Best Judgement Assessment is a process used by the Goods and Services Tax (GST) authorities to determine the tax liability of a taxpayer who has failed to file their GST returns. This guide will provide you with a detailed understanding of what the Best Judgement Assessment is when it is used, and the steps involved in the process.

What is the Best Judgement Assessment in GST?

Best Judgement Assessment in GST is a process used by the authorities to determine the tax liability of a taxpayer who has failed to file their GST returns. This process is initiated when the taxpayer fails to file their returns despite receiving multiple notices from the GST authorities. The authorities then use their best judgement to assess the tax liability of the taxpayer based on the available information. This assessment is done in the absence of any response or information from the taxpayer.

Visit GST Portal Login Guide

When is the Best Judgement Assessment used?

Best Judgement Assessment in GST is used when a taxpayer fails to file their GST returns despite receiving multiple notices from the authorities. It is also used when the taxpayer fails to provide any response or information to the authorities. In such cases, the authorities use their best judgement to assess the tax liability of the taxpayer based on the available information. This process is initiated to ensure that taxpayers comply with the GST regulations and pay their taxes on time.

How is the Best Judgement Assessment conducted?

Best Judgement Assessment in GST is conducted by the tax authorities based on the available information. The authorities will use their best judgement to assess the tax liability of the taxpayer and issue a notice to the taxpayer. The taxpayer will then have an opportunity to respond and provide any additional information or evidence to support their case. If the taxpayer fails to respond or provide any information, the authorities will finalize the assessment based on their best judgement. It is important for taxpayers to comply with the GST regulations and file their returns on time to avoid the Best Judgement Assessment.

What are the consequences of Best Judgement Assessment?

The consequences of the Best Judgement Assessment can be severe for taxpayers. If the authorities finalize the assessment based on their best judgement, the taxpayer may be subject to penalties and interest on the tax liability. Additionally, the taxpayer may be required to pay the assessed tax liability, even if they disagree with the assessment. It is important for taxpayers to respond to the notice and provide any additional information or evidence to support their case to avoid these consequences.

Know How to install Emsigner for GST?

How do I avoid the Best Judgement Assessment?

The best way to avoid Best Judgement Assessment is to maintain accurate and complete records of all transactions and comply with all GST regulations. This includes timely filing of returns, payment of taxes, and responding to any notices or inquiries from the authorities. It is also important to seek professional advice if you are unsure about any aspect of GST compliance to ensure that you are meeting all requirements and avoiding any potential penalties or assessments.

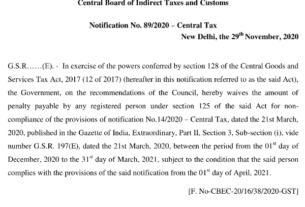

Amnesty Scheme on Best judgement assessment

The Government has brought an Amnesty Scheme w.e.f from 31.03.2023 for the taxpayers who did not file their return on time and received an assessment order. This Scheme is applicable to the registered persons who failed to file a valid return within a period of thirty days from the issue of the assessment order issued on or before the 28th day of February 2023. In this regard, such assessment is deemed to be withdrawn if the registered person follows the below procedure.

- The registered persons shall file the said return on or before the 30th day of June 2023

- The return shall be accompanied by payment of interest due and the late fee payable.

The above scheme is still applicable even if the taxpayer has filed an appeal or appeal pending against such an assessment order.