E-way bill system has recently announced Top 6 Developments in e way bill system on e way bill portal. Therefore, if you are registered on e way bill portal then must read this. These are some of the important enhancements in e way bill system since its implementation this year.

1. Duplication of e way bill for same invoice number is not allowable

The e-way bill system is now enabled in a technique that if the consignor has generated one e-way bill on the specific invoice, then he or consignee or transporter will not be permissible to generate another or more e-way bill on the same invoice number. Therefore now you should be more careful while generating e way bill.

On the other hand, If the transporter or consignee (receiver of goods) has generated one e way bill on the consignor’s invoice, then if any other party (consignor, transporter or consignee) tries to generate the e-way bill for same invoice number, then the system will alert that there is already one e-way bill for that invoice, and further it allows him to continue, if he wants.

2.CKD/SKD/Lots for movement of Export/Import consignment

Now one can use CKD/SKD/Lots supply type for movement of the big consignment in batches, during Import & Export also.

However, delivery challan and tax invoice need to accompany goods as prescribed in Rule 55 (5) of CGST Rules, 2017.

3.Regarding Shipping address in case of export supply type

For Export supply type, the ‘Bill To’ Party will be URP or GSTIN of SEZ Unit with the state as ‘Other Country’. Also, the shipping address and PIN code can be given as the location (airport/shipping yard/border check post/ address of SEZ), from where the consignment is moving out from the country.

4.Regarding dispatching address in case of import supply type

In the case of Import supply, the ‘Bill From’ Party will be URP or GSTIN of SEZ Unit with the state as ‘Other Country’.

Also, the dispatching address and PIN code can be given as the location (airport/shipping yard/border check post/ address of SEZ), from where the consignment is entering the country.

5.Development in ‘Bill To – Ship To’ transactions

E way bill generation is now categorized to four types now Regular and Bill to Ship to, Bill from Dispatch from & combination of both.

6.More Changes in Bulk Generation Tool

The Facility of E way bill generation through the Bulk Generation Tool has been improved further.

Similar Content Links

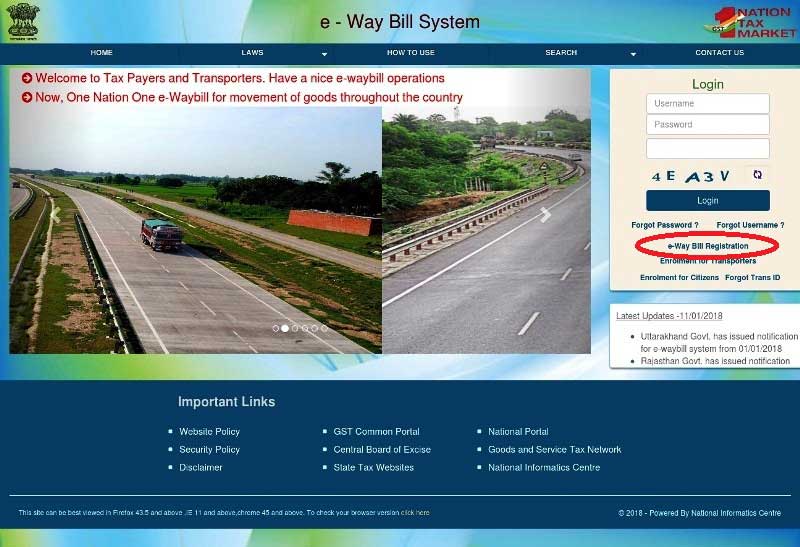

Eway bill login on mobile

Open your mobile browser and type www.ewaybill.gst.gov.in and hit enter. Click on the login link and enter your user name and password to login in e way bill system.

Eway bill customer care

You can dial 1800 103 4786 and reach to e way bill help desk. Learn more about GST related help desk.

Printing of E way bill

Read to know how to take out the print of e way bill from the online portal by entering the serial number of the waybill. Learn more about e way bill print format pdf.

Latest News on E way bill generation

Check out the latest happenings of E way bill system and new functionalities available on the website. Read and subscribe to the GST India News.