Every person registered under GST must submit a statement of outward supplies and inward supplies to the Indian government. The person shall submit such details online mode on the GST portal. Thus, the submission is said to be a GST return filing under the Goods and Service Tax system. Here is the guide on return filing for GST. This includes return filing for outward supplies, inward supplies, or a summary of both with the upload process on the GST Portal.

Main Topics

- Introduction

- Features >> How to File >> Types

- GSTR 1 Filing >> GSTR 3B Filing >> GSTR 2 Filing

- GSTR 4 >> GSTR 5 >> GSTR 6 >> Annual Return Filing

- How to upload >> How to amend >> FAQ

There are different types of returns under GST depending upon the registration of the taxpayer. Every registered taxpayer needs to file a timely monthly, quarterly, and yearly return as specified in GST Law. We have prepared this simplified guide for GST Return Filing. You will see the different types of GST return in the below table.

Features of GST Return

The basic features of GST’s return system include electronic filing of returns and uploading invoice level-wise information. At the same time, it facilitates the Auto population of information relating to an input tax credit from the returns of the supplier to the receiver of goods and services or both.

Also, a facility of auto reversal of input tax credit is available in case details do not match between supplier and receivers returns filed. The return system is available to help the taxpayers so that they take advantage of the easy return filing process and avail of proper ITC.

How to file GST Returns?

Under GST, regular taxpayers need to furnish monthly returns and annual returns. There are separate returns for the registered taxpayer under the composition scheme, the taxpayer registered as an Input Service Distributor, the person responsible for deduction or collection of tax (TDS / TCS), and a person having a unique identification number.

It is important to note that a taxpayer does not need to submit all types of returns. In fact, taxpayers have to file their tax returns, depending on the activities they undertake. However, the GST Council has recommended simplifying the compliance requirements for small taxpayers by providing taxpayers with a total annual turnover of up to Rs. 1.5 Crore sets out the details of outbound deliveries in FORM GSTR-1 quarterly and monthly by taxpayers with an annual fee Total sales of more than Rs ago. 1.5 Crore.

In addition, GST Council has recommended postponing the date of submission of Forms GSTR-2 and GSTR-3 for all ordinary taxpayers, regardless of turnover, pending further announcements in this regard.

The person can prepare GST returns in online and offline mode by using an excel template. The taxpayer can directly enter details of transactions in online mode on the GST portal if he wants to file GST return online. On the other hand, he can prepare the GST return in offline mode, Generate the JSON file, and upload it on the GST portal. The GST portal validates the uploaded return. If everything is correct the taxpayer can proceed to file the return. Click to know how to file GST return with DSC on the GST portal.

Read to know How https://127.0.0.1:1585 can solve your emsigner error.

GST Return Due Date

The due date of GST returns varies from a return to return. For eg., the due date of the GSTR 1 return is the 11th of Next month. Similarly, the last filing date for GSTR 3B Return is the 20th of next month. You may refer to our exclusive chart on GST returns due dates from here.

Check Return Filing Status

You can check the status of your GST Return filed or not for a particular month/quarter from the online GST portal itself. Similarly, you may also track the return filing status of your supplier by entering his GST Number. Here are the quick steps.

- Open the GST portal at www.gst.gov.in

- Click on “Search Taxpayer” >> Search by GSTIN/UAN (Take me there)

- Enter the GST number of which status you want to check.

- Type the characters you see in the image there

- Click on the Search button

- Click on Show filing table

Types of GST Return

Filing GST returns at the specified time is very important to avoid a late fee. Every taxpayer has to file monthly returns, quarterly returns, and yearly returns. Therefore the person has to file the return well in advance rather than waiting for the last date or deadline. kindly note that the taxpayer needs to file GST returns online on the GST portal and need not have to send them physically to any office or mail to be sent to anyone.

GST India Has prepared a complete table, which contains the different types of GST returns. Below is the list of various GST returns to be filed under GST. However, you may refer to the GST return due date to know the exact date of filing these returns.

Type of Returns Table

| SR.No | Return | Description | Due Date |

| 1 | GSTR 1 | Details of outward supplies of goods or services | 10 th of Succeeding month |

| 2 | GSTR 1A | Details of auto-drafted supplies of goods or services | Auto-Generated at the common portal |

| 3 | GSTR 2 | Details of inward supplies of goods or services | 15th of Succeeding month |

| 4 | GSTR 2A | Details of supplies auto-drafted from GSTR-1 or GSTR-5 to the recipient | Auto-Generated at the common portal |

| 6 | GSTR 3B | Summary of inward supplies and outward supplies | 20th of Succeeding month |

| 7 | GSTR 4 | Quarterly return for registered persons opting for composition levy | 18th of Succeeding Quarter |

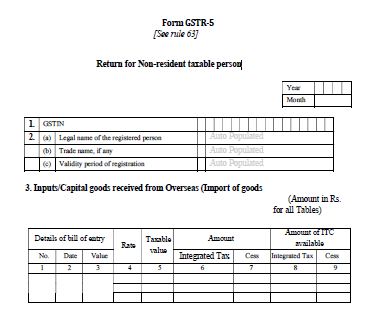

| 9 | GSTR 5 | Return for Non-Resident Taxable Persons | 20th of Succeeding month |

| 10 | GSTR 5A | Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable persons in India | 20th of Succeeding month |

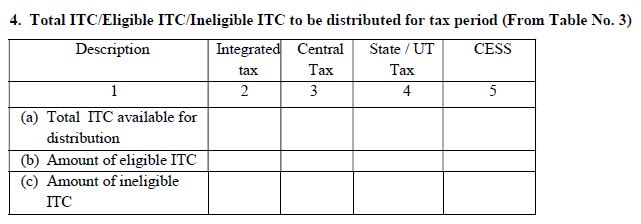

| 11 | GSTR 6 | Return for input service distributors | 13th of Succeeding month |

| 13 | GSTR 7 | Return for Tax Deduction at Source | 10th of Succeeding month |

| 15 | GSTR 8 | Statement for Tax Collection at Source | 10th of Succeeding month |

| 16 | GSTR 9 | Annual Return | 31st December of next FY |

| 17 | GSTR 9A | Simplified Annual Return by Compounding Taxable persons registered under Sec 9 | 31st December of next FY |

| 18 | GSTR 9C | Reconciliation Statement | 31st December of next FY |

| 19 | GSTR 10 | Final Return | Within 3 months of cancellation |

Details of Outward supplies(GSTR 1)

The taxpayer has to file the GSTR 1 return for an outward supply made during the previous month. The official return filing date for GSTR 1 is the 10th of the Succeeding month as per GST Rules. However, the government has notified and made changes in the GSTR 1 return filing dates In the last few months due to GST portal errors.

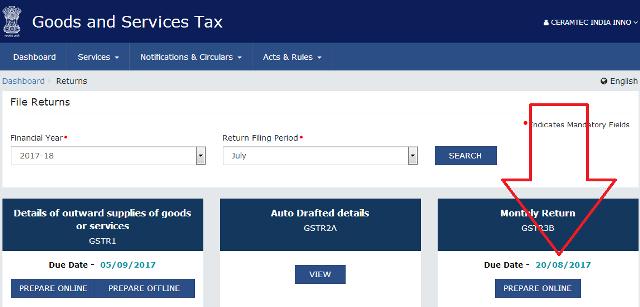

Monthly Summary Return(GSTR- 3B)

GSTR 3B is a summary GST return of all outward, inward, debit notes, credit notes, adjustments, interest, and late fees. Therefore, the taxpayer has to file the GSTR 3B Return by the 20th of the succeeding month. Also, he shall pay the tax due on or before the 20th of the succeeding month. However, if there are no transactions, the taxpayer needs to file a NIL GSTR 3B return.

Inward Supply Return(GSTR 2)

GSTR 2 Return is for inward supplies or purchases done during the previous month. However, according to the Press release Dt. 10.11.2017 government said the due date for filing GSTR 2 will be worked out by a Committee of Officers. The decision is still pending on this matter from the counterpart regarding When to file GSTR 2 Return.

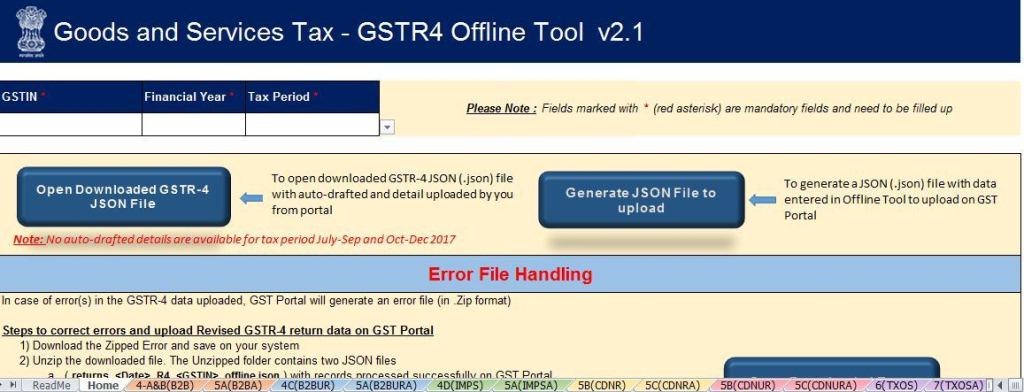

Return for Composition Dealer (GSTR 4)

GSTR 4 is a Quarterly return for registered persons opting for a composition levy.

Return for NRI (GSTR 5 & GSTR 5A)

GTR 5 Return to be filed by Non-Resident Taxable Persons. Whereas GSTR 5A is a return for Details of supplies of online information and database access or retrieval services by a person located outside India made to non-taxable persons in India

GSTR 6 – Filing

GSTR 6 returns are to be filed by Input service distributors. The default date is the 13th succeeding month.

Annual GST Return Filing

Annual GST Return is also called GSTR 9. The due date to file GSTR 9 is 31st December of the succeeding year. However, the government extends these dates from time to time. Check out our article on GSTR 9 due date extension for notification updates.

Return Formats

There are two types of GST return formats i.e one is pdf and another is excel utility. The pdf format is the official format of any GST return. Whereas, the excel utility is provided by the GSTN. The taxpayer can download the excel file and prepare the return in offline mode and upload it on the GST portal for filing. you may download the pdf format from here. The excel offline utilities can be downloaded from here. We suggest downloading the offline utilities from the GST portal only.

Revision of GST Return

The Return framework in GST is completely transaction-based. Any changes required to be done at any state have to be done at the transaction level rather than at the aggregate level of return. Therefore, in GST, No revision of the return is allowed after filing the return.

Returns Dashboard

In order, to see the types of returns you need log in with your credentials on the GST portal. As soon as you log in, you can click on the Return Dashboard button. Clicking on the button will take you to the respective period from which you can file or view your return status.

Fees by CA(Chartered Accountant)

The fees of CA may vary from one CA to another for filing your GST returns. Therefore, there are no fixed fees for GST return filing fees by CA. Thus, one CA may charge you Rs. 500/- per return. On the other hand, another CA may charge you Rs. 1000/- per return. Similarly, if you have good knowledge of GST, you can file your own return except for GSTR 9C.

Non Filing of GST Return

The taxpayer will have to bear the late fees, interest, and penalty for the nonfiling of GST return on time. Thus, it’s very important to file regular returns under GST law. Similarly, if the return is nil, then also the taxpayer needs to file their nil return on time to avoid late fees. Check out our late fees and interest calculator for more details.

How can the returns be uploaded?

a) Returns should be uploaded through the Web interface of the GST common portal.

b) Offline utility to either enter the details in offline mode and upload it in one go or export it from the system of the taxpayer and upload it to GSTN servers.

c) Many software providers integrated their system with a GSTN system to allow direct upload of GST Returns from their accounts to GSTN.

Amend GST Returns already filed

Many businesses have already filed or are preparing for the return, for July month-end. GST council has further extended the deadline for July return filing. (see the previous article).

Since this is the first time, taxpayers are filing returns under GST, and hence bound to make many mistakes.

Let us see the first return i.e GSTR-3B, which has been already filed, and later many have noticed errors as cited below:

- Missed out to enter a few outward taxable supplies and thereby paid less tax. can I modify the return now?

- Did not add tax liability to be paid on a reverse charge basis on inward supplies.

- Shown less Input tax credit in the said return. can I claim it now?

- Did not show HSN code-wise tax payable details in the given table.

Before going further we should know that there is no revised return concept in GST. Once the return is filed means, it will become frozen. one can make changes in the return before hitting the submit button only.

GSTR-3B Is a summaries return of your Taxable supplies and Inward supplies. Therefore do not get panic and make all your changes in the coming return i.e GSTR-1 for outward supplies and GSTR-2 for inward supplies.

Based on the correct details enter in these returns, the revised tax liability and eligible ITC will reflect your e-ledger. Also, the said details will get auto-populated in Form GSTR-3. Similarly, you may refer to our guide on How to amend GSTR 1 after filing on the GST portal.

Glossary

This is a complete guide about returns including annual GST returns, composition dealer filing, applicability, charges, due dates, and extension. Similarly, it also captures the information on checking the details of GST return filing status by the suppliers.

Further, you have seen how to file GST return 3b and GSTR 1 return in short. Also, now you know how to download GST return forms and other excel formats from the GST portal.

General Questions

Question 1: How a taxpayer can upload the GST return?

Answer 1:

a) A taxpayer shall upload the GST returns through the Web interface of the GST portal.

b) Offline utility to either enter the details in offline mode and upload it in one go or export it from the system of the taxpayer and upload it to GSTN servers.

c) Many software providers integrated their system with the GSTN system to allow direct upload of GST Returns from their accounts to GSTN.

FAQ on GST Return

The Summary of outward and Inward supplies.

The taxpayer needs to upload the details of outward and inward supplies on the GST site.

The person registered under GST can file a GST return.

The GST Return once filed can not be revised.

The regular taxpayer needs to file GSTR 1, GSTR 3B, and GSTR 9 returns.

Related Articles

GST Return Due Date Extension

Are you new to GST? Upcoming GST return payable dates are here to file your GST return on time. See if the dates of GSTR1 and GSTR3B, in particular, have been extended by the government. more

GST Return Filing

Regular taxpayers are required to file monthly and quarterly returns. For a taxpayer registered under a composition scheme, a taxpayer registered as an input service distributor, a person responsible for a tax deduction needs to file different returns. more

GSTR 9 Due Date Extended

The GSTR 9 due date is further extended till 31st march 2021 for the financial year 2019-20. The return for the financial year 2020-2021 should be filed on or before 31st December 2021. more

How to file GSTR 3B Return?

The GSTR 3b return can be filed online mode and offline mode. In the offline mode, the GSTR 3B return can be prepared in offline mode and submitted online. more