1) How to register for e way bill SMS facility ?

Login to eway bill portal

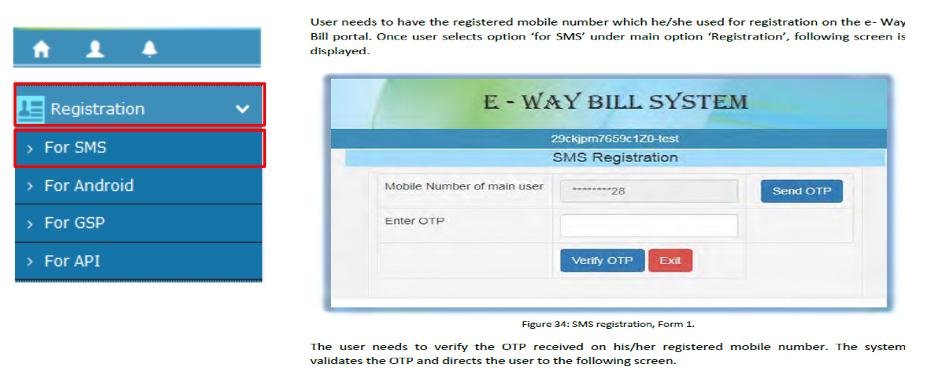

Click on ‘Registration’ appearing on the left-hand side of the dashboard and select ‘For SMS’ from the drop-down.

The mobile number registered for the GSTIN gets partly displayed. Click on ‘Send OTP’. Enter the OTP generated and click on ‘Verify OTP’.

Only those mobile numbers that are registered with the website can be registered for the SMS facility.

A maximum of two mobile numbers can be registered against one GSTIN.

For multiple user IDs against a single mobile number, Following screen appears:

If your mobile number is being used for more than one User IDs created, then you must select the desired user ID/username and click ‘Submit’.

2. How to use the SMS facility for creating/ cancelling E-way bills?

There are a set of SMS codes defined which can be used to work on the eway bills generation/ cancellation.

Download SMS Codes Here

While using this facility, suppliers or transporter has to ensure that correct information is keyed in, to avoid any errors.

For example, EWBG/EWBT for Eway Bill Generate Request for suppliers and transporters respectively; EWBV for Eway Bill vehicle update Request; EWBC for Eway Bill Cancel Request are the codes.

Overview:

Type the message( code_input info) and send the SMS to the mobile number of the State from which user(taxpayer or transporter) is registered.Eg: 97319 79899 in Karnataka

Type the relevant code for the desired action eg: Generation or cancellation and /or type the input against each code giving single space and wait for validation to take place. Verify and proceed.

Let’s see how to use this SMS facility for different actions as follows:

1. For Suppliers- Generate E-way bills

The format of SMS request is as follows:

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Send this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Mr A of Bangalore, Karnataka delivering goods worth Rs. 1,00,000 bearing HSN code-7215, against an invoice he created- No. 1005 dated 27/01/2018 to a unit of Mr. B at Kolar, Karnataka through vehicle number KA 12 AB 2456 covering a distance of 73 km.

The draft SMS to be typed in by Mr. A will be :

“ EWBG OSUP 29AABPX0892K1ZK 560021 1005 27/01/2018 100000.00 7215 73 KA12AB2456 ”

This SMS needs to be sent to “ 9731979899 ” mobile number( officially registered for Karnataka users)

A message as follows is received as reply instantly if no errors:

“ E-way bill generated successfully. E-Way Bill No:181000000287 and date is 27/01/2018 ”

2.For Transporters- Generate e-way bills

The format of SMS request is as follows:

EWBT TranType SuppGSTIN RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

Send this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Sans Transports of Bangalore, Karnataka a GTA delivering goods worth Rs. 1,50,000 bearing HSN code-7215, on behalf of Mr. A of Bangalore, Karnataka, against the invoice – No. 456 dated 20/01/2018 to a unit of Mr. B at Kolar, Karnataka through vehicle number KA 02 AB 7542 covering a distance of 73 km.

The draft SMS to be typed in by the operator at Sans Transports will be :

“ EWBT OSUP 29AABPX0892K1ZK 29AAEPM1443K1ZP 560021 456 20/01/2018 150000.00 7215 73 KA02AB7542 ”

This SMS needs to be sent to “ 9731979899 ” mobile number( officially registered for Karnataka users)

A message as follows is received as reply instantly if no errors:

“ E-way bill generated successfully. E-way Bill No:171000006745 and date is 20/01/2018 ”

3. Updation of Vehicle Number

The format of SMS request is as follows:

EWBV EWB_NO Vehicle ReasCode

Send this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Sans Transports of Bangalore, Karnataka a GTA delivering goods worth Rs. 1,50,000 bearing HSN code-7215, on behalf of Mr. A of Bangalore, Karnataka, against the invoice – No. 456 dated 20/01/2018 to a unit of Mr. B at Kolar, Karnataka through vehicle number KA 02 AB 7542 covering a distance of 73 km has generated the eway bill no. 171000006745 dated 20/01/2018

Suppose the vehicle breaks down during the journey on 20/01/2018 afternoon and Sans Transports arranges alternate vehicle bearing registration number KA 43 AB 2267 for the delivery of the consignment to the destination.

The draft SMS to be typed in by the operator at Sans Transporters will be :

“EWBV 171000006745 KA43AB2267 BRK”

This SMS needs to be sent to “ 9731979899 ” mobile number( officially registered for Karnataka users)

A message as follows is received as reply instantly if no errors:

“Vehicle details updated successfully and date is 20/01/2018”

Note: The eway bill cannot be updated with the vehicle details, If in case the validity of the eway bill expires eg. one day in case distance covered is less than 200 km.

4. Cancel E-way bill

The format of SMS request is as follows:

EWBC EWB_NO

Send this SMS to the registered mobile number of the State from which you are operating. Eg: 97319 79899 in Karnataka

Illustration:

Mr A of Bangalore, Karnataka wants to cancel the eway bill generated by him bearing number 160056750192.

The draft SMS to be typed in by Mr. A will be :

“ EWBC 160056750192 ”

This SMS needs to be sent to “ 9731979899 ” mobile number( officially registered for Karnataka users)

A message as follows is received as reply instantly if no errors:

“ eway bill is cancelled successfully ”

Errors are sent to the user as reply messages automatically.

For example: “This eway Bill is not generated by your GSTIN” and so on. Then make the necessary correction in the SMS and resend.

Note the following :

Cancellation is allowed only for generator of the E-Way Bill Cancellation is allowed with 24 hours of generation of E-Way Bill The verified e-waybill cannot be cancelled.

Indian Customs Proposes New procedure | Exports through India Post

Customs and Postal Department jointly organized the first-ever joint summit through which the imports and exports can be streamlined through India Post. In order to facilitate SMEs and to promote the Make in India program, Indian Customs Proposes New procedure for Exports through India Post.

Exports through India Post

Indian Customs and Department of India Posts, organized the joint conference at Vigyan Bhawan in New Delhi today. Customs commissioners from all the states having foreign post offices (FPOs) were present with their equivalent postmaster general.

Import and export figures are at number 6 in CPGRAMS. Customs and Directorate General of Foreign Trade (DGFT) have worked together to liberalize, improve and align the relevant laws by importing the year. From 2016, e-commerce exports were allowed under EEIS incentives from the post office in Chennai, Mumbai, and Delhi.

Now, the customers may be able to advance the revised race by allowing all e-commerce exports through the FPO, but without the benefits of MEIS. One of the major obstacles in the postal system is the absence of business logistics companies that can offer online access to SMEs and global access to third parties, leaving postal logistics.

Customs India Post proposes new simplified procedures for exports, to meet SMEs and what will be increased in the Make In India program. In one of the progressive knocks, Amazon and DHL were invited to present the world’s best practices and to identify the problems faced by exporters in India. “According to a private sector perspective, it was a good idea to gather customs and positions to find solutions for the Reserve Bank of India,” said Dr. Pritam Banerjee, Director (DAHL), Chief Commissioner of Customs, Mr. Sunil Sahni said that improving infrastructure and postal service in the foreign post office. Increasing the ability to go beyond India in the division is a big project Can demonstrate the export potential of the quantity.

Custom Forces are designed to identify non-repressive technologies such as X-ray scanning for the release of goods. These measures are likely to control drug trafficking, from which over 300,000 disinfection tablets have been seized. To strengthen law enforcement, customs mail scans your airport at the customs duty to identify suspected conspiracy and goods.

Useful Formats in GST

Purchase order Format in Word

Download the standard purchase order format in word for sending to your customer. Also, you can download here the Excel format of the purchase order.

Proforma Invoice Format in Word

Download the latest proforma invoice format in word and excel files. Also, you may download the excel format.

DC format for GST

You may require the delivery challan(DC) to send goods to your customer on a trial basis. Thus, download the DC challan format in excel and word.

Cashflow Statement in Excel

The Excel format of the cash flow statement is available to download and prepare your cash flow with ease. You can now download the excel cash flow format.