Introduction:

Here is a quick guide on GST Certificate Download from the Portal. There may be various times when you want to download and print your GST Certificate. This includes, after new registration, after amending the registration and issuing to your customers or suppliers. Similarly, you will see the list of institutions, that provide the online GST Certificate course with certification.

Further, by following these simple steps you can download your GST certificate in pdf format. Therefore, after going through this article you will be able to download GST Certificate in 5 easy steps. This is an Online procedure to Print your Registration copy in a pdf image. You may also Verify the Goods and Service Tax certificate after downloading it.

Quick Links

- About >> Download >> Address Change

- Display >> FAQ

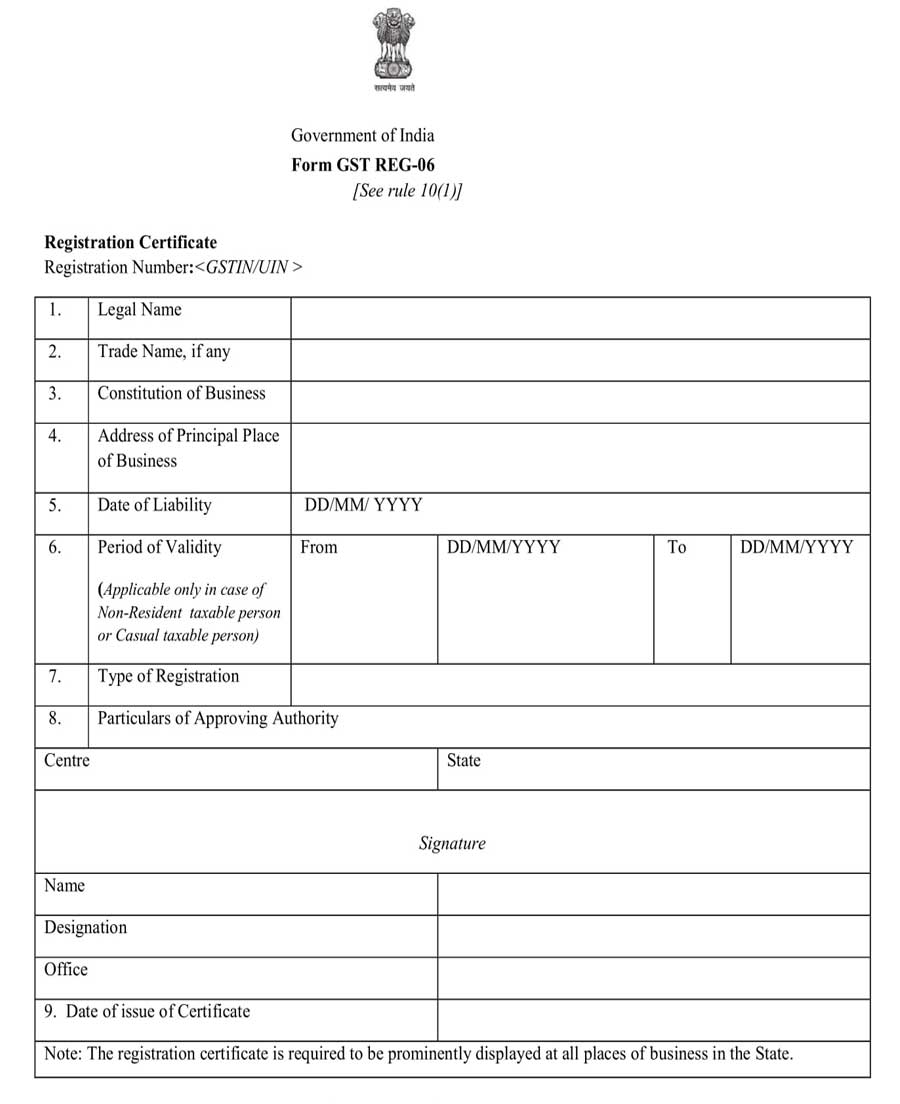

Image of the GST Certificate

Further, there is no option for the GST certificate display on the GST portal. Therefore, you can only download the GST certificate and then you can open it to view its details.

We explain here how to find the GST registration certificate copy download option on the GST portal in easy steps. You need to follow the same steps for a provisional registration certificate download option.

Download Certificate with login option only

You can not download GST Registration Certificate without a login on the GST portal. One must log in to the GST portal to download his GST Registration Certificate. Thus, there is no alternate way for GST certificate download by GST number without login unless you have the login credentials of that taxpayer.

To download the GST certificate issued by the GST tax authorities, perform the following steps:

1. Visit the GST portal at www.gst.gov.in (Click here to go)

2. Enter your Login credentials

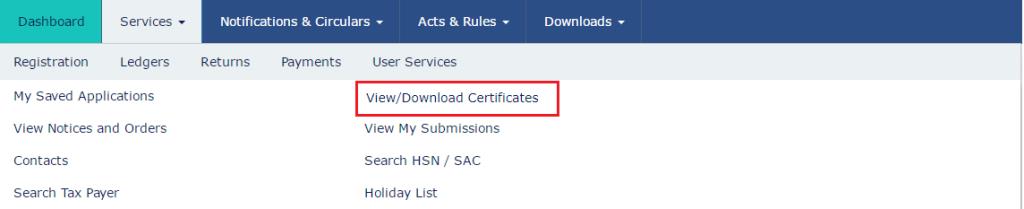

3. Click on the Services > User Services > View/Download Certificates option.

All the certificates issued by the GST tax authorities will get displayed on the screen in descending order.

4. Click on the link under the “Download” option as shown above. Another window will open to choose “open/save”

5. Click to save the file. Now you have the GST Certificate copy in pdf format.

Thus, these are the simple steps for the GST registration certificate download in pdf format. You may see the below video to see, how to download the GST certificate from the GST portal.

Download by gst number without login

Is it possible to download the GST certificate by GST number without login?. The straight answer is no. This is because the GST portal does not allow us to download the GST certificate without login. Thus, any person can not just simply visit the GST portal, enter the GST number of any taxpayer, and download the certificate. Therefore, the person must log in to the GST portal with the login credentials provided by the GST portal after successful online Registration.

How to Download GST Certificate Online?

If you are already registered under GST, then you may go through the above steps to download the GST Certificate online. The downloaded GST certificate is computer-generated, hence it does not require any signature on it.

However, if you have not yet registered under GST in India, then you must register your business under GST to get the GST registration certificate. You may read our article on the online GST registration process to register your business under GST. After you complete your registration online you will be able to download your copy of the GST Certificate.

How to apply for GST Certificate?

You can get a GST Number online by submitting a registration application on the GST portal in India. Thus, you can follow simple steps to get the GSTIN of your business. Also, the GST application processing is completely free and there are no fees charged by the government. Here are quick steps to get your 1st GST number:

Time needed: 4 minutes

- Visit www.gst.gov.in website

- Click on Services Tab >> Registration >> New Registration

- Fill in all required details and submit your registration form

- You will receive a unique 15 digits GST number, as soon your application is approved

You may see here GST Registration online Process

Change of Address on GST Certificate

Once the taxpayer is registered under GST, the need for amendments in registration may arise due to several factors. This includes a change in address, change in contact number, change in business details, and so on.

Thus, In order to amend any information after registration, the taxpayer needs to file an Application for Amendment of Registration. The application for Amendment of Registration can be categorized into two types:

- Application for Amendment of Core fields

- Application for Amendment of Non-Core fields

In order, to change the address on the certificate, you need to go for Amendment of core fields.

How to change the address online?

1. Go to the GST portal and log in

2. Navigate to Services > Registration > Amendment of Registration Core Fields link.

3. Click on the Principal Place of business Tab

4. Make the necessary changes in the respective fields

5. Upload the document for proof of place of business

6. Save the changes, sign the application through DSC/EVC

7. Click to submit the application

The application filed for making changes in core fields, requires approval by the Tax Official. You will be notified by SMS/email once the application is processed. Thereafter, you can download the fresh GST certificate with the changed address.

How to Display the GST Certificate?

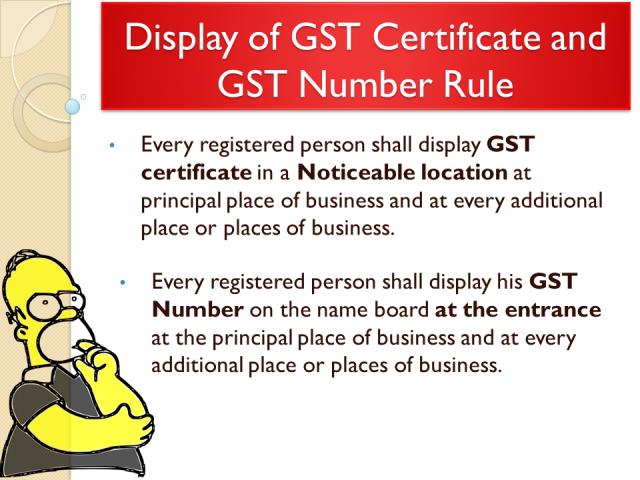

According to the CGST Rules, there are certain GST certificate display rules binding on the taxpayer. However, there is no additional GST number display circular yet in this regard.

As per CGST rule 18(1), the certificate shall be displayed in a noticeable location at the principal place of business. Also, one needs to display the GST certificate at every additional place or place of business.

Further, As per CGST rule, 18(2) taxpayer needs to display Goods and Services Tax Identification Number on the name board located at the entry of their principal place of business. Similarly, he needs to display the GST Number at every additional place or place of business.

you can see above, the image GST certificate. Thus, the image of the Registration Certificate is very simple to read. However, the above is only the draft format of the certificate. But once you download your certificate you will see all your information on this certificate. On the other hand, the image displays only important details of registration in the certificate. However, more details are available in the GSTN database, which does not print on the above certificate.

This guide is applicable for downloading the GST certificate as a proprietorship entity, an Individual GST Registration. Similarly, it is applicable for partnership GST registration and Private limited companies GST Registrations.

Who is the issuing authority?

The GST certificate issuing authority is the Goods and Service Tax Network (GSTN), which issues these certificates electronically. Also, this certificate is issued and authorized as per the provisions of the Goods and Service tax Revised Act 2017.

The certificate of GST registration in FORM GST REG-06 contains details like:

- Legal Name of business

- Trade Name

- Type of Registration

- Principal place of business

- Additional place or places of business

Parts of GST Registration Certificate

The first part of the certificate is the actual GST certificate as above. The second page of the GST Certificate in ‘Annexure A’ contains details of any additional place of business. Similarly, the third page in ‘Annexure B’ provides information about the Person in Charge of the business like the managing director.

This GST Registration certificate(download pdf format) guide is available to all GST registered people. Similarly, the GST certificate download by GST number is not possible as said above. Therefore, One can download his GST certificate only with his login credentials.

What is the validity?

a) GST Registration Application not approved by the Tax officer

If you see your GST Certificate is deemed approved that means The tax officer did not take action within the given time for application approval.

Hence the GST Registration application gets approval automatically after the specific time. Therefore, this does not have any impact on the validity of your GST Registration Certificate. The below message will reflect in the GST Certificate in the above situation:

“This is a system-generated digitally signed Registration Certificate issued based on deemed approval of t

b)GST Registration Application approved by the Tax officer

If the GST Registration Application comes through the approval tax officer the following message will reflect in your GST Registration certificate.

“ This is a system-generated digitally signed Registration Certificate issued based on approval of application granted on <dd/mm/yyyy> by the jurisdictional authority.”

GST Certificate Verification

You can check the certificate by downloading it from the website. However, if you want to know the registration status of your certificate then you can check it on GST Website. Here is how to check the status.

- Visit www.gst.gov.in website

- Click on “Search Taxpayer” Tab

- You can search your GST certificate status by:

- GSTIN/UIN”

- By PAN

- Search composite Taxpayer

- Click on the above option is as applicable to you.

- Enter the GSTIN, PAN or composite taxpayer details.

- After entering the correct details, click on the “Search” button

- The system will show your “GSTIN / UIN Status”

Your Registration is active, If the system shows it as “Active”

What are the fees?

There are no fees for the GST certificate. One can apply it online on the GST portal without paying any fees. You will receive a soft copy of the GST certificate once your registration is successful. However, if you are applying for an online GST Certification course, you will have to pay the fees of that institution.

Therefore, in this article, you have learned how to download GST certificates, Providers of online GST Certificate courses, how to print the certificate, how to get the GST certificate, etc. If this was helpful to you kindly share it.

Frequently Asked Questions on GST Certificate

1. log in to the GST portal

2. Click on Services

3. Go to View/Download Certificates

4. Click on DOWNLOAD and save the pdf file

Yes, GST Registration in India is 100% free on the GST portal. However, if you are hiring any professional to do your job, then you will have to pay his fees.

You need to apply for GST Registration on the GST portal. As soon as your application gets approved you get your GST number.

The GST Registration is valid until you do not apply to cancel it by following the cancellation process. The department may also cancel your GST registration in case of tax defaults.

Important Links

Resolve https://127.0.0.1:1585 error in simple steps

Are you getting a “failed to establish a connection to the server” error while filing GST Return?. If yes then here is the 100% step-by-step solution. more

Download Emsigner for GST

Learn how to download the emsigner utility from the GST portal. The Emsigner utility is a must if you want to sign your GST return with DSC. more

Verify GST Number online

It is always a better idea to verify the GST number of your customers and supplier before making any commercial transaction with them. Here are the steps to check the GST number by PAN. more

Simple online GST Calculator

If you are ever wondering how GST gets calculated under the new system, then here is the answer. Check out the online calculator to see how the new tax works. more

How to make GST payment online?

Making payment of GST is very simple. First, go to the GST portal at www.gst.gov.in. Login with valid credentials. Generate the challan and make the payment. more

Dear Team,

I am Private lender some time GST number found edited or Date of issue of Certificate not confirm, please share how to download GST certificate for verification.