Learn how GST is calculated in India on various items with examples. The below GST online Calculator can calculate GST on any value you enter. Also, it will calculate GST on revere basis i.e calculate GST on your MRP price. Learn here how GST is calculated in India. with formula and percentage.

Further, calculate the GST payable amount on the basic value you enter below. Similarly, you can download the GST calculator in excel format from here. You may read another article on how to calculate interest on GST payments.

Index

- Introduction >> About

- How GST is Computed? >> Calculation Formula

- Calculation for Invoice >> Online Calculator >>

- Reverse GST calculation >> Manual Calculation

- Excel GST Calculator >> FAQ >> Similar Links

About

Calculating the GST amount at the time of filing a GST return is a quite complex task. If you do not know how to calculate GST with CGST, SGST, IGST, and cess break-up then it will be an additional headache for you.

GST Tax calculation formula is very important to arrive correct GST payable to the government. As a taxpayer, you always want to pay the correct GST amount rather than paying less amount due to calculation error. Thus, this article explains how GST is calculated in India in simple & easy steps.

How GST is calculated in India?

Here is how you can calculate GST Tax. This GST Tax calculation formula can be used to calculate GST for offline use. You can apply the formula for making GST payments while filing your GSTR 3B return. Also, you can find an example of how the GST is calculated in actuality. As you can see below the formula to calculate GST is, Cost of the product is multiplied by GST Rate and then divided by 100.

However, you can always deduct the discount from the original while before calculating GST. Thus, under the GST law, the supplier of goods or services shows a discount on the basic price and then charges GST.

However, this is not applicable in the case of freight charges. Thus, if the freight is to be shown on the invoice then it must be included in the basic price/value of the goods or services. Similarly, if the taxpayer is sending the goods through courier mode and is charged to the recipient on the invoice, the GST is to be payable on such courier charges.

Related: How GST is calculated on Gold?

GST Calculation formula

GST Amount = (Original Cost x GST%)/100

Net Price = Original Cost + GST Amount

Example: The total cost of a product or service is Rs. 25000/-. The dealer gives a 5% additional cash discount on the basic cost to the customer. Further, the dealer charges 3% freight to the customer to deliver the material on his go-down. The Current CGST rate on the above product is 9%. Assume that the

Calculate the Total Assessable value for GST calculation, Total GST Amount payable, and net invoice amount.

GST Calculation Table for Invoicing

| Description | Amount(Rs) |

| Net Cost of Product / Service | 25,000=00 |

| Less Cash Discount @5% | 1,250=00 |

| Sub Total | 23,750=00 |

| Add Freight @3% | 712=50 |

| Sub Total | 24,462=50 |

| CGST @ 9% | 2,201=63 |

| SGST @ 9% | 2,201=63 |

| Total (Invoice To Customer) | 28,865=75 |

Related: How GST is calculated on Flats?

How to Calculate GST Online?

You may use our above online calculator to calculate GST Online. However, it calculates only the

Time needed: 2 minutes

- Fill the Amount

This is the assessable value amount after deducting any discount if any. if you want to include any cost to this value like freight amount, then you should enter it by clubbing together. This is specifically for Indian taxpayers.

- Enter rate of GST as applicable (6%, 12%, 18%, 28%)

- Click on the +Add GST button to Calculate

- That’s it. It gives you a total GST amount payable

How to Calculate GST on Reverse Basis?

If you have some price Like M.R.P (Maximum Retail Price) of any product and you want to know what is GST amount included in that. Then you can do it right here. Here is what you have to do.

- Enter MRP price next to Initial Amount

- Enter the rate of Tax applicable

- Click on the “-subtract button”

- This will give you the basic value of the product

- GST amount included in the MRP

- Your Gross amount/MRP.

How to calculate it manually?

If you want to calculate it manually then the Formula is = M.R.P x 100 / 100 + GST Rate. Here is how to do it.

- Write down the M.R.P

- Multiply it by 100 factor

- Divide it by 100 + GST Rate

Example: Let us assume that the M.R.P of product A is Rs. 125/- and the GST rate is 18%. Therefore, your calculation should be as follows:

Basic Value= 125 x 100 / 118 = 105.93

GST Amount in M.R.P = 125.00 – 105.93 = 19.07

How to Calculate GST Payable?

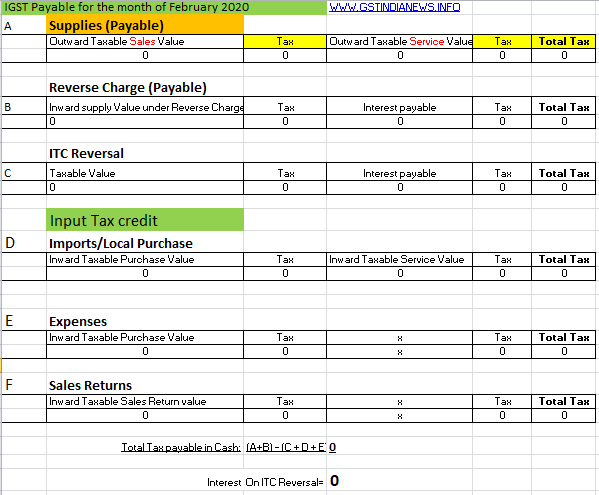

You can calculate GST payable by using our below excel file. Similarly, you can also calculate it by following the simple formula below.

Total GST payable = (Total GST Charged on the Invoice + Debit Note) – Input Tax credit availed + Credit Note)

GST Calculator in Excel Format

Download the GST calculator in excel format, which can calculate the GST payment after deducting input tax credit. Thus, you can enter sales details, purchases, Actual ITC availed, and sales return. Similarly, you can enter ITC entries as per your books of accounts. This, online GST payment calculator will help you make your GST payment in GSTR 3B with ease.

Thereafter, you can reconcile these entries with your GSTR 2B, which is now happening automatically in our revised format updated in March 2024.

This will help you to take an input tax credit as available in GSTR 2B. Similarly, this will maintain reconciliation between GST Return and your books.

Further, you can customize this GST calculation template as per your requirements. There is no protection to this file. Therefore, you can download the file and use it as per your requirements.

Kindly mail us if you have a better Excel sheet at admin@gstindianews.info so that we can make it available for other users. Also, comment below if you have any suggestions to improve the tool or if you are looking for a video showing how to use the above format.

Related: How to make online GST payments?

Free GST Calculator online

1)GST Calculator Online India or GST Tax Calculator Online in India Automatically calculates how much your product or service would

cost after the application of GST. It Calculates GST payable to be shown on the invoice. You may also buy a GST calculator from Amazon’s online shopping portal to use in your day-to-day calculation.

2) On the other hand, GST Calculation online Calculates GST payable after considering various discounts and value additions.

GST Calculator Note: Please refer to Section – 15 (Value of taxable supply). Such as for the above “Value addition and discount fields if any”, to be entered or not. Also, you may keep these fields blank if you do not have any value for these fields.

On the other hand, the taxpayer can use online GST calculator software online for goods and service tax calculations. Also, GST Calculator Online India software helps you to easily calculate the GST amount and put it on the invoice. This is how GST is calculated in India with the percentage and formula.

The FAQ on GST Calculator

The GST calculator is an electronic device or online software that can calculate the tax amount on a given price.

Enter the initial amount on which Total GST is to be calculated. Enter the GST rate i.e either IGST or CGST + SGST. Click on the “Calculate” button to show the results.

Enter the ‘Initial Amount’ including the GST amount. Enter the rate of GST. select (- GST) from the list. Click the ‘Calculate’ button to display the results.

Visit the GST rate of Goods page to check the rates. Also, you may GST rates of Services to find the rate for services.

You may use our above online GST calculator to find out the GST amount included in any product.

Important Similar Links

- How to Set off GST with rules

- How to Calculate GST late fees

- Interest Calculator for GST

- GST Rates of Goods

- GST Rates of Services

This guide explains how to calculate GST under the Goods and Service Tax regime in India. Check the latest GST updates and news on Calculation, rates, percentages, assessable value, etc. in India. All about GST calculation formula, GST calculator in Excel, reverse GST calculator, and GST payment calculator. Learn the Simple GST calculation method with an example.