GST RET 1 is a normal return under GST. This return shall be filed on a monthly basis. However, the taxpayer can choose the quarterly/monthly filing option a

Further, the taxpayer will have to upload the outward supplies and inward supplies details in GST RET 1 return. Thus, after implementing this return, taxpayers will not have to file GSTR 1 return additionally.

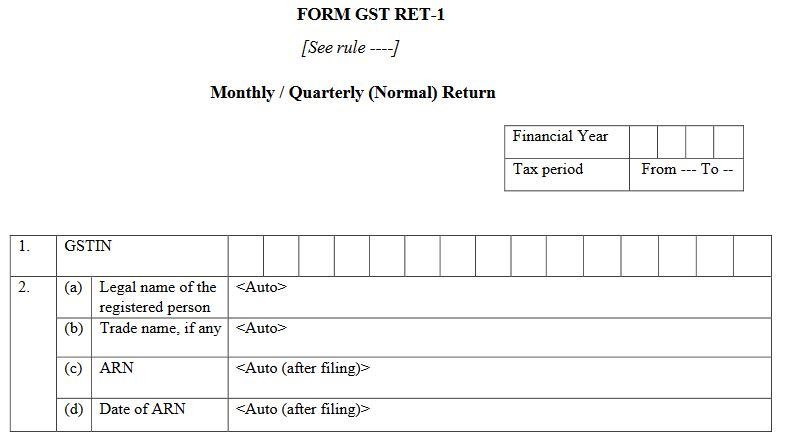

You can download GST RET 1 format in Excel as soon as it is available on this page. On the other hand, you will able to download GST RET 1 in pdf also. Similarly, you will find below the online filing instructions of GST RET 1.

Who shall file GST RET 1 Return

All Taxpayers registered under GST shall file GST RET 1 return. The taxpayers having turnover below 5 crores will have an option to file Return Quarterly.

However, the payment of taxes shall be made on a monthly basis. On the other hand, taxpayers having more than 5 crore turnover in a previous financial year shall file GST RET 1 on a

Further, the turnover of newly registered taxpayers, are considered as zero. Thus, they have the option to file monthly, Sahaj (GST RET 2), Sugam or Quarterly (Normal) return. Sugam return is also known as GST RET 3 return.

GST RET 1 Due date

The due date of GST RET 1 return filing is not yet declared. However, it maybe 20th of Next month to declare supplier of previous months.

According to the press release

Large Taxpayers [Turnover > 5 cr.]

The large taxpayers whose turnover is more than 5 crores will have to file their First GST ANX 1 from October 2019 onwards. Also, they will have to file their GSTR 3B Return on a

Further, the large taxpayers will file their first GST RET 1 for the month of December 2019 by 20th January 2020.

Small Taxpayers [Turnover < 5 cr.]

The Small taxpayers with turnover less th

Further, the small taxpayers will stop filing their GSTR 3B from October 2019 onwards and will start filing GST PMT 08.

Thus, they will file their First GST RET 01 for the period October 2019 to December 2019 by 20th January 2020.

GST RET 1 format in Excel

Here you can download the actual offline GST RET 1 format in Excel. Thus you can download GST RET 1 offline tool and fill in your data in offline mode and upload it to file your GST RET 1 Return. However,

You may click and download below excel file of GST RET 1 format for offline use.

GST RET 1 format in pdf

Download GSTR 1 Format in a

How to file GST RET 1 online

Here is how you will able to file your GST RET 1 online.

1. You will be able to file Nil GST RET 1 return through SMS if no

2. You will able to file GST RET 1 online only after uploading details of supplies in FORM GSTANX-1. Similarly, you will have to take action on the documents auto-populated in FORM GSTANX-2.

3. You will see the Information of GST ANX-1 and FORM GST ANX-2 in your GST RET 1 while filing online.

4. Suppliers can report excess tax collection if any from the recipients, in Sr. No. 8 of table 3A.

5. you will see the rejection of the details of various documents wrongly uploaded by the suppliers. Similarly, the pendency of supplies not received but available for taking ITC, reversals, adjustments will be auto

6. TDS/TCS amount will be available as a

7. The System will calculate other taxes automatically like late fees, interest if any. However, interest due to reversal, etc will be entered by the taxpayer.

8. you will be able to utilize ITC as per latest ITC set off rules for making the

9. The taxpayer has to make the other payments in cash only like Tax on account of supplies attracting a reverse charge, interest, fee, penalty, etc.

10. One has to make the Adjustment of negative liability of the previous tax period with the current tax period’s liability in GST RET 1 return.

11. You can view the balance amount available in electronic cash and electronic credit ledger on the screen before you make the GST payment.

12. Your turnover will be exclusive of the value of inward supplies attracting a reverse charge and import of services in table 3B.

13. The taxpayer has to report the adjustment of liabilities or input tax credit of the prior period to the introduction of the current system

About: Download GST RET 1 format in excel and pdf. New GST return format for monthly and quarterly filing. This is a new GST normal return filing system in 2019. View