What is additional place of business in GST?

Answer: Since the GST registration is PAN based and state-specific, the supplier has to register in each such state. Therefore, a business having multiple branches in various states have to take separate state-wise registration.

On the other hand, a business with multiple branches in the same state can declare one place as a principal place of business and other branches as an additional place of business. However, a business entity having a separate business vertical in a single state can opt for separate registration. This is as defined in section 2 (18) of the CGST Act, 2017.

Documents Required for Additional Place of Business

There is no need to attach documentary proof of Nature of Possession of Premises for all the additional places of business. Therefore, the applicant needs to provide only the details of additional places such as:

- Address details of additional place

- Contact information

- Nature of possession

- Nature of business activity carried out in the premises.

How to add additional place of business in GST?

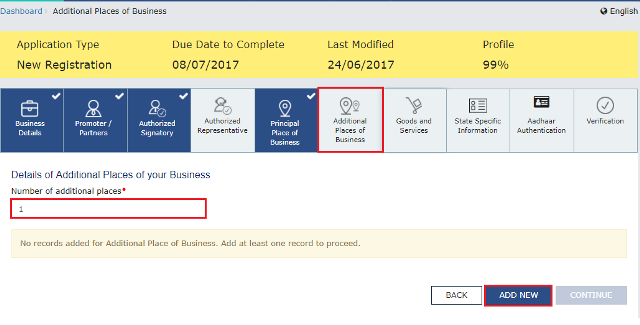

The additional Place of Business is a core field. Therefore, you will see the tab while applying for new registration as shown below. Similarly, you can also add a number of such additional business places after the registration. This can be done by using the online facility of amendment of core fields in GST registration. Follow the below steps to add the additional places of business in GST after registration.

- Login to the GST portal at www.gst.gov.in

- Navigate to Services >> Registration >> Amendment of Registration core fields

- Click on the “Additional place of a business” tab

- Click on the “Add new button to enter the details. Also, fill in the reason for the amendment and the date of the amendment. You can also edit the existing details of such additional places of business by clicking on the “Edit button”

Frequently Asked Questions

The taxpayer can add up to Five Hundred places.

Changes in existing GST registration can be done through amendment of registration.

Select the “Additional place of business” tab. Click on the “Delete” button to remove existing entries.

Similar Articles

Online GST Registration Process

The GST Registration is applicable to Normal Taxpayers, Composition Dealers, Casual Taxable Persons, Input Service Distributors (ISD), and SEZ developers/ SEZ Units. more

Download the GST Registration Certificate

In order, to download the GST certificate visit www.gst.gov.in >> login with your credentials. Click on the Services > User Services > View/Download Certificates. more

How to Check GST registration status?

If you have recently applied for New GST registration, then you may want to know the current status of the application. The applicant can do it by visiting the GST official portal at https://www.gst.gov.in/. more

Aadhaar Authentication for GST registration

The Aadhar verification while applying for new GST registration has become compulsory. Therefore, the applicants need to link their Aadhar card with the GST registration. more