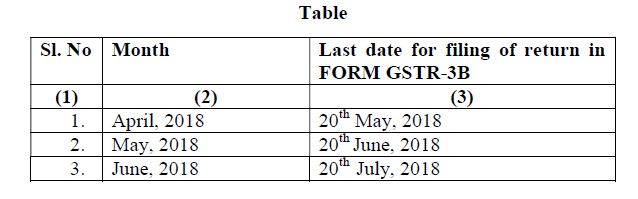

1. GST Updates on GSTR 3B for April – June 2018

24.03.2018: The Central Board of Excise and Customs has issued a notification to declare due dates for filing GSTR 3b return for the month of April – June 2018 is as per the below-given table. This is issued vide Notification No. 16 /2018 – Central Tax dt.23.03.2018. Also, Payment of taxes for discharge of tax liability as per FORM GSTR-3B is due as per the below table only.

2. Implementation of E way bill

The government has declared that e way bill has to be brought into force from 01st April 2018, vide Notification No. 15/2018 – Central Tax dt.23.03.2018.

3. Third amendment of CGST Rules

E way bill rules have been modified vide Notification No. 14/2018 – Central Tax dt.23.03.2018. The important part of change reads as below.

(i) in rule 45, in sub-rule (1), after the words, “where such goods are sent directly to a job worker”, occurring at

the end, the following shall be inserted, namely:-

“, and where the goods are sent,t from one job worker to another job worker, the challan may be issued either by the

the principal or the job worker sending the goods to another job worker:

Provided that the challan issued by the principal may be endorsed by the job worker, indicating therein the quantity

and description of goods where the goods are sent by one job worker to another or are returned to the principal:

Provided further that the challan endorsed by the job worker may be further endorsed by another job worker,

indicating therein the quantity and description of goods where the goods are sen,t by one job worker to another or are

returned to the principal.”;

Related Articles on GST India News

Latest News on GST Due Date

The CBIC has recently issued various notifications to waive the late fees of return filing for the month of March and April 2021. more

GST due date extension notification 2021

Read and download the various GST returns due date extension notifications issued by the government in the month of May 2021. more

GSTR 3b Due Date Extension

Check out the GSTR 3B due date of March, April, and May 2021. The government has waived the late fees and reduced interest for delay in filing of this return. more

Indian GST Calculator

Use our online GST calculator to know how to calculate GST on MRP in India. Download the excel sheet for GST calculation. more