In our previous post, we informed you about the top proposals suggested by the Council for making changes in GST Rules, GST ACT, or GST sections. Read here the Top 12 proposals change in GST Rules.

Further, the government invited suggestions/feedback from the general public, experts, professionals, etc. Here are the Top 24 GST rules suggestions given by many people to the government for making changes in GST Rules and ACT.

You may also comment on your suggestions below so that we can have more ideas for improvement. Also, we will try to submit your further comments to the government for consideration.

Late fees on GST Returns

1. GSTR-3B Return should be on a quarterly basis. Quarterly GSTR 3B Return will reduce the effect of late fees of Rs. 50 and Rs. 20 per day to Rs. 25 and Rs. 10 per day.

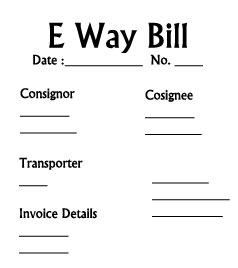

Extension of E Way bill Amount Limitation

2. E waybill should be beyond Rs. 2,00,000/-, as this will reduce the burden on small businessmen. In today’s scenario Rs. 50,000/- is nothing. We can purchase a ring of Rs. 50,000/- and carry in our pockets. Please keep a practical attitude.

3. When TDS, VAT, Service Tax, Income Tax returns are based on a quarterly, half-yearly, and yearly basis why the GST returns should not be on monthly basis.

4. When the Income-tax department only levies interest on late payment of tax, then why in GST regime Rs.200, Rs.50, Rs 20 late fees based on per day basis.

The Government’s motto is to “ease of doing business” not cease doing business. GST should be simple tax reform otherwise it will be called jajiya kar.

5) GST Rate@ 20% for luxury items with a focus on more revenue.

GST Rate on Hotels

6) GST Rate should be 10 % for hotels up to the four-star category. GST @ 15 % with five stars and above category with a view greater focus on more revenue and promote tourism in India

7. Advance paid should be treated as a taxable receipt and input credit should be allowed on it. There shouldn’t further issue of tax invoice.

8. The recipient should be able to upload Invoices not uploaded by suppliers. Tax should collect from suppliers in case of evasion.

9. Separate rules should be framed for input credit utilization and reversal by builders.

10. Allow refund of unutilized ITC on services. Eg. In Ahmedabad, fabric job work process houses do not have labor as their fixed employees rather they are under a contractor.

This contractor charges GST @ 18% for his services. While output tax on fabric job work is 5%. Maybe you can notify such class of people who can claim a refund of unutilized ITC on services.

11. The reversal of ITC for non-payment within 180 days must be deleted it has no meaning in it.

12. Single Return Format and common dates for all tax-payers are suggested.

Extension of GST Number Search Facility

13. More friendly option for searching GSTIN number or search GSTIN by trade name should be available.]

14) Filing a return with an OTP in India is impractical as no one is going to file a return themselves they ought to take the service of a professional, it is always a big burden for professionals to call their clients and ask them for OTP when especially those professionals are dealing with 160-170 clients.

15.) Do not implement those three returns it’s soo much of compliance and a heavy burden on taxpayers and professionals alike.

16.) Sending a notice of input mismatch before a year is not acceptable.

17) GST audit limit must be over / minimum 5 crores (presently 2 crore limit)

Retain section 9(4) in the present form:

18. Do not amend section 9(4) of the reverse charge mechanism. This will inspire the cash economy, fuel tax evasion.

I knew the impact it created and the widening of the tax base when it is in operation. Even now, at the field level, most of the registrations happening only because of the impression that section 9(4) will come into play sooner than later.

Request to keep section 9(4) and after wide publicity withdraws its postponement and bring it into operation.

Apportionment of credit and blocked credits – sec17 (i)

19. In this section motor vehicle and other conveyance except when they are used is not clear.

Whether the GST allowed on repairs and maintains cost of passenger vehicle used for the business purpose or GST on the purchase cost of the vehicle only.

GST refund

20. Is a GST refund allowable on the export of goods without payment of IGST on the basis of RFD-01a (as per GST rule formula) or on a net ITC basis?

21. In case of input of motor cars purchased by the hotel industry for the pick and drop of their customers, should be allowed as it is been used for the business purpose purely, though the seating capacity is less than 13 passengers.

22. For comments relating to amendment detailed at serial no.26 of the draft proposals:- There is no provision to file nil GSTR-1 if there is no outward supply although provision for filling nil GSTR 3B is available.

23. For comments pertaining to amendment detailed at serial no.26 of the draft proposals: Rule 39(b) to distribute ineligible credit is unreasonable by section 17(5) you are not allowing to take credit and by this rule, you are asking to distribute ineligible ITC.

24) After the words cost accountant “ or a GSTP having 5 years of experience (as STP) and passed the examination conducted by NASIN and shall submit a copy of audited annual accounts..”

Important GST Links

GST News and Update as on today

GST India news has brought this article exclusively for taxpayers. Do not forget to subscribe to our post to receive future GST updates in your inbox.

www gst gov in news and updates

Know about the latest news and updates at www.gst.gov.in. Read more about the official website of gst.gov.in.

gst login user id

Read everything about obtaining a GST login id and password in India. Also, read the various functions available on the GST portal.

GST Return Due Dates monthly

Know the GST return filing due dates on a monthly basis. File your GSTR 1, GSTR 3B before last date of filing runs out.

Govt should waive of late fees for first year to all gst tax payers since its inception there were many issues & confusion in regards to filling of return

Please allow to make revised Gstr 3b so that it can be matched with gstr1 and balance .

Late fees are continuously coming even if we file within date . We have contacted for department but their answer is we don’t know.

exemption from e-way bill upto 100 kilometer within the state