The government has issued a press release today to clarify the bill to ship to transactions under GST for generating e waybill. Bill to ship to e way bill procedure clarification is based on the press release by CBEC on 23.04.2018. Let us see how the bill to ship process should work.

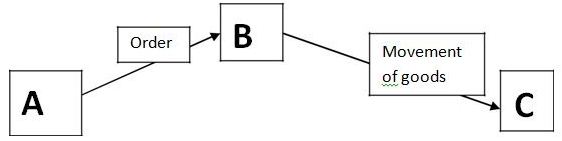

In a typical “Bill To Ship To” model of supply, there are three persons involved in a transaction, namely:

a) A is the person who has ordered “B‟ to send goods directly to “C‟.

b) B is the person who is sending goods directly to “C‟ on behalf of “A‟

c) C is the recipient of goods.

In this complete scenario two supplies are involved and accordingly, two tax invoices are required to be issued:

a) Invoice -1, which would be issued by “B” to “A”.

b) Invoice -2 which would be issued by “A” to “C”.

Who would generate the e-Way Bill for the movement of goods which is taking place from “B‟ to “C‟ on behalf of “A”.

It is clarified that as per the CGST Rules, 2017 either “A‟ or “B‟ can generate the e Way, Bill. But only one e Way Bill is required to be generated as per the following procedure:

Case -1: Where e-Way Bill is generated by “B‟, the following fields shall be filled in Part A of GST FORM EWB-01:

| 1 | Bill From: | In this field details of “B” are supposed to be filled. |

| 2 | Dispatch from: | This is the place from where goods are actually dispatched. It may be the principal or additional place of business of “B” |

| 3 | Bill To: | In this field details of “A” are supposed to be filled in. |

| 4 | Ship to: | In this field address of “C” is supposed to be filled. |

| 5 | Invoice Details: | Details of Invoice-1 are supposed to be filled |

Case -2: Where e-Way Bill is generated by “A‟, the following fields shall be filled in Part A of GST FORM EWB-01:

| 1 | Bill From: | In this field details of “A” are supposed to be filled. |

| 2 | Dispatch From: | This is the place from where goods are actually dispatched. It may be the principal or additional place of business of “B”. |

| 3 | Bill To: | In this field details of “C‟ are supposed to be filled in. |

| 4 | Ship to: | In this field address of “C” is supposed to be filled. |

| 5 | Invoice Details: | Details of Invoice-2 are supposed to be filled. |

E way bill Related Links

When e way bill is not required?

One of the reasons for e way bill, not a requirement is that if the consignment value is below Rs. 50,000/-, there is no need to have e waybill. more

When e way bill Required?

E way will is required when the total consignment value is above Rs. 50000/-. However, it is not required for exempted items. more

What to do if e way bill is expired?

Nothing can be done, once the e way bill is expired. However, the e way bill validity can be extended by the transporter before its expiry. more

Whether e way bill can be cancelled or not?

Yes, the PART A of e way bill can be canceled within 24hours of its generation. However, it can not be canceled once, PART B is filled by the transporter. more