1. Latest updates on e Way Bill in India

About E Way bill System in India: E Way Bill system became mandatory from today i.e. 01st April 2018 for all inter-State movement of goods. Also, the implementation of the nationwide e Way Bill mechanism under the GST regime is being done by GSTN. This mechanism is done in association with the National Informatics Centre (NIC) and is being run on a portal namely https://ewaybillgst.gov.in.

2. History of E way bill in India

Earlier the trial was started on 16th January 2018 for the entire country and was implemented also from 01st February 2018. But due to the system glitches, it was further postponed till 31st March 2018.

3. Registration status on E way bill portal

1. A total of 10,96,905 taxpayers have registered on e Way Bill Portal till date.

2. 19,796 transporters, who are not registered under GST, have enrolled themselves on the e Way Bill Portal.

3. 1,71,503 e waybills have been successfully generated on the portal from 00:00 hours till 17:00 hrs of 1st April 2018.

4. e way bill customer care number

To answer queries of taxpayers and transporters, the Central helpdesk of GST has made special arrangements with 100 agents exclusively dedicated to answer queries related to e way bills .

E way bill help desk number – 0120-4888999

5. E Way Bill Generation Modes

E-way Bill can be generate-d through various modes like:

1. Web (Online) on https://ewaybillgst.gov.in

2. Android Mobile App.

3. SMS Facility

4. Bulk Upload Tool

5. API based site to site integration

6. Consolidated e-way Bill can be generate-d by transporters for vehicle carrying multiple consignments.

6. Sub users to generate E way bills

Transporters can create multiple Sub-Users and allocate roles to them. This way large transporters can declare their various offices as sub-users. By using this feature many assigned users can generate e way bill for single GSTN registration.

7. Cancellation of E way bill

There is a provision for cancellation of e way Bill within 24 hours by the person who has generated the e way, Bill. The recipient can also reject the e way Bill within the validity period of the e-way bill or 72 hours of generation of the e way bill by the consignor whichever is earlier.

Similar Articles on E way bill

GST updates on E way bill

Read and subscribe the latest news and updates on E way bill generation in India. Eway bill is required for every movement of shipment which has value more then Rs. 50,000. more

How to download eway bill in pdf ?

Now you can download and save the e way bill in pdf file. This enables you to send the email of pdf file to your customer after generating it from the e way bill portal. more

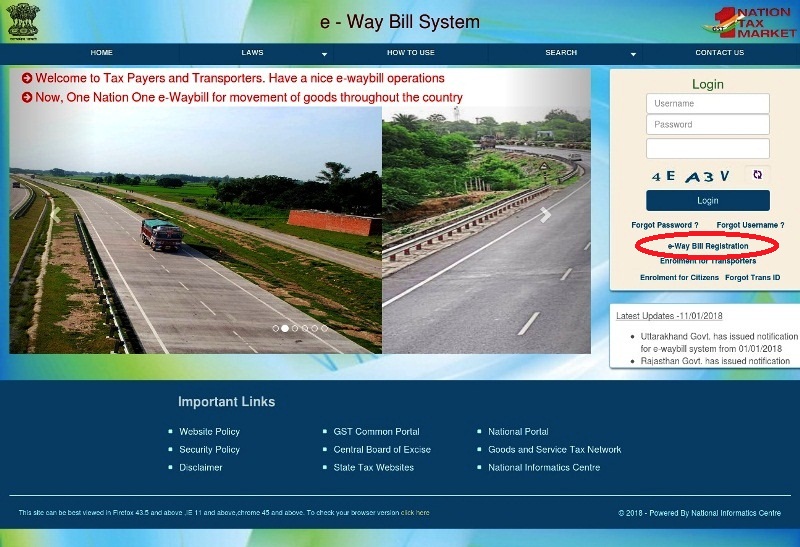

Eway bill Login System

The https://ewaybillgst.gov.in is the official website address of e way bill portal in India. One must register to generate the online e way bill. more

What are eway bill rules?

The GST law has laid download rules for e way bill. Therefore, one must comply with these rules while generating the eway bill. It also down the conditions for various purposes. more