GSTR-3B return filing is to be compulsorily filed by every registered taxpayer monthly or quarterly.

Taxpayers must note that GSTR-3B CAN not be amended once filed. Hence, it is crucial to file GSTR-3B without any errors carefully.

There are common errors that most taxpayers tend to make while their GSTR-3B return filing.

In this short article, we discuss these errors and submit some tips to avoid them.

GSTR-3B filing – Common mistakes

Delayed or non-filing of GSTR-3B returns before the due date.

• It is crucial to adhere to the GSTR-3B return filing due dates. Therefore, taxpayers must complete their GSTR-3B return filing BEFORE the due date.

• Dues dates for GSTR-3B filing differ for the monthly and quarterly filers.

• When a business files their GSTR-3B return online, they save on penalties and interest levied on delayed filing of GSTR-3B returns.

We have discussed the monthly and quarterly due dates and late fees for the GSTR-3B filing below:

a. GSTR-3B filing Dues Dates

| No | Is GSTR-3B opted (Monthly or Quarterly?) | Place of business of taxable person(State/UT) | GSTR-3B filing due date |

|---|---|---|---|

| 1 | Monthly filing | All the states & UT | 20th of the following month |

| 2 | Quarterly filing | Category 11 states/UT (Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu, and Dadra & Nagar Haveli, Puducherry, Andaman and Nicobar Islands, Lakshadweep) | 22nd of the following month |

| 3 | Quarterly filing | Category 1 states/UT (Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand, Odisha, Jammu and Kashmir, Ladakh, Chandigarh, Delhi) | 24th of the following month |

b. GSTR-3B filing late fees

| Particulars | Penalty for intra-state supplies | Penalty for inter-state supplies |

|---|---|---|

| A person having zero returns for the respective tax period | Rs 20 per day (Rs 10 under CGST + Rs 10 under SGST) | Rs 20 per day (under IGST) |

| Other cases | Rs 50 per day (Rs 25 under CGST + Rs 25 under SGST) | Rs 50 per day (under IGST) |

2. Taxpayers DO NOT file NIL GSTR-3B returns

• Most taxpayers assume that there is no need to file the NIL GSTR-3B return. However, this is NOT TRUE.

• It is mandatory to file a NIL GSTR-3B return under GST for a particular tax period in which there are no transactions recorded. (i.e. no outward supplies or no inward supplies and no claiming of Input Tax Credit under GST).

• If a taxpayer fails to file a NIL GSTR-3B return, it attracts a penalty on a per-day basis until the NIL GSTR-3B return is furnished.

• Taxpayers can now file their NIL GSTR-3B return by sending an SMS on 14409. The government has provided this facility to ease taxpayers’ efforts and encourage them to file NIL GSTR-3B return.

3. Clerical errors in GSTR-3B form

• Many taxpayers end up furnishing incorrect tax amounts in their GSTR-3B form. Also, incorrect details of ITC claimed on inward supplies are often furnished incorrectly.

• These errors in the GSTR-3B return filing can affect the taxpayer’s GSTR-9 annual return filing. Hence, taxpayers must be careful while filing their GSTR-3B returns.

• GSTR-3B cannot be amended once filed. Hence, taxpayers are advised to use automated GST return filing software like GSTHero to file the GSTR-3B return within a few minutes seamlessly and without worrying about the clerical errors introduced due to the manual GST return filing.

An automated GST returns filing software helps taxpayers be accurate and claim maximum Input Tax Credit under GST by staying 100% compliant with the GST laws.

4. Missing on furnishing Debit notes & Credit notes details

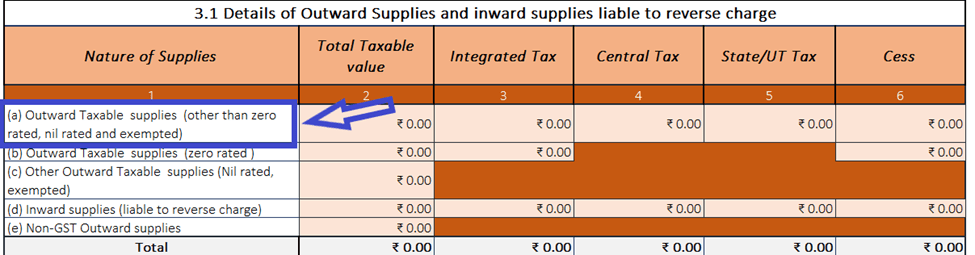

• Table 3.1 captures the Debit & Credit notes details in the column ‘Outward Taxable Supplies (other than zero-rated, nil rated & exempted).

• Taxpayers must furnish the details of Credit & Debit notes issued during a tax period in their GSTR 3B form.

• Taxpayers must furnish the Credit & Debit notes details in the section highlighted in the image above.

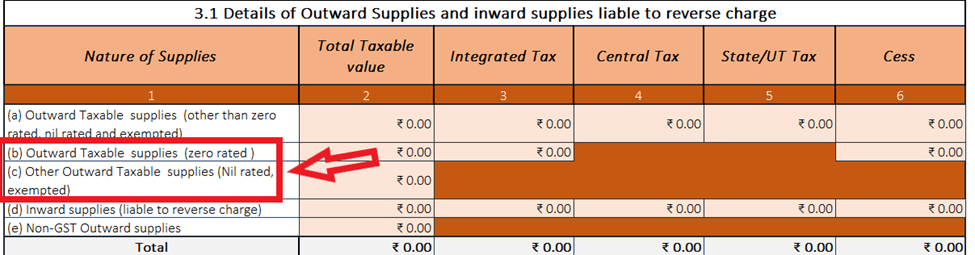

5. Incorrect details of EXPORTS in GSTR-3B form

Column 3.1 (b) & (c) captures the EXPORT data for the given tax period.

It is observed that taxpayers tend to input incorrect values in these sections.

The export figures and the supply values to the Special Economic Zones (SEZs) are captured in Column 3.1 (c) of the GSTR-3B form.

Incorrect details furnishing in these sections can harm GST Input Tax Credit claims.

6. Details for ITC claimed on Normal purchases

• GSTR-3B filing is a consolidated return that captures every detail of inward & outward supplies ITC claimed within a tax period.

• Hence, sometimes it becomes tedious to do GSTR-3B return filing manually. Therefore, businesses are advised to use automated GST return filing software like GSTHero to file GSTR-3B within a few minutes and with 100% accuracy.

• Details of Input Tax Credit claimed under GST in the tax period should also be mentioned in the GSTR-3B form.

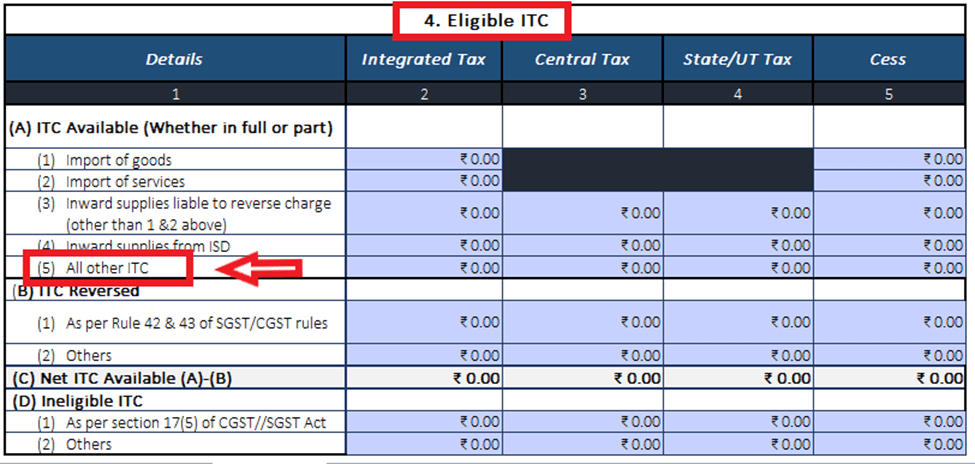

• Table 4 of the GSTR-3B form captures the ITC details for the tax period.

• ‘ITC Available’ is further classified into FIVE different types in Table 4 of the GSTR-3B form.

• There is NO separate classification for ‘Normal Purchases’ in Table 4, column A. Hence, businesses tend to miss out on furnishing the details of the ‘ITC claimed on the Normal Purchases’.

• Taxpayers must furnish the ITC claimed on the ‘Normal Purchases’ in the ‘All Other ITC’ section in Column A.

In conclusion

Common errors during GSTR-3B filing can be avoided by taking simple precautionary measures like automated reconciliation.

In this article, we discussed the significant errors that taxpayers make while filing their GSTR-3B returns.

Taxpayers must observe utmost diligence to eliminate errors in GSTR-3B filing. Using an automated GST return filing solution like GSTHero will help taxpayers comply with the GST laws and achieve 100% accuracy in GST return filing.

Stay updated; stay ahead!

Until the next time…..