EVC is an Electronic Verification Code under GST. The taxpayer receives this code on his mobile and email whenever he proceeds with the return filing by Choosing the EVC option. In other words, it is an OTP through which the taxpayer can authorize the return filing.

You can File GST Return with EVC like GSTR 1 return with EVC, GSTR 2 Return with EVC, and GSTR 3 return with EVC. The taxpayer can also file GSTR 3B with EVC a monthly summary return. On the other hand, taxpayers can file GST returns with an access codes by using the EVC option.

We assume here that you have filled all the required details in GST Returns on the GST portal and you are in the final stage to file your return. If you have not filled in the details yet then first fill in the details in the GST return and then return back on this page. Click > File GSTR Return on GST portal – Complete step by step procedure to file GST Return.

Related https://127.0.0.1:1585 DSC Error

File GST Return WITH EVC – Steps to follow

1. Click on PROCEED TO FILE

2. Once you click proceed to file following information will flash on the screen. Select the checkbox to accept the declaration.

3. From the Authorised Signatory drop-down list, select the authorized signatory.

4. Click the FILE GSTR-3B WITH EVC button or other type of Return option to File GST Return with EVC

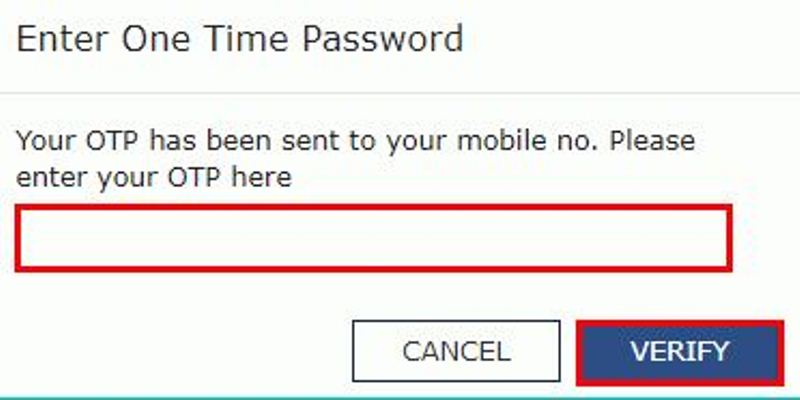

5. Enter the OTP sent on email and mobile number of the Authorized Signatory registered at the GST Portal and click the VERIFY button.

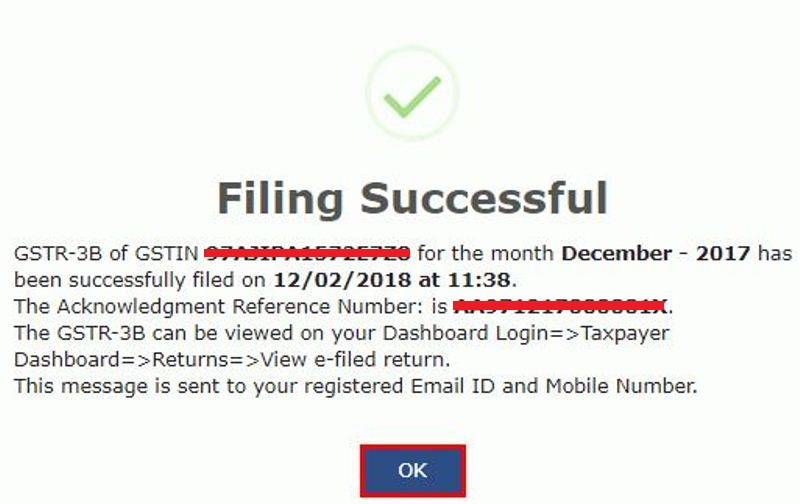

6. Once you enter correct OTP, below window will popup on the screen.

Now you can view the status of return by visiting return dashboard and then selecting the particular period. You will see there the status of GSTR 3B or other GST return will be shown as filed. You can click VIEW GSTR B or other GST return to download the PDF copy of return filed.

Recent updates on EVC Filing

- GSTR 3B and GSTR 1 can be filed through EVC instead of DSC from the period starting from 27th April 2021 To 31st May 2021.

- GSTR 3B can be filed from 21st April 2020 to 30th June 2020 through EVC without the need of signing with DSC. This has reference to Notification no. 38/2020 – Central Tax dt. 5th May 2020.

- The above facility is provided due to COVID 19 situation in the country.

- The Government has also inserted the rule for NIL return filing through a short messaging service (SMS). However, it will announce the implementation date shortly.

- All of the above provisions are applicable for all types of categories of Companies (including Limited Liability Partnerships and PSUs), registered under the Companies Act, 2013.

Similar Links

Also, You may see:

How to file GST return with DSC?

The full form of DSC is a “Digital Signature Certificate”. Under this method, the taxpayer can plug the DSC token into the computer and authorize GST to file the return by choosing the Sign with DSC option. more

Emsigner Installation

Learn how to install emsigner for GST, MCA, and traces in easy steps. Here you can download the latest version 2.6 for free with the file name Emsigner.msi. more

“Failed to establish connection to the server” error

Learn how to solve Dsc errors while filing the GST returns and applications. Most often the taxpayers see an error like “failed to establish connection the server. kindly restart the emsigner”. more

Solve PAN error in GST Registration

If you are facing PAN-related errors while doing GST registration, then you can find the solution here. more