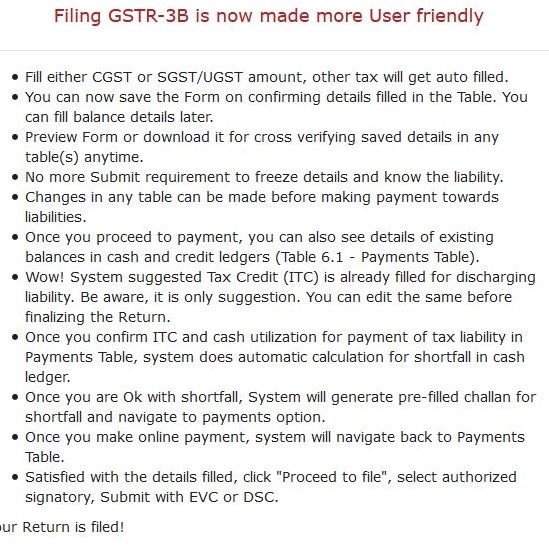

14.03.2018: GSTR 3B revised News, Changes you should know before proceeding to file GSTR 3B monthly summery return. GSTN has recently made further changes in GSTR 3B filing system to facilitate taxpayers in setting off the liabilities. At the same time Once you select the particular month to file the GSTR 3B return, the below window will flash on the screen.

Let us discuss these changes in more detail.

1) Fill either CGST or SGST/UGST amount, other tax will get auto-filled.

– This means now you need to fill only CGST or SGST/UGST amount column to setoff the liability.

– If you have IGST liability then system will automatically fill IGST ITC available field to setoff the IGST liability.

– Now your part is if your IGST liability is more than IGST ITC available then you can utilize it from CGST or SGST/UGST.

– If you don’t have CGST or SGST/UGST ITC available then you need to deposit in cash ledger.

– Once your cash ledger gets the credit of sufficient balance, the system will automatically take the required amount to set off balance liability. That’s it!

2) You can now save the Form on confirming details filled in the Table. You can fill balance details later.

– Now you can fill the liability details in advance , confirm it and fill balance setoff later on.

3) Preview Form or download it for cross verifying saved details in any table(s) anytime.

– Self-explanatory

4) No more Submit requirements to freeze details and know the liability.

– In order to arrive at tax liability system used to freeze the data in past. i.e once you Submit the return means, the data was to get a lock. So now there is no option to submit. Just Set-off the liabilities and proceed to file the return.

5) Changes in any table can be made before making a payment towards liabilities.

– Self explanatory

6) Once you proceed to payment, you can also see details of existing balances in cash and credit ledgers (Table 6.1 – Payments Table).

– Self explanatory

7) Wow! The system suggested Tax Credit (ITC) is already filled for discharging liability. Be aware, it is only a suggestion. You can edit the same before finalizing the Return.

– System will suggest utilizing credit available. Many times you may not want to utilize the existing ITC(Input Tax Credit) because of various reasons. In such cases, you may remove the suggested amount from the given fields.

8) Once you confirm ITC and cash utilization for payment of tax liability in the Payments Table, the system does the automatic calculation for the shortfall in the cash ledger.

– you need not have to enter the Cash payment field. The system will pick up the necessary required amount and debit the cash ledger also to set off the liability.

9) Once you are Ok with the shortfall, System will generate a pre-filled challan for the shortfall and navigate to the payments option.

– If you click to proceed without doing setoff of required liabilities, the system will suggest generating a cash deposit challan.

10) Once you make an online payment, the system will navigate back to Payments Table.

– Self explanatory

11) Satisfied with the details filled, click “Proceed to file”, select authorized signatory, Submit with EVC or DSC.

Your Return is filed!

You can Track Return status as well as download the GSTR 3B Return from through Track Return Status functionality available at your dashboard.

Related Articles on GST India News

How to file GSTR 3B Return online?

In order, to file the GSTR 3B return, you must have login details of the GST portal. If you already have these details log in to the GST portal at www.gst.gov.in. more

When to File GSTR 3B return?

The GSTR 3B has to be filed on the 20th of next month. Hence, the return for the month of April 2021 should be filed on or before the 20th of May 2021. However, the government may extend this date as to when it becomes necessary. more

IFF in GST(Goods and Service Tax)

The Invoice Furnishing Facility (IFF) is a facility that is provided to quarterly return filers by the government. Under this system, the taxpayer needs to upload only the outward details in each month of the quarter. more

GST on Gold Purchase

Know what is the GST rate on the purchase of Gold and jewelry. understand how the making charges are taxable under the new GST system. more