17.11.2022: The Goods and Service Tax system has made mandatory Authentication of Aadhar Cards to other services besides GST registration. Therefore, the taxpayers need to authenticate their application with Aadhar for the below type of additional services.

- To file an application for revocation of cancellation of registration in FORM GST REG-21 under Rule 23 of CGST Rules, 2017

- To file a refund application in FORM RFD-01 under Rule 89 of CGST Rules, 2017

- Filing Refund application for the IGST paid on goods exported out of India under Rule 96 of CGST Rules, 2017.

Thus, the taxable person, who has not yet authenticated their Aadhaar, may like to go through this authentication process before filing the above two applications and enabling the GST system to validate and transmit the IGST refund data from the GST system to the ICEGATE system.

In absence of an Aadhar Number

If an Aadhaar number has not been assigned to the concerned taxable person for Aadhaar authentication as specified above, such person may undergo e-KYC verification by furnishing the following:

(a) She/he will feed Aadhaar Enrolment ID and upload the acknowledgment; and

(b) She/he shall also upload any one of the following documents:

(i) Bank passbook with photograph; or

(ii) Voter identity card issued by the Election Commission of India; or

(iii) Passport; or

(iv) Driving license issued by the Licensing Authority under the Motor Vehicles Act, 1988 (59 of 1988):

Also, the person shall undergo the Aadhaar authentication within a period of thirty days from allotment of the Aadhaar number.

The Aadhaar authentication or e-KYC verification before the filing of the refund may be completed by navigating to “Dashboard > My Profile > Aadhaar Authentication Status”.

This has reference to Notification No. 38/2021-CT dated 21.12.2021 and CGST Rule 10B of CGST Rules, 2017.

What’s New in GST Registration with Aadhaar Authentication?

The government has made compulsory Aadhar card authentication for new GST registration w.e.f from 21st August 2020. Thus, every person obtaining new GST registration needs to link his/her aadhar with the GST. The government issued a notification in this regard having reference no. 63/2020–Central Tax dt.25.08.2020. Similarly, the govt. has amended the CGST Section 25(6) w.e.f 1st January 2020 for inserting new Sub-sections 6A, 6B, 6C, and 6.

Why Aadhar Authentication for New GST Registration?

There is a class of business people who takes disadvantage of the online GST registration approval process. Thus, they obtain GST registration by providing false identities and uploading fake documents. Thereafter they close down their business to avoid paying taxes. Below are some more reasons why GST registration is necessary with aadhar authentication.

- Currently, the GST Registration is completely online and the system itself approved it within 3 working days. Also, there is no need for field inspection in this new system.

- To obtain Statistics from e-way bill

- To stop pretending to be another person for the purpose of GST Registration fraud.

- Check bogus billing through ‘laptop shops’

How to do Aadhaar Authentication for GST registration?

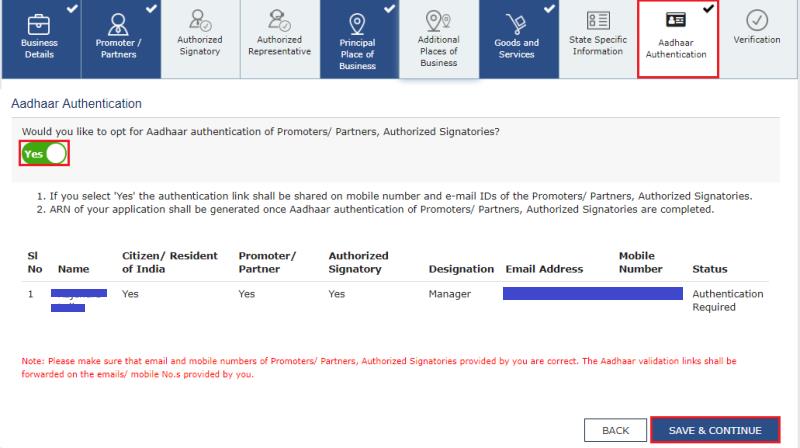

If you are a new applicant then you can find the below screen while filling up the online GST registration form.

- Click on Save & Continue >> Choose the submission option

- Click on Submit with E-Signature for Aadhar Authentication

- Choose either C-DAC and NSDL option as e-sign Service Providers

- Select the Checkbox

The system sends one Time Password(OTP) to your Aadhaar registered e-mail address and mobile number.

- Enter the OTP Received and your application will be submitted.

- You will receive another OTP as Consent for Authentication. Enter your VID or Aadhaar Number to confirm the authentication.

Further, the Applicant can access the link again for authentication by navigating to My Saved Applications > Aadhaar Authentication Status > RESEND VERIFICATION LINK,

Is Aadhar mandatory for GST Registration?

Aadhar Authentication is mandatory for persons, who are already having Aadhar Card. However, if you do not have aadhar Card, you need not have to undergo aadhar linking process.

However, for the applicant who does not authenticate with aadhar, the GST department grants the registration only after physical verification of the place of business. Similarly, the tax authority based on the documents produced can grant GST registration. On the other hand, if the officer does not take any action within 21 days of the application, the application stands approved as per the law.

Who Exempts from Aadhar Authentication?

The Aadhar authentication is not applicable to:

- A person who is not a citizen of India

- Other than Individual, authorized signatory of all types, Managing and Authorised partner, and Karta of a Hindu undivided family

Where to upload an Aadhar card in GST Registration?

The applicant can not upload nor does he/she has to upload the aadhar card. During the new registration process, the applicant has to link the aadhar with the registration. This process is completely online. In order, to link successfully, the taxpayer needs that he/she is registered with aadhar and hold a mobile number linked to Aadhar.

Registration without Aadhar Linking

The government has made a provision for all below persons applying for new GST registration.

- Normal Taxpayer

- Composition Dealer

- Casual Taxable Person

- Input Service Distributor (ISD)

- SEZ Developer/ SEZ Unit

Therefore, the Individuals, Authorised signatories of all types of businesses, Managing and Authorised partners of a partnership firm, and Karta of a Hindu undivided family, shall undergo e-KYC authentication of their Aadhaar number.

Further, for the applicants who do not provide Aadhaar or fail to authenticate with new GST registration, the department will make the site visit. However, the authorities may grant the New registration on the basis of the documents provided. Therefore, it is the only exception where you can get the new registration without Aadhar linking.

The approved GST registrations prior to 21st August 2020 need not have to go Aadhar authentication.

What are the new timelines for Registration with Aadhar Linking?

Here are the revised timelines for granting new GST registration with or without linking aadhar authentication.

- The system will auto-approve new GST registration within 3 days if the applicant links the GST Registration application with Aadhar.

- In case, the applicant chooses not to authenticate with aadhar, the tax officials may issue a show cause notice(SCN) asking for clarification. If they fail to issue such SCN within 21 days of application, the registration stands approved as per the law.

- The applicant can reply to the SCN within 7 working days if he/she receives one from the tax officials.

Quick Solutions on Aadhar Linking

Here are some quick questions and solutions for your reference. You may have to face the below challenges while authenticating Aadhar with the GST application.

1. Opted to SUBMIT with E-SIGN but not receiving the OTP

Ans: The Aadhaar authority (UIDAI) sends the OTP on the aadhar linked mobile number. Therefore, it is possible that your existing number is not linked with aadhar card. Thus, you need to update your current mobile number with aadhar. On the other hand, you may choose the “Sign with DSC” option to submit the application.

2. What happens after I choose Yes” for Aadhaar authentication while registering on the GST Portal?

Ans: The system will send an authentication link to the mobile number and the e-mail ID of the Authorized Signatories. Similarly, the authorization link will also be sent to individuals, promoters, and partners, who are selected as owners, partners, and HUF of the Constitution of business.

3. What are the benefits of Aadhaar authentication for GST Registration?

Ans: The system will auto-approve your application within 3 working days. Also, the system will not mark the application as mandatory for site verification. However, if the tax office issues an SCN, you have 7 working days to reply to it. Thereafter, if the tax office does not take any further action on the reply within seven days, the system will auto-approve the registration.

4. What if aadhar details do not match during the authentication process?

Ans: The system will mark your application as mandatory site verification. The tax office needs to take action within 21 days on such an application. However, if they fail, your application will be deemed approved after 21 days of such submission.

5. What is the timeline to verify Aadhaar details after the submission of the registration application?

Ans: 15 days from the generation of TRN.

6. What if Aadhar details are not verified within 15 days?

Ans: The system will generate ARN for the Registration Application. Further, it will be marked for mandatory site visit and approval thereafter by the Tax Official.

7. Do I need to complete Aadhaar authentication of all Promoters/ Partners and Authorized Signatories?

Ans: Yes, you need to complete it within 3 working days.

8. Can I do Aadhar Authentication for all existing authorized signatories in approved registration?

Ans: No. The facility is not yet available on the GST portal.

Similar Articles

Step-by-Step GST Registration Process

Want to Apply for New GST Registration? If yes here is the Step by step guide for GST registration and getting a GST Number. This is the Free GST application process exclusively available on the GST India website. more

GST Registration Certificate Download

Here is a quick guide on how to download an online GST Certificate of Registration from Portal. The guide includes, downloading the certificate after making new registration, amending the existing registration, etc. more

The Limit for GST Registration

If you are newly applying for GST registration then you must know the GST registration limit for turnover. There are various types of registrations available in GST for regular, composition dealer, etc. more

GST Registration Documents Requirement

See the complete list of GST Registration required documents for the Proprietor. The documents required for the GST registration of an individual or proprietor are based on the type of premises available. more