In order to bring further transparency to the GST process, the GSTN has introduced a new feature on the GST portal called “Communication between Recipient and Supplier Taxpayers“.

The facility will ease the communication process between the taxpayers for various purposes related to GST. Similarly, this communication will take place in a legal manner. Let us see the details below.

What is “Communication between Taxpayers” facility?

The “Communication between Taxpayers” facility on the GST portal is used to send notifications to another taxpayer. Similarly, the taxpayer will receive the new notifications and replies from another taxpayer. Thus, it will work like a thread of mail exchange on the GST portal itself.

What type of mails can be sent?

Here are some of the important topics on which taxpayers can send emails or notifications to their suppliers or customers.

- Asking to upload missing invoices

- Rejected – Amendment required in earlier uploaded invoices

- Rejected – Invoices wrongly send to the customer of another customer

- Intimation of re-uploaded documents to the customer

- Payment made intimation to the supplier from the customer.

- Any other related information

Who can use the facility?

The facility can be used by all taxpayers except TDS, TCS, and NRTP taxpayers. Also, TDS, TCS, and NRP taxpayers will not see the link of this facility on their dashboard under the Services tab.

Advantages of sending mail from the portal

- The opposite party taxpayer will receive an e-mail and an SMS on their registered e-mail address and mobile number for all notifications.

- The taxpayer will see an alert after logging into the GST portal.

- The taxpayer can send up to 100 notifications to a single GSTIN for a particular tax period.

- The recipient can upload the details of missing tax invoices and send a notification to their supplier. Later, the supplier can add such invoices directly in their GSTR-1, if not reported earlier.

- The facility to upload and download the invoices will also be available soon.

Step by step process to send mail

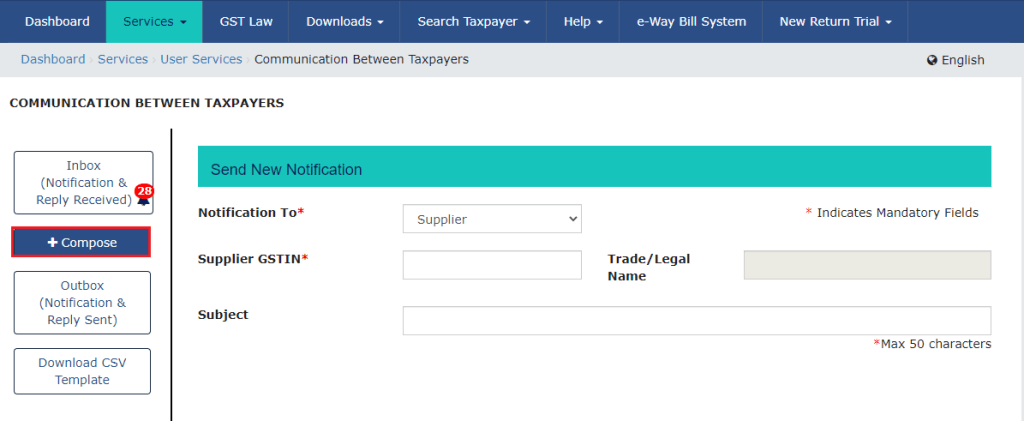

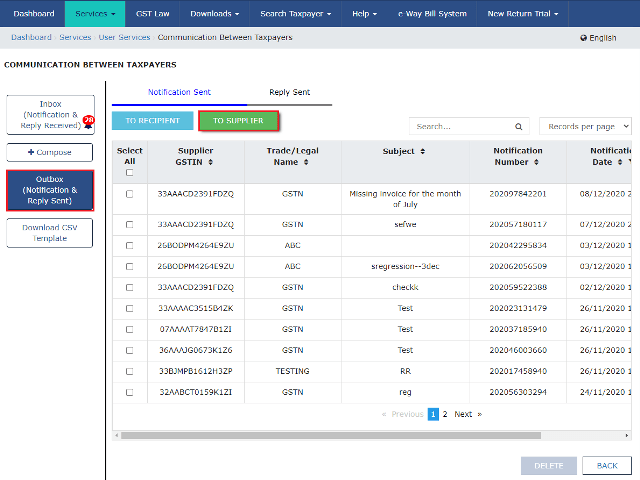

- Go to Services > User Services > Communication Between Taxpayers > and select the Compose option

- Select the Supplier option to send a notification to a Supplier, otherwise select Recipient

- Under the Document Details, select the Action Required by Supplier/ Recipient from the drop-down list

- Enter the required details

- Upload required documents/invoices, if any. A taxpayer can upload up to fifty documents in a notification.

- Add Remarks, if any in the provided box

- Click on the Send button.

Conclusion

As a taxpayer you can use this facility “Communication between Recipient and Supplier” to reach directly to the taxpayer instead of getting in touch with one of their staff to resolve the issue.

This feature will help the taxpayer to reach the concerned person who takes care of GST related process. For eg., a supplier can send a notification to the customer for making payment of invoices that are overdue by 180 days as per CGST rule 37.

Thus, the supplier can say, as per the above rule, if the payment is not made within the above period, the input tax credit availed by you, against such invoices will be invalid.

Similarly, the customer has to reverse such ITC with interest. Thus sending this notification will ensure the supplier gets prompt payments from their customers.

Related Articles

How to login at GST Portal?

In order, to log in to the GST portal one needs to register on the GST portal. After successful submission of an online application, the applicant will receive the user name and password. Thereafter these credentials can be used to login into the GST portal. Read more

About www.gst.gov.in Official GST Website

Know everything about www.gst.gov.in website by the government of India. Check out the various features available on the portal after login into the website. Read more

GST News on Annual Returns

The regular taxpayer needs to file the GST Annual Return on or before 31st December, of the previous period. Check out the latest updates on GSTR 9/C Annual return filing extension dates. Read more

What are GST Returns and How to file them?

The regular taxpayer has to file monthly returns called GSTR 3B and GSTR 1. Whereas the composition taxpayer has to make the monthly payments and file a quarterly return of outward supplies. Read more