GSTR 2A Return Meaning – Reconciliation of Input Tax Credit in GST

What is GSTR 2A Return?

Form GSTR 2A is a system generated ‘draft’ Report of Inward Supplies for a receiver taxpayer. GSTR 2A is an auto-populated statement.

This statement generates from the return GSTR-1/5, GSTR-7 (TDS), GSTR-6 (ISD), and GSTR-8 (TCS), filed by the supplier.

The data in GSTR 2A shows from whom goods and/or services have been procured or received by the receiver taxpayer, in a given tax period.

GSTR 2A data is meant for a recipient of the goods and services or both. GSTR 2A captures the data automatically from the GSTN database.

This process takes place automatically because the supplier uploads his outward supplies on the GST portal on the monthly/quarterly basis in the form of various returns.

On the other hand, the receiver can take input tax credit on the goods or services he receives from the supplier on the basis of documents.

The details of outward supplies by the supplier becomes available to the recipient for view and download in excel and JSON format.

The details are updated incrementally as and when supplier taxpayer upload or change details in their respective Form GSTR, for the given tax period.

GSTR 2A return filing due date

GSTR 2A means a statement of Input Tax credit and you need not have to file GSTR 2A legally. Hence there is no gstr 2a due date of filing.

When Can a Receiver View data in GSTR 2A file?

The data in GSTR 2A form will be available in the below scenarios

• As soon as the supplier uploads the B2B transaction details in Form GSTR-1& 5/ &

• Input Service distributor(ISD) details will be available automatically on submission of Form GSTR-6 by the counterparty. Also, TDS & TCS details will be available automatically on the filing of Form GSTR-7 & 8 respectively by the counterparty.

• The data in Form GSTR-2A is in Read-only view form and you cannot take any action in Form GSTR 2A.

Form GSTR-2A generation method:

• After filing or submission of Form GSTR-1 by suppliers. Also, when counterparty adds Invoices / Credit notes / Debit Notes etc. or make Amendments in Form GSTR-1/5.

• When Form GSTR-6 is submitted for further distribution of credit in the form of ISD credit invoice or ISD credit notes.

• In case of TDS and TCS credit, this data gets updated, when counterparty files Form GSTR-7 & 8.

Please note that the details of TDS and TCS returns will be available only when Form GSTR-7 & 8 will be made operational in the nearby future.

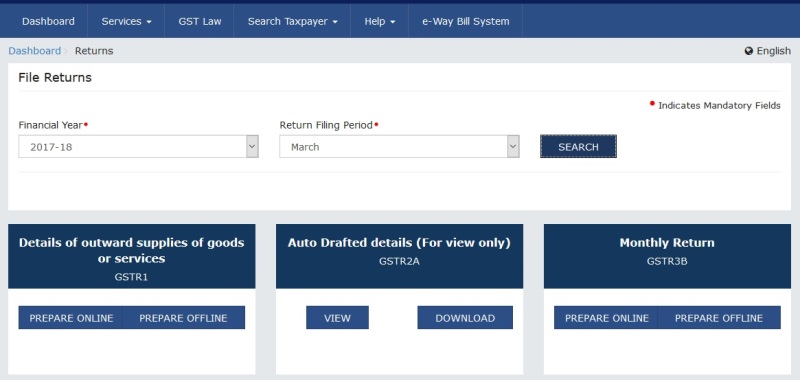

View GSTR 2A on GST Portal

a) Login into GST portal (www.gst.gov.in)

b) Click on services > Returns > Return Dashboard

c) Select the Return period for which you want to generate GSTR 2A Data.

d) Go to GSTR 2A Tile > Click on view as below:

e) Click to select the tile like B2B, Credit note/debit note, Amendments to B2B invoices etc. Now you will see GSTIN wise supplier Details, Supplier Name and Counter Party Submit Status.

GSTR 2A Download in JSON format from GST portal

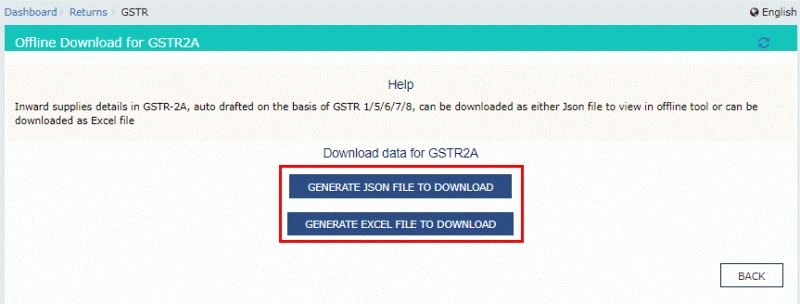

a) Go to GSTR 2A Tile as above > Click on Download

b) Click on “GENERATE JSON FILE TO DOWNLOAD“. You will see the link “Click here to download JSON – File 1” after the generation of the file.

Advertisement

Download GSTR 2a format in excel from GST portal

Learn how to download gstr 2a in excel format from below steps. After going through the entire steps you will learn how to download gstr 2a in excel from GST portal. These are easy and simple steps to download gstr 2a reconciliation format in excel.

a) Go to GSTR 2A Tile as above > Click on Download

b) Click on “GENERATE EXCEL FILE TO DOWNLOAD“. You will see the link “Click here to download Excel- File 1” after the generation of the file. This excel file will be in the compressed file ( .zip ).

Open GSTR-2a downloaded file in Excel and JSON format

Follow the below steps to know how to open gstr-2a downloaded file.

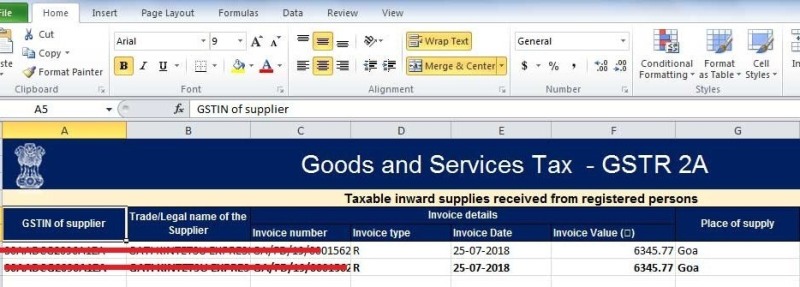

A) Open Excel file – Extract the above-downloaded zip file. Double click on the excel file to open, after extracting it. This is how to view gstr 2a in excel format.

B) Open JSON File – You need a gstr 2a reconciliation software to open this file. First, you need to upload this file in the software like tally and then you can view the existing records in the file. You can easily do gstr 2a reconciliation in tally software.

You can not open this file and view the records by just double-clicking on it.

GSTR 2A Reconciliation in Excel

Reconcile GSTR2 A data with your Input Tax credit Availed in GSTR 3B. There are total of 10 sheets in this excel file. These sheets contain the input tax credit(ITC) received from the various types of persons.

It contains the data like GSTIN of the supplier, Trade/Legal name of the Supplier, Invoice number, Invoice date, etc. Also, it contains a type of ITC received, such as IGST, SGST, CGGST, and cess.

With the help of these details, you can reconcile your input tax credit already availed and utilized for doing setoff. There may be chances that the supplier did not upload the invoices still and you took the ITC on such input invoices. In such a case, you need to ask your supplier to upload the invoices.

You may see below the video to do reconciliation in Excel without using any third-party software.

GSTR 2A General Questions

1. Download the GSTR 2A excel file (contains the GSTR 1 data uploaded by your suppliers) from the GST Portal.

2. Match your ITC availed entries with the entries downloaded in GSTR 2a.

Unfortunately, the GST portal doesn’t have the option to download it on a yearly basis.

1. Download the GSTR 2A JSON file from the GST portal.

2. Open the GSTR 2 in tally and import the downloaded GSTR 2A JSON file to make the reconciliation.

Matching of actual Input tax credit availed and available in the GSTR 2A statement.

Yes, you can download it from the GST portal.