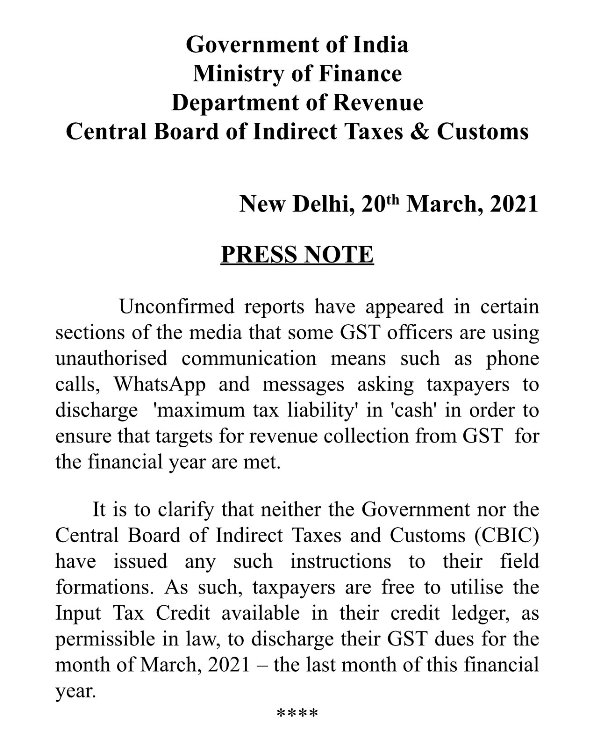

21.03.2021: The Central Board Indirect Taxes and customs issued a press release on 20.03.2021 on making GST payment for March 2021. According to the press release, the department has received unconfirmed reports saying few officers are asking taxpayers to deposit money in cash for making GST payments. The purpose is to meet the revenue collection for the current financial year. The officers are sending messages, using WhatsApp, and making phone calls to the taxpayers to get this done.

In this regard, the CBIC has clarified that neither the government nor the departments have issued any such instructions to the officers. Therefore, the taxpayers are free to use their input tax credit available in their credit ledger to make the payment for March 2021. Here is the official press release published.

The press release was published through the official tweeter handle owned by CBIC. After, going through the press release, various reactions of taxpayers and stakeholders came to light. Here are some of the replies posted on the tweeter handle with the source tweet.

Tweeter Replies

- Not only this, in GST registration gst officers are taking cash payments illegally and the application got approved without proper documentation.

- Money is being demanded for Revocation of Cancellation, even if adhar is verified they are visiting the address and demanding money.

- Please look into state gst official as they are charging for getting gst number approved and just rejecting the same due to invalid reasons. Please look into the matter as this is more Harassing than anything else.

- Publish the names of those officers and bring transparency to your godforsaken system. You do it for the taxpayers, why not weed out those following illegal practices in your department.

- Taxpayers who are in the QRMP scheme are getting notices for non-filing GST returns this is a very serious issue to take note of, notice for no filing in QRMP schemes means the officers aren’t aware of the new scheme is or somehow ignorant.

- We used to get these kinds of requests or can say directions from the excise Dept prior to GST to pay max in PLA ( cash ) during March to meet targets and keep the credit to be availed in April.

Related Links

How to make GST Payment?

Learn everything about making GST payments. This is including payment date, checking payment status, generating challan, authorized banks, etc. more

GST Set off Rules

First, you have to utilize the complete IGST input tax credit available if any, to set off IGST output liability on account of integrated tax on outward supplies. more

List of ineligible input tax credit under GST

The ITC is not available in few cases as mentioned in CGST section 17(5) of the CGST Act, 2017. Here is the complete list of such ineligible input tax credits under GST. more

GSTR 3B Due Date For March 2021

Here are the due dates for filing GSTR 3b for the month March 2021. These dates varies on the basis of turnover and then on the group of states. more