31.03.2021: The CBIC waves the penalty up to Rs. 25000/- till 30th June 2021 for not printing QR code on GST Invoice. This has reference to Notification No. 06/2021–Central Tax dt.30.03.2021. The taxpayers whose turnover is more than 500 crores shall print QR Code from 01st July 2021.

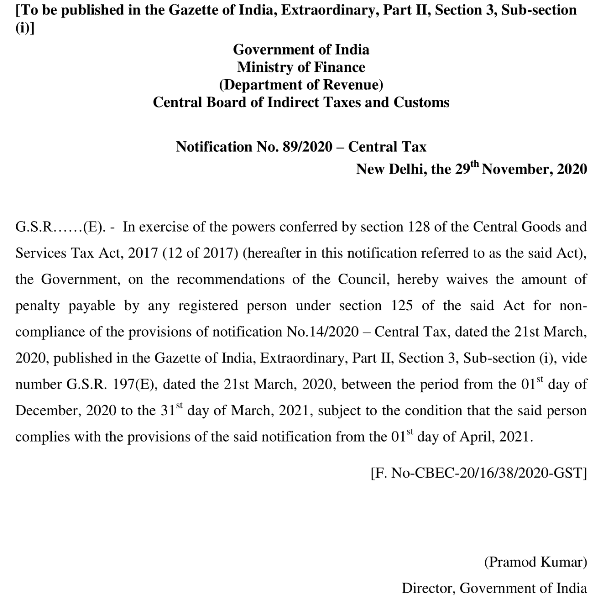

Earlier, the CBIC has extended the QR code generation compulsion on the invoice till 31.03.2021. Thus, the government has made it compulsory to generate a QR code, whose aggregate turnover in a financial year exceeds five hundred crore rupees from 01st October 2020 and then till 31st March 2021. This has reference to the initial Notification No. 14/2020– Central Tax dt. 21.03.2020.

Related Articles

QR code Notifications

Check out the latest GST notifications on QR code generation. QR code generation is mandatory for B2C supplies by registered persons. more

E-invoice in GST

The e-invoicing under the GST system has become mandatory from 01st April 2021 for turnover with Rs. 50 crore in the financial year. more

einvoice1 portal

To visit the e-invoice portal type einvoice1.gst.gov.in in your internet browser. einvoice1.gst.gov.in is the official internet address to generate e-invoices from 01st April 2021. more

Download GST Invoice

Are you looking to download the GST invoice format? If yes then you can do it from here. You can download the invoice format in excel and pdf to prepare GST compliant Invoices in GST. more