstate supply?

Hello,

you may upload only b2b for IFF. But at the quarter-end, you need to file GSTR 1 with B2C transactions also.

Similarly, for monthly liability payments, you must consider b2b and b2c transactions.

regards

From where can i switch from QRMP to monthly GSTR 3B in the GST portal? please clarify

Hi

Kindly Login to the GST portal and then go to Services > Returns > Opt-in for Quarterly Return option to opt in or opt out of the QRMP scheme.

I hope this helps.

regards

If I have opt for QRMP scheme, is it mandatory to deposit monthly gst amount ? If yes, which method I should choose?

Well, if you have enough electronic credit or cash balance, you don’t need to create challan.

But if you do not have enough balance, you will need to deposit (either 35% or self-assessment).

Remember the amount you deposited, you will not be able to use until you submit the March GST 3B.

You may read more about QRMP payment from here https://gstindianews.info/qrmp-payment-method/