The government has noticed that many taxpayers had authorized some intermediator or consultant to apply for GST registration on their behalf in the beginning. During the registration process, these intermediates had entered their own mobile number and email in the GST application.

They are now not sharing the user credentials like username and password, OTP received on registered mobile number, etc. Therefore the taxpayers are now at their mercy. In order to overcome this issue, the government has recently released one press note to help such taxpayers under GST.

As per this press note, the GSTN system has the functionality to update the mobile number and email address of the authorized signatory. Also, the email and mobile number can be updated only by the concerned Jurisdictional tax authority. The jurisdiction officer and taxpayer shall follow the below procedure to make these changes:

Do you have these types of questions regarding Email and mobile numbers?

– I don’t have access to my mobile number used while registering on the GST portal?

– We have changed our Authorized signatory on the GST portal. How do I change his email and mobile number?

– My Primary Authorized Signatory has died or is not traceable. How to reset his mobile number and email?

Here are these 9 Steps to change email and mobile numbers on the GST portal.

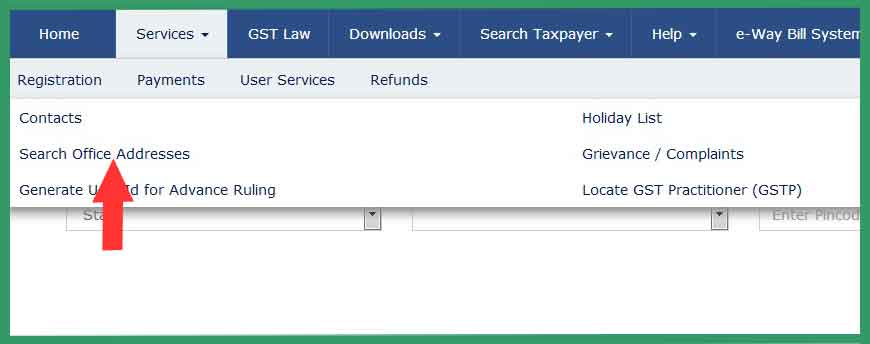

1) The taxpayer needs to approach the jurisdictional Tax Officer to get the password for the GSTIN issued to his business. You can find your jurisdiction through the Search Taxpayer option available on https://www.gst.gov.in. The same is visible in red text.

Also, you may search the jurisdiction address by going to services > user services > Search office Address:

2) The taxpayer will have to provide valid documents to the tax officer as proof of his/her identity. Also, he may require some other documents to validate with the business and the authorized signatory related to your business.

3) Thereafter tax officer will check if the said person exists as Authorized Signatory for that GSTIN in the GSTN system.

4) Tax officer will upload all necessary proof of identity and business on the GST Portal in support to authenticate the activity.

5) After the authentication process Tax officer will enter the new email address and mobile phone number. This must be provided by the Taxpayer by making a simple letter on the company’s letterhead.

6) Tax officer will reset the password for the GSTIN in the system after uploading the documents.

7) Temporary Username and password reset will get communicated to the email address as entered by the Tax Officer.

8) Now the taxpayer needs to log in to GST Portal at https://www.gst.gov.in/ using the First time login link on step number 7.

9) After the first-time login, the system will prompt the taxpayer to change the temporary username and password. These details were already sent to a new email address. Now the new username and password are available to the taxpayer to perform all future activities.

These were the 9 steps for making alterations or modifications to the email and mobile number on the GST portal. Also Kindly keep visiting this page to check the changes. We will make necessary amendments in the above steps as to how to reset the mobile number and email on the GST portal.

How to add a new Primary Authorized Signatory, if the existing signatory does not exist?

In this case, you need to approach the relevant jurisdictional Tax Officer to set a new Authorized Signatory in the GST Portal.

Top 4 Similar Articles

GST Registration process for proprietorship

Follow the simple step-by-step guide to obtain registration for proprietorship under GST. Read to know more about GST registration.

Cancel Existing GST Registration

The taxpayer may need to cancel his/her existing GST registration. Here is how to apply for the cancellation of GST.

List of documents for GST Registration

Make a list of necessary documents required for GST registration as a proprietor before proceeding to apply for fresh registration under GST. Read more about the GST Registration documentation.

Check GST Registration Certificate

Learn how to download and check your GST registration certificate. See the video explaining step by step download process of the GST certificate.