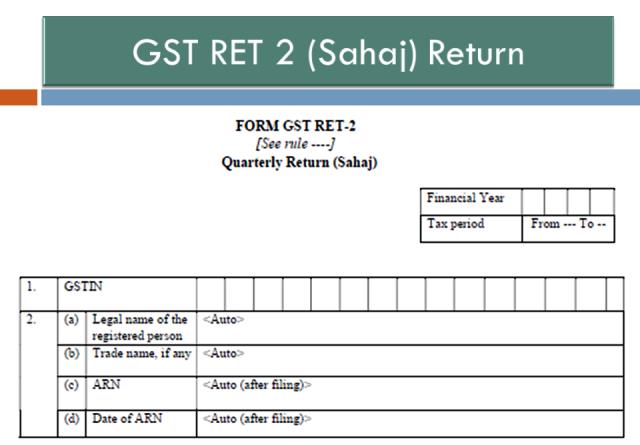

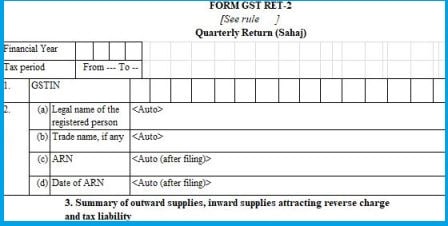

The GST RET 2 return is a new type of return to be filed from April 2020 onwards. Thus, this new GST return is also called as “SAHAJ” return. You can download the GST RET 2 format in pdf from the below section. Similarly, you may also download the GST RET 2 format in excel for your offline usage. In this article, you will learn how to file Sahaj return online on the GST portal, limitations, due date, etc. kindly note the return is still not implemented by the government.

Further, the Sahaj returns to be filed on a monthly basis unless the quarterly option is chosen. The taxpayer will have the option to choose the periodicity of filing while filing the first return. Thus, the taxpayer will able to change his filing periodicity only at the beginning of the next financial year.

Who Needs to File Sahaj Return?

The taxpayer whose aggregate turnover in the previous financial year is up to Rs. 5 Crore shall file the Sahaj return. Similarly, if he is making only B2C supplies or has inward supplies on which tax is payable on a reverse charge basis(RCM) shall opt to file this return.

Sahaj Return Quarterly Filing Limitations

Here are some of the limitations that are binding on the taxpayers opting to file Sahaj return on a quarterly basis.

- Can show only B2C outward supplies

- Can show the inward supplies which attract reverse charge tax liability.

- Not allowable to make supplies through e-commerce operators.

- Shall not take credit on missing invoices.

However, these return filers can make nil rated, exempted or non-GST supplies as it is not required to be declared in this return.

Due date of Filing

The due date of filing GST RET 2 is yet to be declared. Since the Sahaj return should be filed by attaching the GST ANX 1 and ANX 2, the due date can be 20th of Next month. However, for the quarterly filers, it maybe 20th of next month immediately after completion of such a tax period.

GST RET 2 Excel Format

You may download the excel format of GST RET 2 as per the pdf format. kindly note this format is only for reference purposes. Thus, it cannot be used to fill and upload on the GST portal. The GSTN is yet to upload the offline utility in excel to prepare the Sahaj offline for submitting on the GST portal. Thus, you may click below to download the sample of a Sahaj format.

GST RET 2 PDF Format

Download the pdf format of GST RET 2 or Sahaj new return in GST. Thus, you can use this format to read the instructions and various other columns to declare the data. Similarly, you may also download other GST forms from here for your offline requirement.

How to File GST RET 2 Return online?

The taxpayer will have to log in on the GST portal to file the Sahaj Return. Thus, here are the possible steps that will be required to file the return online.

- Visit the portal > Login with your valid credentials

- Navigate to Returns

- Choose the period

- Select the periodicity monthly/quarterly filing.

- Fill in the necessary details in the provided tiles.

- Attach the ANX 1 and ANX 2

- Submit and file the return.

Related Questions

The GST RET 2 is a new Sahaj return for small taxpayers.

The Sahaj is a simple new return for small taxpayers.

Do you mean GST RET 2?. If your answer is Yes then you can change it from quarterly to monthly once in a financial year.

Yes, you can file it on a quarterly basis.

Yes. you can switch over it at the beginning of the financial year.

yes.