Here is the complete, GST state code list available to download under Goods and Service Tax in India. The GST number is based on the GST state code. Therefore, it plays a very important role in GST. Here are some of the famous GST State codes from the below list. GST state code 29 is for Karnataka and 06 is for Haryana. The state code 24 is for Gujarat and 09 for Uttar Pradesh. For Maharashtra, it is 27. In the state of Goa, the GST state code is 30. The complete state code list is as below:

Index

- Introduction

- State Code Meaning >> List >> pdf list >> Excel List >>Need

- GST Jurisdiction >> Importance >> FAQ

What is the GST State Code?

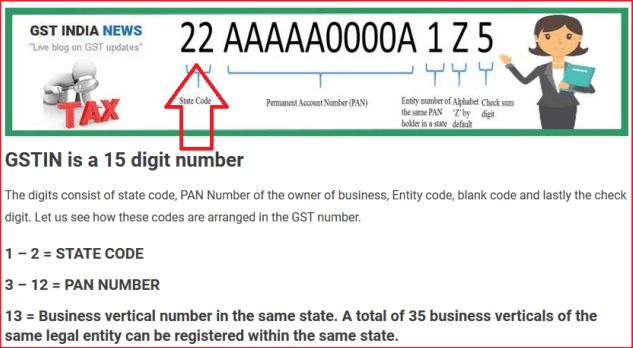

The GST number assigned to the taxpayer consists of the first two digits of the state code, where the business entity is registered. Similarly, the state code indicates the location of the business entity, and the manufacturing activity is carried out.

Thus, it is the unique code assigned to every state in India under GST law. Through this code, the government can classify registered taxpayers in any given state. You can see the format of the Goods and Service Tax Identification Number(GSTIN) in the below picture. The first 2 digits of the GST number/GSTIN are the state code.

GST State Code List

| S.No | Name of the state | State code (GST) | Alpha Code |

| 1. | Andaman and Nicobar Islands | 35 | AN |

| 2. | Andhra Pradesh | 28 | AP |

| 3. | Andhra Pradesh (New) | 37 | AD |

| 4. | Arunachal Pradesh | 12 | AR |

| 5. | Assam | 18 | AS |

| 6. | Bihar | 10 | BH |

| 7. | Chandigarh | 04 | CH |

| 8. | Chattisgarh | 22 | CT |

| 9. | Dadra and Nagar Haveli | 26 | DN |

| 10. | Daman and Diu | 25 | DD |

| 11. | Delhi | 07 | DL |

| 12. | Goa | 30 | GA |

| 13. | Gujarat | 24 | GJ |

| 14. | Haryana | 06 | HR |

| 15. | Himachal Pradesh | 02 | HP |

| 16. | Jammu and Kashmir | 01 | JK |

| 17. | Jharkhand | 20 | JH |

| 18. | Karnataka | 29 | KA |

| 19. | Kerala | 32 | KL |

| 20. | Ladakh | 38 | LA |

| 21. | Lakshadweep Islands | 31 | LD |

| 22. | Madhya Pradesh | 23 | MP |

| 23. | Maharashtra | 27 | MH |

| 24. | Manipur | 14 | MN |

| 25. | Meghalaya | 17 | ME |

| 26. | Mizoram | 15 | MI |

| 27. | Nagaland | 13 | NL |

| 28. | Odisha | 21 | OR |

| 29. | Pondicherry | 34 | PY |

| 30. | Punjab | 03 | PB |

| 31. | Rajasthan | 08 | RJ |

| 32. | Sikkim | 11 | SK |

| 33. | Tamil Nadu | 33 | TN |

| 34. | Telangana | 36 | TS |

| 35. | Tripura | 16 | TR |

| 36. | Uttar Pradesh | 09 | UP |

| 37. | Uttarakhand | 05 | UT |

| 38. | West Bengal | 19 | WB |

State code list in Pdf format

You may download the above GST state code list in pdf format from here. Click on the below download button to save the pdf file on your computer. Kindly ensure that you have the latest pdf viewer to open the downloaded file.

State code list in Excel format

Download the GST state code list in Excel format by clicking on the below button.

What is the need for the GST State Code?

In GST law there is a concept of a place of supply, where the place of supply is the place of delivery of goods or services or both. Thus, the government charges IGST tax for inter-state supply, and for intra-state it is CGST+SGST. Therefore, it becomes necessary to know the place of supply with some unique logic.

Further, the government charges IGST, if the supplier state code & the place of supply state code is different from each other. On the other hand, if the supplier state code and the place of supply are the same then the CGST and IGST will be applicable. Let us understand this concept with the below example.

- If the supplier state code is “30” and the place of supply state code is “22” then IGST will be charged.

- If the supplier state code is “30” and the place of supply state code is also “30” then CGST+SGST/UTGST will be charged.

As far as the Invoicing is concerned, the supplier needs to mention the place of supply state code on the tax invoice. Thus, on the basis of the Supplier & buyer state code, the states are identified from the first two digits of GSTIN. Thereafter, the type of tax ie. IGST or CGST & SGST/UTGST is decided.

06 GST State Code

The GST is applicable to the state of Haryana. Therefore, The Goods and Services Tax (GST) state code for the state of Haryana in India is “06.” The GSTN system uses this GST code to identify Haryana for GST-related transactions and documentation.

Haryana, like all other states and union territories in India, has its own specific GST code, and it is important to use the correct code when dealing with GST-related activities, including filing GST returns, invoicing, and reporting for businesses and individuals operating in Haryana.

07 GST State code

The Goods and Services Tax (GST) state code for the National Capital Territory of Delhi is “07.” Thus, the GSTN uses this code to identify Delhi for GST-related transactions and documentation. So, do not forget to use the GST code 07 when filing your returns, registration purposes, and any other related work of GST.

09 State Code

The Goods and Services Tax (GST) state code for the Indian state of Uttar Pradesh is “09.” This GST code is used to identify Uttar Pradesh for GST-related transactions and documentation.

Further, If you are dealing with GST-related activities in Uttar Pradesh, such as filing GST returns, generating invoices, or reporting GST transactions. Also, it is important to use the correct GST state code, which is “09” in this case.

Similarly, Keep in mind that the GST system and its details may not change for the GST state code even over time. Therefore, if your GST registration is in the state of Uttar Pradesh, then you will notice that your registration is starting with the 09 GST code.

24 GST State Code

The 24 GST state code is assigned to Gujarat state of India. So, if your registration is in Gujarat then your Registration number will start with code 24. Thus 24 state code is applicable to all the registrations done in Gujarat. Thus, for all your online correspondence on the GST portal, you need to select the state code 24.

Further, if you are wondering when you can get a different GST code other than 24 in the state of Gujarat, then the answer is No. This is because, in the records of GST state code list 24, the GSTN has kept this code exclusively for the state of Gujarat. So, not only for Gujarat but, for the rest of the states also, a unique state code is assigned. Hence, anytime you see a GST number starting with 24, that means the registration is of Gujarat State.

36 GST State Code

The GST state code 36 is a unique two-digit code that is used to identify the state of Telangana in India under the Goods and Services Tax (GST) system. This code is important for various GST-related transactions and documentation. Similarly, each state and union territory in India is assigned a specific code to simplify and streamline the GST process.

Thus, the GST state code for the state of Telangana is “36,” as mentioned earlier. Each state and union territory has its own GST state code to help identify the origin or destination of goods and services for tax purposes.

These state codes are essential for businesses and individuals when they are involved in interstate transactions or when they need to indicate the place of supply, as GST rates and rules may vary from one state to another. It is important to use the correct GST state code to ensure accurate and compliant GST filings and reporting.

How to Find your GST State’s Jurisdiction?

Want to know the GST state’s jurisdiction, range office, and GST commissioner office in your locality? th

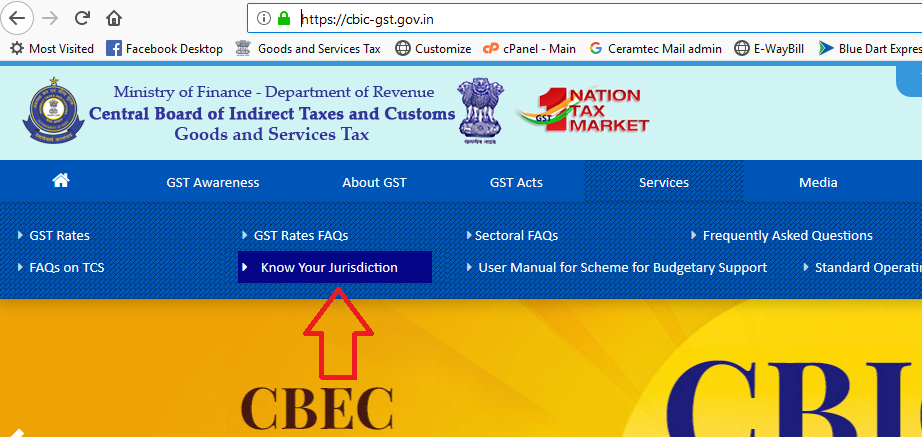

1. Visit the CBIC website at https://cbic-gst.gov.in/

2. Click on Services

3. Click on “Know your jurisdiction”

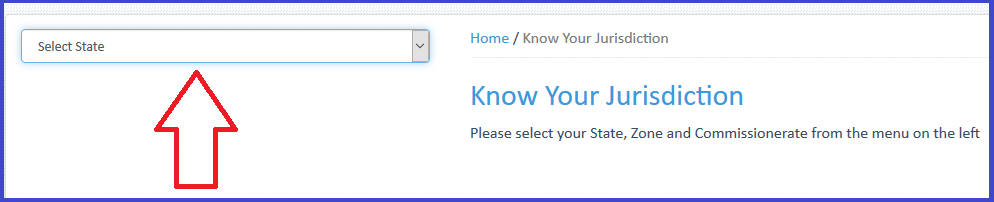

4. Select the state for which you are looking for the GST jurisdiction list.

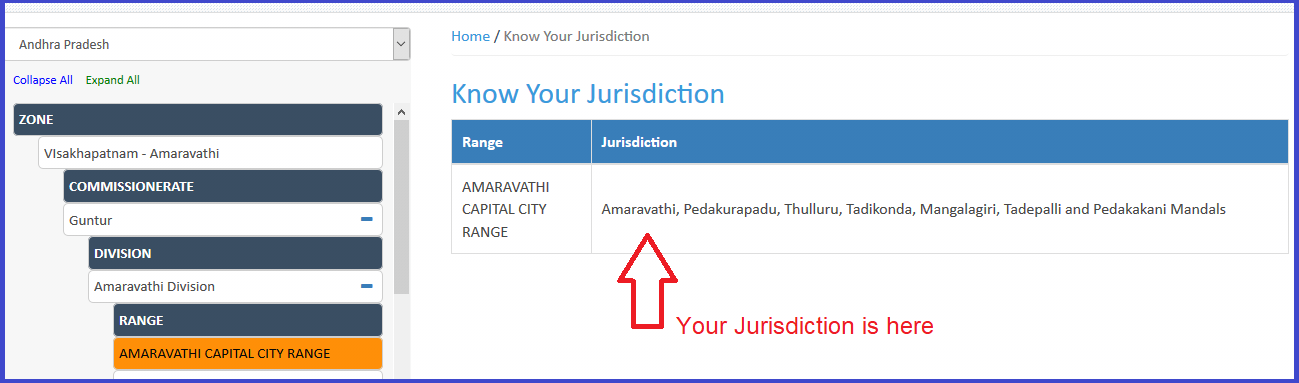

5. Next, select your zone if shown

6. Thereafter, you will have commissioner options

7. Choose your Division

8. Now select your range

9. you will see all localities falling under that range.

10. Based on this Service, you can see now in which range/jurisdiction your business premises fall.

Importance of GST Jurisdiction

The GST jurisdiction is very important for the person who is required to take GST Registration. Thus, the person applying for the GST registration has to fill in the details like state, Zone, Division, and Range in the application form.

Further, the jurisdiction is also important for the taxpayer as he needs to coordinate with the given jurisdiction as and when needed. Also, the jurisdiction commissionaire of that area is responsible for the activities, and compliance carried out by the taxpayer.

The FAQ on State Codes

You can see the above list to check the GST state code.

It is Telangana

The state of Maharashtra

Its Rajasthan

Gujarat

Delhi