25.11.2022: The Central Government released Rs. 17,000 crores to States/UTs on 24.11.2022. Thus it is towards the balance GST compensation for the period April to June 2022. Therefore, the total amount of compensation released to the States/UTs so far, including the aforesaid amount, during the year 2022-23 is Rs.1,15,662 crore.

Despite the total cess collection till October 2022 being only Rs.72,147 crore, the balance is Rs. 43,515 crores is being released by the Center from its own resources. Thus, with this release, the Center has released in advance the entire amount of cess to be collected this year till the end of March, available for payment of compensation to the states.

Further, the decision has been taken to help the states to manage their resources and successfully carry out their programs especially capital expenditure during the financial year.

In the month of May this year too, the central government announced Rs. 86,912 crores as provisional GST compensation to the states for the period February-May 2022. However, there was a shortfall in the GST compensation fund of Rs. 25,000 crore. The Govt. arranged a fund of about Rs. 62,000 crores from its own resources.

Dues Cleared till 31st May 2022

31.05.2022: The central Government releases the entire amount of GST compensation payable to States up to 31st May 2022. Thus, it is releasing an amount of Rs.86,912 crores.

The central Govt. releases this amount for helping the states to manage their resources for the current financial year. Also, the said decision is taken despite there being a shortfall in the GST compensation fund.

How do GST Compensation funds get accumulated?

The Goods and Services Tax(GST) was introduced in the country w.e.f. 1st July 2017 and States have assured compensation for loss of any revenue. It is to say here that the loss arising on account of the implementation of GST as per the provisions of the GST (Compensation to States) Act, 2017 for a period of five years.

Thus, for providing compensation to States, Cess is being levied on certain goods. The amount of Cess that is collected is credited to Compensation Fund. Thereafter, the compensation to States is being paid out of the Compensation Fund w.e.f. 1st July 2017.

Govt. Releases Rs. 30,000 crores to States

30.03.2021: On 27th March 2021, The Central Government releases Rs. 30,000 crores as GST compensation to the states. Also, it has released Rs. 28,000 crores as IGST ad-hoc settlement to the States and UTs. The above GST compensation of Rs. 30000 crore is admissible for FY 2020-21.

Therefore, the total amount of GST compensation released so far for the year 2020-21 is Rs. 70,000 crore. Thus, now only Rs. 63,000 crores approx. is pending as GST Compensation to States and UTs for FY 2020-21.

Rs. 2,104 crores in 19th Installment

09.03.2021: On Monday 08th March 2021, The government has released the 19th Installment of Rs. 2,104 crore as GST compensation. Out of this, the total amount of Rs. 2,103.95 crores has been released to 7 States. Whereas, an amount of Rs. 0.05 crore has been released to the Union Territory of Puducherry.

Here is the list of major states with an Amount of fundraised through a special window passed on to these States/ UTs.

- Andhra Pradesh = 2306.59 crores

- Karnataka = 12383.13 crores

- Maharashtra = 11954.02 crores

- Delhi = 5853.76 crores

- Tamilnadu = 6229.05 crores

- Punjab = 7137.53 crores

18th Installment of GST Compensation to States

01.03.2021: The ministry of finance releases the 18th Installment of Rs. 4,000 crores to the States on Monday, 1st March 2021. Thus, the total GST compensation shortfall released to States reaches Rs. 1.04 Lakh crore.

Out of the total release of this month, an amount of Rs. 3,677.74 crores has been released to 23 States. On the other hand, an amount of Rs. 322.26 crores has been released to the 3 Union Territories (UT) with Legislative Assembly (Delhi, Jammu & Kashmir & Puducherry).

The rest of the 5 States namely, Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Sikkim do not have any gap in GST revenue on account of GST implementation. Therefore, until now, 94 percent of the total estimated GST compensation shortfall has been released to the States & UTs with Legislative Assembly.

16th Installment of GST Compensation to States

18.02.2021: The government releases the 16th installment of Rs. 5000 cores for GST compensation shortfall in the previous week. A total amount of Rs. 4,597.16 crores has been released to 23 States. Similarly, an amount of Rs.402.84 crore has been released to the 3 Union Territories (UT) with Legislative Assembly (Delhi, Jammu & Kashmir & Puducherry).

Further, these five States, namely Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Sikkim do not have a gap in revenue on account of GST implementation.

Here is the State-wise additional borrowing of 0.50 percent of GSDP allowed. Also, the number of funds raised through a special window passed on to the States/UTs till 15.02.2021 are shown.

Table Showing State Wise issue of Compensation (Rs. in Crore)

| S. No. | Name of State / UT | Additional borrowing of 0.50 percent allowed to States | Amount of fundraised through special window passed on to the States/ UTs |

|---|---|---|---|

| 1 | Andhra Pradesh | 5051 | 2167.20 |

| 2 | Arunachal Pradesh* | 143 | 0.00 |

| 3 | Assam | 1869 | 932.42 |

| 4 | Bihar | 3231 | 3661.70 |

| 5 | Chhattisgarh | 1792 | 1833.65 |

| 6 | Goa | 446 | 787.61 |

| 7 | Gujarat | 8704 | 8647.89 |

| 8 | Haryana | 4293 | 4081.14 |

| 9 | Himachal Pradesh | 877 | 1610.17 |

| 10 | Jharkhand | 1765 | 996.13 |

| 11 | Karnataka | 9018 | 11634.88 |

| 12 | Kerala | 4,522 | 3729.00 |

| 13 | Madhya Pradesh | 4746 | 4259.37 |

| 14 | Maharashtra | 15394 | 11231.97 |

| 15 | Manipur* | 151 | 0.00 |

| 16 | Meghalaya | 194 | 104.97 |

| 17 | Mizoram* | 132 | 0.00 |

| 18 | Nagaland* | 157 | 0.00 |

| 19 | Odisha | 2858 | 3584.17 |

| 20 | Punjab | 3033 | 5405.84 |

| 21 | Rajasthan | 5462 | 3622.50 |

| 22 | Sikkim* | 156 | 0.00 |

| 23 | Tamil Nadu | 9627 | 5852.85 |

| 24 | Telangana | 5017 | 1703.56 |

| 25 | Tripura | 297 | 212.15 |

| 26 | Uttar Pradesh | 9703 | 5633.14 |

| 27 | Uttarakhand | 1405 | 2172.07 |

| 28 | West Bengal | 6787 | 2865.55 |

| Total (A): | 106830 | 86729.93 | |

| 1 | Delhi | Not applicable | 5499.96 |

| 2 | Jammu & Kashmir | Not applicable | 2130.51 |

| 3 | Puducherry | Not applicable | 639.60 |

| Total (B): | Not applicable | 8270.07 | |

| Grand Total (A+B) | 106830 | 95000.00 |

15th Installment

12.02.2021: To meet the GST shortfall, the Finance Ministry, Expenditure Department today announced the 15th weekly installment of Rs 6,000 crore to the states.

So far, 81 percent of the total estimates of GST compensation have been given to the States and Union Territories, including the Legislative Assembly.

Out of this, Rs 82,132.76 crore has been given to the states and Rs 7,867.24 crore has been given to the Union Territories including the Legislative Assembly.

The amount released this week was the 15th installment of the fund to be provided to the states. This week, the amount has been borrowed at 5.5288% interest.

So far, the Central Government has borrowed an amount of Rs.90,000 crore through the special borrowing window at an average interest rate of 4.7921%.

14th Installment of GST Compensation

03.02.2021: The Ministry of Finance, Department of Expenditure has released the 14th weekly installment of Rs. 6,000 crores to the States today to meet the GST compensation shortfall.

Out of this, a number of Rs. 5,516.60 crores has been released to 23 States, and an amount of Rs. 483.40 crores has been released to the 3 Union Territories (UT) with Legislative Assembly (Delhi, Jammu & Kashmir & Puducherry) who are members of the GST Council.

The remaining 5 States, Arunachal Pradesh, Manipur, Mizoram, Nagaland, and Sikkim do not have a gap in revenue on account of GST implementation.

Till now, 76 percent of the total estimated GST compensation shortfall has been released to the States & UTs with Legislative Assembly. Out of this, an amount of Rs. 76,616.16 crores has been released to the States, and an amount of Rs. 7,383.84 crores has been released to the 3 UTs with Legislative Assembly.

The Government of India had set up a special borrowing window in October 2020 to meet the estimated shortfall of Rs. 1.10 lakh crore in revenue arising on account of the implementation of GST.

The borrowings are being done through this window by the Government of India on behalf of the States and UTs. 14 rounds of borrowings have been completed so far starting from 23rd October 2020.

The amount released this week was the 14th installment of such funds provided to the States. The amount has been borrowed this week at an interest rate of 4.6144%.

So far, an amount of Rs. 84,000 crores has been borrowed by the Central Government through the special borrowing window at an average interest rate of 4.7395%.

Government Releases Rs 6,000 crores

03.11.2020: The Ministry of Finance, under its “Special Window to States for meeting the GST Compensation Cess shortfall,” Release an amount of Rs 6000 crore as a second tranche to 16 States and 3 Union Territories yesterday.

This amount was raised at a weighted average yield of 4.42 percent. This amount will be passed on to the States/UTs at the same interest rate, which is lower than the cost of borrowings for the States and UTs, thus benefitting them. Ministry of Finance has facilitated loans of Rs 12,000 crore to date under the Special Window to States/UTs.

21 States and 3 Union Territories till date, have opted for the Special Window under Option I. The loans raised by GoI are released on a back-to-back basis to States/UTs, in lieu of GST Compensation Cess releases.

The loans have been released to the following States and Union Territories – Andhra Pradesh, Assam, Bihar, Goa, Gujarat, Haryana, Himachal Pradesh, Karnataka, Madhya Pradesh, Maharashtra, Meghalaya, Odisha, Tamil Nadu, Tripura, Uttar Pradesh, Uttarakhand, UT of Delhi, UT of Jammu and Kashmir and UT of Puducherry.

What is GST Compensation to States?

The central Government agrees to provide the loss of revenue to states, due to the imposition of goods and services tax in India. Therefore, GST Compensation is an amount paid to the states as per the provisions of Section 7 of the GST (Compensation to States) Act, 2017.

According to the Act, the GST compensation will be payable to the States during the transition period. The compensation in a State will be calculated and released on a temporary basis. However, the period has been extended beyond the transition period of five years i.e. beyond June 2022. The decision has been taken in the 42nd GST council meeting.

Related Articles

GST Collection Monthwise updates

The GST Revenue collection touches almost 1.20 lakh crore in the month of January 2021. The actual figure is reached ₹ 1,19,847 crore on 31.01.2021. more

How to make online GST payments?

Visit the www.gst.gov.in portal. Click on Services > Payments > Create Challan. Fill in your GSTIN/UIN/TRPID/TMPID. more

What is GST Return Filing?

Every person registered under GST should upload the details of sales and purchases to the government. more

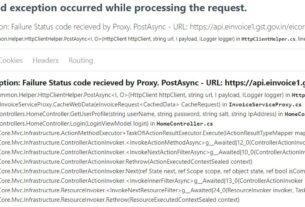

Website address of Einvoice Portal in India

Https://einvoice1.gst.gov.in is the official e-invoice portal of GST. The taxpayers can generate e-invoices from this portal. more