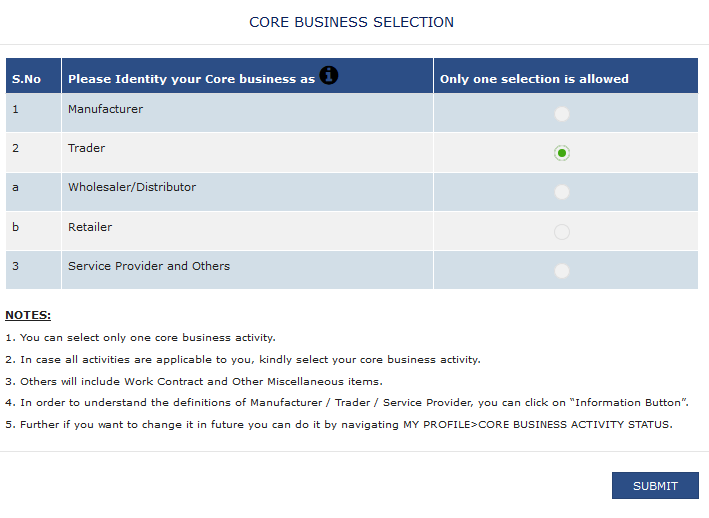

06.03.2021: The GST login portal is now asking to choose the core business activity of registered taxpayers. As soon as the taxpayer login into the GST portal, a popup will flash on the screen as shown below. Therefore, the taxpayer must choose the option to continue working on the GST portal.

How to choose a core business option?

The taxpayer has to select his/her business activity only once either any one of the below options.

- Manufacturer

- Trader/wholesaler/Distributor

- Retailer

- Service providers & others

What is Core business in GST?

The core business of any company under GST is the “main” or “essential” activity that is carried out as a major business.

Therefore, even if you are into various types of activities, you have to choose any one major type of activity. This can be identified by its turnover. For eg., you are a manufacturer of textiles and also doing a trading activity of chemicals. Suppose your turnover of the textile business is 1 core per year. whereas the trading turnover is only 50lakh per year.

Therefore, in the above scenario, you have to choose as a Manufacturer as manufacturing is your core business activity.

Who is Manufacturer under GST?

A manufacturer is a registered person who produces new products from raw materials and parts thereof. The manufactures may be doing this by using tools, equipment, and machines. Thus, after producing the manufacturer sells them to the consumers, wholesalers, distributors, retailers, or to the other manufacturers.

Similarly, a manufacturer may sell some more brought-out items or may provide some ancillary services to the customers. However, he/she will be classified as a manufacturer because it is the Primary Business Activity.

Who is Trader?

A trader is a GST registered person who is into the business of buying and selling goods. Similarly, the traders are further classified as :

• Retailer

Here the Retailer includes a registered person selling goods through e-commerce operators.

Who is Service Provide in GST?

The service provider under GST is a registered person who provides services to the clients. Thus, he is neither a manufacturer nor a trader.

Examples: Banking service, IT service, works-contract service, agents, intermediaries, Goods Transport Agencies, etc.

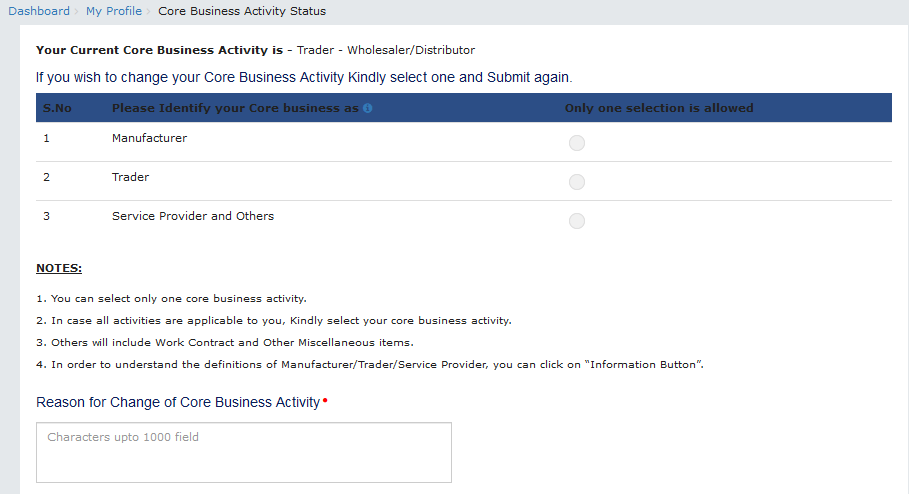

How to Change core business activity on later stage?

In order to change the core business activity, navigate to MY PROFILE > CORE BUSINESS ACTIVITY STATUS.

Related Articles:

About www.gst.gov.in Website

www.gst.gov.in is the official website of the GST system. It is also known as the GST portal. more

How to make GST payment online?

The taxpayer has to make a monthly payment of GST liabilities to the government. more

Invoice Furnishing Facility(IFF) in GST

The government has recently provided a new return filing facility for small taxpayers. more