Introduction: The GST Council introduced the

Further, again it was made mandatory from 01.01.2021 for taxpayers with a turnover of 100 crores. Similarly, from 01st April 2021, taxpayers with a turnover of Rs. 50 crore have to issue e-invoices. As per the latest information e-Invoicing is mandatory w.e.f from 01.08.2023 for Taxpayers whose turnover crosses Rs. 5 crores.

E-Invoice Limit Reduced from Rs. 50 – 20Crores

W.e.f 01.04.2022, E-invoice generation will be mandatory for taxpayers with a turnover of 20 crores in a previous financial year. Therefore, the taxpayers who cross the turnover(PAN India) of Rs. 20 crores in FY 2021-22, must generate e-invoice from 01st April 2022. This has reference to GST notification no. 01/2022 Central Tax dt. 24.02.2022.

Electronic Invoicing Limit Reduced from 20crores to 10Crores

The government has reduced the electronic invoicing limit from Rs.20 crores to 10 crores w.e.f 01.10.2022. In this regard, the Ministry of Finance has issued a notification having reference no. No. 17/2022 – Central Tax Dt. 01.08.2022.

E-Invoicing Limit Reduced from 10 crores to 5 crores

The E-invoicing limit is further reduced from Rs. 10 crores to Rs. 5 crores w.e.f 01.08.2023. This has reference to Notification No. No. 10/2023 –Central Tax Dt. 10.05.2023.

What is E invoice in GST?

E invoice in GST is an “Electronic Invoice” generated through your existing/New software. However, the E-invoice shall meet some compulsory requirements provided by the GSTN. Therefore, the taxpayer will have to redesign his existing invoice format so that it can include the fields required by the GSTN.

Further, an e-invoice will authenticate only B2B transactions and will provide one unique identification number to each invoice. This will be managed by the Invoice registration portal(IRP) by GSTN.

E invoicing will facilitate taxpayers to prepare GST ANX 1 automatically. Thus, he need not have to enter the details manually in the said annexure.

E Invoicing Q&A

Q1: How to create e invoice in GST portal?

Answer 1: You can not create e-invoice in the GST portal. However, you can upload specific invoice details on the e-invoice portal at https://einvoice1.gst.gov.in and get the IRN. Your invoice becomes e-invoice as soon as you obtain IRN against your regular invoice.

Q2: How does e Invoice Work?

Answer 2: The taxpayer has to upload his invoice details in JSON format on e invoice portal and get the IRN number. That’s it.

Q3: Who is eligible for e invoice?

Answer 3: The taxpayer who has crossed Rs.10 crores turnover in any Financial year from 2017-18 onwards.

Q4. What is E invoice API?

Answer 4: API is a small piece of code provided by the GST portal which can be inserted in your existing software. This enables the taxpayer to generate IRN in his existing software without going onto the e invoice portal.

Q5. What is e invoice notification?

Answer 5: Notification no. 70/2019–Central Tax dt.13.12.2019

Q6. How to Configure e invoice in SAP?

Answer 7: If you are already registered in e way bill portal, then you can use the same user and password to login to e invoice API.

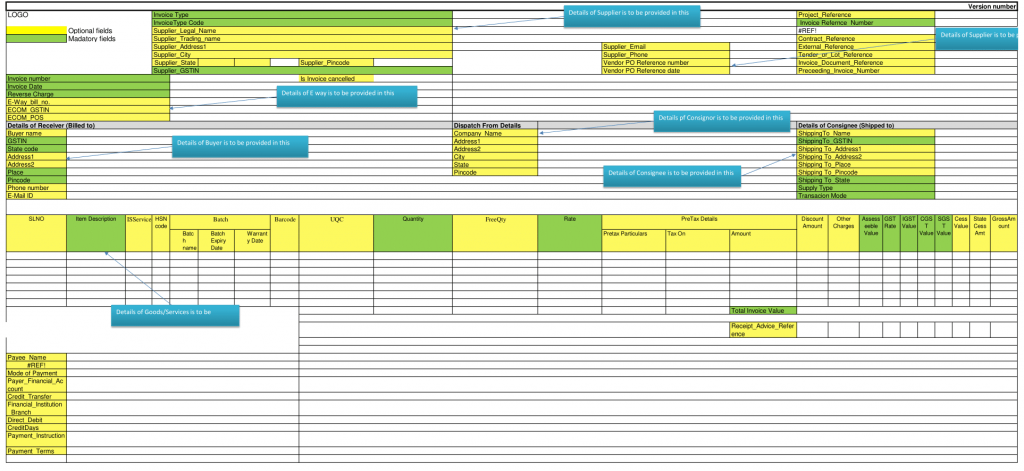

E Invoice Format

Below is the E-invoice format prepared by the GSTN. You can see yellow and green colors in the below format. Where yellow color highlights optional fields and green color as compulsory fields. Thus, the taxpayer will have to include all compulsory fields in his existing formats. On the other hand, he can keep or add more fields as optional in his existing format. Therefore, when you upload the e invoice, the IRP portal will validate the invoice with all compulsory fields.

Software for E-Invoicing

The GSTN has provided links to eight accounting & billing software that provide basic accounting and billing systems free of cost to small taxpayers. Thus, taxpayers who do not have in-house software, can make use of this free software and generate E-invoice to upload on the GST portal.

GST E-Invoice Portal

Here is is the list of E-Invoice portal addresses as per notification No. 69/2019-Central Tax, dt. 13-12-2019. Thus, the below sites will be the Common Goods and Services Tax Electronic Portal(websites) to issue E invoices.

(i) www.einvoice1.gst.gov.in;

(ii) www.einvoice2.gst.gov.in;

(iii) www.einvoice3.gst.gov.in;

(iv) www.einvoice4.gst.gov.in;

(v) www.einvoice5.gst.gov.in;

(vi) www.einvoice6.gst.gov.in;

(vii) www.einvoice7.gst.gov.in;

(viii) www.einvoice8.gst.gov.in;

(ix) www.einvoice9.gst.gov.in;

(x) www.einvoice10.gst.gov.in.

Applicability of E-Invoice in GST

The GST

Further, the registered person, whose aggregate turnover in any preceding financial year from 2017-18 onwards exceeds Five hundred crore rupees, shall prepare E-invoice compulsory from 01.10.2020.

This has a reference to notification No. 13/2020-Central Tax, dt. 21-03-2020. Thus, e-invoice generation is now compulsory from 01.10.2020.

Similarly, from 01.01.2021 e-invoicing is compulsory for taxpayers with a turnover of Rs. 100 crore.

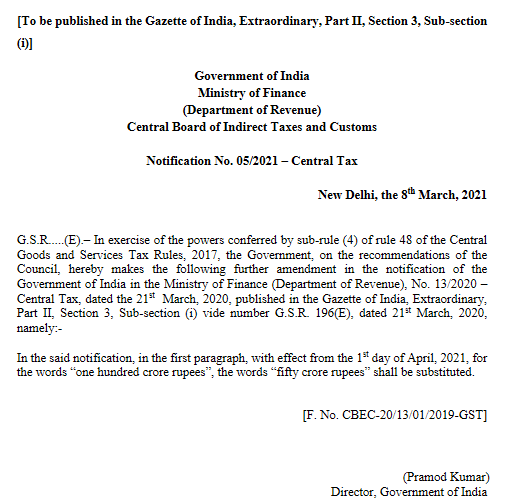

From 01.04.2021, e-invoicing is compulsory for taxpayers with turnover RS. 50 crore. This has reference to notification no. 05/2021–Central Tax dt.05.03.2021.

The above limit is now reduced from 50 crores to 20 Crores and then 10 crores in the previous financial year w.e.f 01.10.2022.

Who is exempted from issuing E-Invoice?

The following class of persons does not require to issue E-invoice as and when they are applicable. Thus, please refer to the 39th GST Council meeting recommendations supporting this class of persons.

- The supplier of taxable service is an insurer or a banking company or a financial institution, including a non-banking financial company.

- The supplier of taxable service is a goods transport agency supplying services in relation to the transportation of goods by road in a goods carriage.

- supplier of taxable services is supplying passenger transportation services.

- A person supplying services by way of admission to an exhibition of cinematography films in multiplex screens.

- Special Economic Zone unit

Notification of E invoice Applicability

- 05/2021–Central Tax dt.08.03.2021

- 88/2020–Central Tax dt.10.11.2020

- 70/2020-Central Tax dated 30.09.2020

- 61/2020 – Central Tax dt.30.07.2020

- 13/2020– Central Tax dt.21.03.2020

- 70/2019–Central Tax dt.13.12.2019

E-Invoicing Myths

There are a lot of myths and misconceptions about E-Invoice in GST. Many people think that the taxpayer will have to generate an invoice from the GST portal. However, the GSTN said that the taxpayer will generate the invoices by using his/her accounting or a billing software of the taxpayer only. But, the taxpayer will have to make some changes in the existing format, so that it can include compulsory fields asked by the GSTN.

Impact of Electronic Invoicing

Electronic Invoicing may have the following impacts on businesses in India. On the other hand, it will give more exposure to the government with regard to outward supplies.

- Ease in filing outward supply related returns by the taxpayer

- Reduction of Tax evasion

- Elimination of fake invoices

- Reporting of invoices to the Central System

- Invoice generated on one system can be read by another system.

- Reduce the reconciliation problems

- Software buying cost to the taxpayer: The existing free software provided by GSTN may not work for a lifetime as free. Thus, small taxpayers may have to invest in software and its customization.

Physical copy of e invoice

Carrying the physical copy of the e-invoice with the vehicle is not compulsory. However, the invoice should be electronically generated by uploading it on the e-invoice portal of GST. Also, it should have the QR code for verification by the office if needed. For more details refer to Circular No. 160/16/2021-GST dt.20.09.2021.

What type of supply requires E-invoice Generation?

The supplies to GST-registered persons (B2B) and Supplies to SEZs (with/without payment) require e-invoice generation. Also, invoicing is mandatory for Exports (with/without payment) and Deemed Exports, by notified class of taxpayers.

On the other hand, e-invoicing is mandatory for documents like Invoices, Credit Notes, and Debit Notes for B2B or for the purpose of Exports.

However, there is no requirement for generating e-invoices for B2C invoices, and currently not available.

Import and Reverse charge Transactions

As of 14.10.2022 e-invoice is not applicable for import Bills of Entry.

As far as the reverse charge is concerned, the invoice issued by a notified person is in respect of supplies made by him but attracting reverse charge under Section 9(3), e-invoicing is applicable.

For example, if a taxpayer (say Goods Transport Agency having aggregate turnover in an FY is more than Rs. 10 Cr.) is supplying services to a company (who will be discharging tax liability as a recipient under RCM), such invoices have to be reported by the notified person to IRP.

On the other hand, where supplies are received by the notified person from (i) an unregistered person (attracting reverse charge under Section 9(4)) or (ii) through the import of services, e-invoicing doesn’t arise/is not applicable.

E-Invoice Verification Through Mobile App

The GSTN has developed an E-Invoice Verifier App to make e-invoice verification more convenient and efficient. This app offers a simple solution for verifying e-invoices and related details. With the importance of accurate e-invoice verification in mind, GSTN aims to simplify the process for users through this app.

Key Features of the E-Invoice Verifier App

- With the e-invoice app, users can easily verify the authenticity of an e-invoice by scanning its QR code. The app is designed to authenticate the embedded value within the code, ensuring that the e-invoice is accurate and legitimate. This feature provides users with peace of mind and helps to prevent fraudulent activities.

- The e-invoice app boasts a user-friendly interface that is designed to be intuitive and easy to navigate. With its simple and straightforward layout, users can easily access all of the app’s features and functionalities without any confusion or frustration.

- The e-invoice app offers comprehensive coverage by supporting the verification of e-invoices reported across all six IRPs, making it convenient for users.

- The e-invoice app operates without requiring users to create an account or provide personal information, making it a non-login-based system. This approach simplifies the user experience and provides greater convenience for users who want to access its functionalities without having to worry about sensitive information.

How to use the E-Invoice App?

- To access the E-Invoice QR Code Verifier app, simply head to the Google Play Store and search for it by name.

- Once you find it, download and install it on your mobile device for free.

If you’re using an iOS device, don’t worry – the iOS version of the app will be available soon.

- With the e-invoice app, you can easily scan the QR codes on your invoices using your smartphone camera. The app will then verify the authenticity of the information embedded in the code and allow you to compare it with the information printed on the invoice. This feature ensures that you have a secure and reliable way to manage your invoices and payments.

- The e-Invoice Verifier App, developed by GSTN, is a user-friendly tool that allows anyone to scan QR codes and access relevant information without the need for a login or authentication process. This app is designed to simplify the process of verifying e-invoices and make it accessible to all users.

Latest Update on E-Invoicing

30.09.2022: Electronic Invoicing has become mandatory from 01.10.2022 for turnover exceeding 10 crores in any financial year.

09.03.2021: E-invoicing is going to become compulsory from 01st April 2021, for taxpayers whose aggregate turnover in a financial year exceeds Rs. 50 crore rupees.

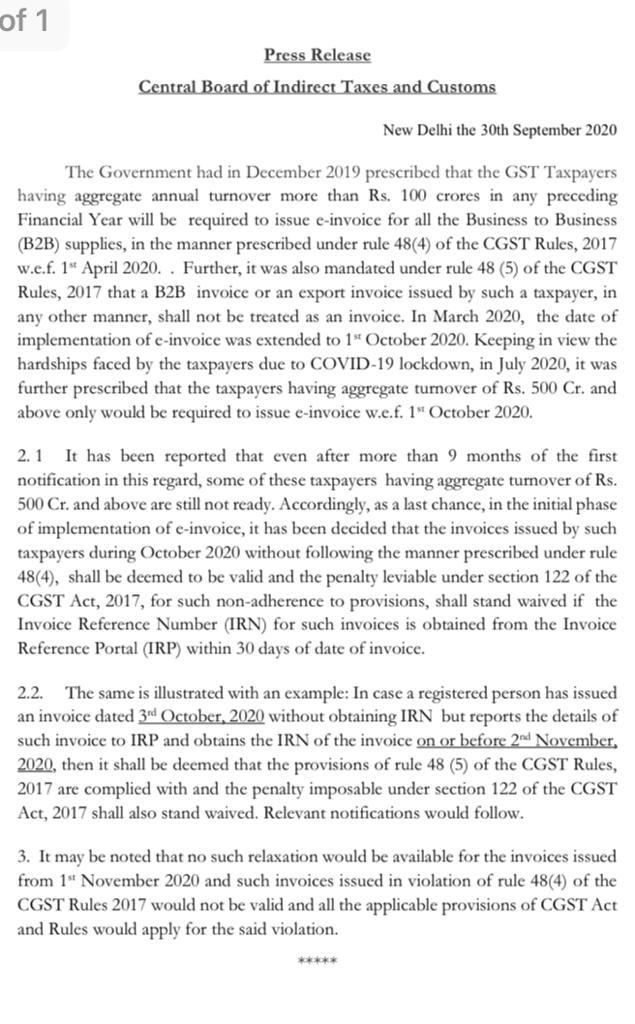

In this regard, the CGST notification is issued having reference number 05/2021–Central Tax dt.08.03.2021. Earlier, the government made e-invoicing compulsory for taxpayers with a turnover of Rs. 500 crores and subsequently for Rs. 100 crores. Here is the screenshot of the latest notification. Read more

01.10.2020: The CBIC has issued a press release dt.30.09.2020 giving further relaxation of 30 days in e-invoicing from 1st October 2020. Thus, according to the press release, the invoices generated from 01st October 2020 without IRN will be valid. However, the taxpayer must obtain IRN from the e-invoice portal within 30 days of issuance of such invoices. If not obtained a penalty will be leviable under section 122 of CGST ACT 2017.

Further, this has reference to the CGST Notification no. 73/2020 –Central Tax dt.01.10.2020.

Frequently Asked Questions

01st October 2020.

No. The taxpayer can generate an

No. All must follow the same schema of Invoicing.

The maximum limit is 100 items.

NO. The IRP portal will digitally sign the e invoice even if is signed by the taxpayer while uploading.

The government will notify the time limit before its implementation.

Yes. The taxpayer can cancel the e-invoice before filing the GST Return.

Similar Links

https://einvoice1.gst.gov.in – The official E Invoice portal

The https://einvoice1.gst.gov.in is the official E-Invoice website of GST in India. In order, to generate an e-invoice, simply visit the above website and Enable e-invoicing under Registration. more

GST Invoice Format in Excel with Rules

Now download the GST invoice format in excel and pdf to prepare GST compliant Invoices. Read out the latest requirement for the preparation of invoices. more

Free GST Billing Sofware Download

If you own a small business and want to issue GST invoices then you can use this free GST billing software and start printing GST invoices. more

Delivery challan format in GST

Download delivery challan format in Excel for sending goods to the customer and job worker. These formats are compatible with the latest GST rules. more