Here are some of those queries addressed by the CBEC(Central Board of Excise and customs) regarding separate registration for traders and manufacturers.

Q1. If a company in Maharashtra holds only one event in Delhi, will they have to register in Delhi? Will paying IGST from Maharashtra suffice?

Answer 1: Only if you provide any supply from Delhi, you need to take registration in Delhi. Else, registration at Mumbai is sufficient (and pay IGST on supplies made from Mumbai to Delhi).

Q2. Will a separate GSTIN be allotted to a registered person for deducting TDS (if he/she has PAN and TAN as well)?

Answer 2: A separate registration as tax deductor is required.

Q3. Are separate registrations required for trading and manufacturing by an entity in one state?

Ans: There will be only one registration per state for all activities.

Q4. Will turnover of agents be added to that of the principal for registration?

Answer 4: No.

Q5. I am registered in TN and getting the services from an unregistered dealer of AP. Should I take registration in AP to discharge GST under RCM?

Answer 5: Any person who makes an inter-state taxable supply is required to take registration. Therefore, in this case, the AP dealer will take registration and pay tax.

Q6. If I take up a composition scheme under GST and purchase goods from an unregistered person, will I be required to pay GST to the government?

Answer 6: Yes, you will be liable to pay tax on a reverse charge basis for supplies from an unregistered person.

Related Links:

Process for GST Registration

GST registration process is a step-by-step activity. Since it is an online process, you have to visit the www.gst.gov.in portal. more

Download online GST Certificate

You can download your GST certificate online on the GST portal by following the simple steps. more

How to search GST number online?

You can search the GST number online by entering the GSTIN or by entering the PAN Number. more

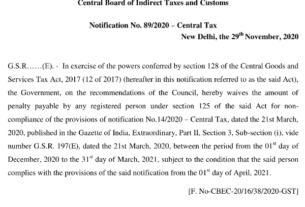

GST registration limit 40 lakhs notification

Readout about the GST registration limit for goods and services in India with notification details. more