What is e way bill for job work?

Every taxable person who is registered under GST shall generate an e way bill for sending goods for job work. Similarly, he must generate e way bill while receiving the goods back from the job worker’s premises irrespective of consignment value.

Thus, if the job worker does not generate e

Further, E waybill must be generated by the principal where the handicraft goods are transported from one State or Union territory to another State or Union territory. This is applicable even a person is exempted from the requirement of obtaining registration under e waybill.

E way bill for interstate Movement

E-way bill for job work for interstate – Eway bill for Interstate movement of goods means, job worker or supplier of material shall generate e way bill when sending goods for job worker from one state to another state or union territory. Thus, Generating an E waybill for job work for interstate movement of goods is a must.

E way bill for intrastate Movement

E-way bill for job work for intrastate – Intrastate means the movement of goods within the state. Therefore, e way bill must be generated for intra-state movement. However, there may be different rules for the individual state. You must check with your state jurisdiction

Limitations of E way bill for job Work

There is no e way bill job work limit for generating e

However, where the goods are transported for a distance of up to fifty kilometers within the State or Union territory from the place of business of the consignor to the place of business of the transporter for further transportation, the supplier or the recipient, or as the case may be, the transporter may not furnish the details of conveyance in Part B of FORM GST EWB-01.

Valuation for Eway bill

The consignment value of goods sending for job work shall be calculated as per valuation criteria specified in CGST section 15. Thus, the value shall include the central tax, State or Union territory tax, integrated tax,

How to generate e way bill for job work?

You need to follow the below procedure of e waybill in case of job work activity undertaken. Let us see how to generate e waybill for the job work process.

1.Visit https://ewaybillgst.gov.in/ website

2.Follow the e way bill registration process if already not registered by selecting the below options.

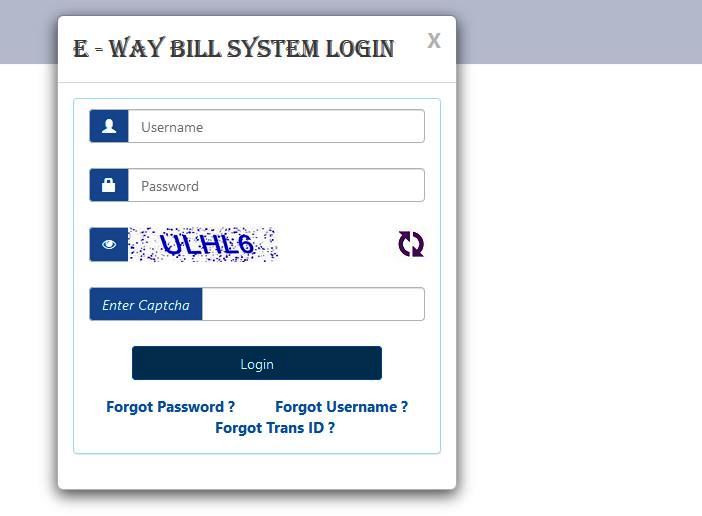

3. After registration, login into e

3. The

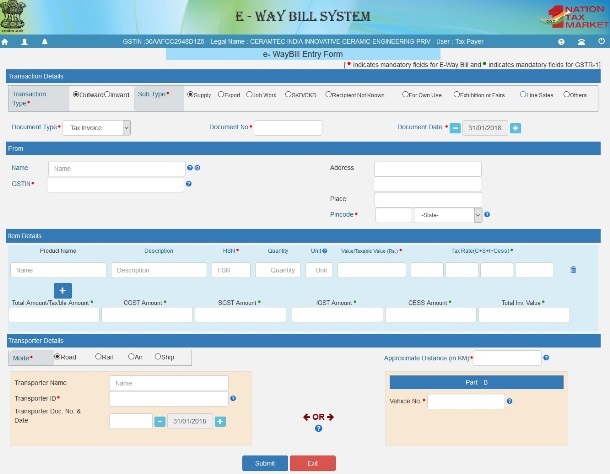

4. Click on “Generate New”. You may also choose the bulk e way bill option to generate multiple e waybills at a time.

5. Click the type of Supply. If you are sending goods for job work you have to select supply type as “outward”. Click sub-type as “job Work”.

6. Enter all details shown on the screen and click on the “submit” button.

7. you see generated e waybill on the screen.

8. Click to “Print” the e waybill.

Related Searches: