The GST portal is now facilitating the taxpayer to file GSTR 3b return with ease. This is by providing automated data while filing the GSTR 3b return. The system captures the data from your GSTR 1 filed for calculating tax liability. Whereas the input tax credit is derived from GSTR 2A i.e GSTR 1 filed by your supplier.

How the liabilities are auto calculated?

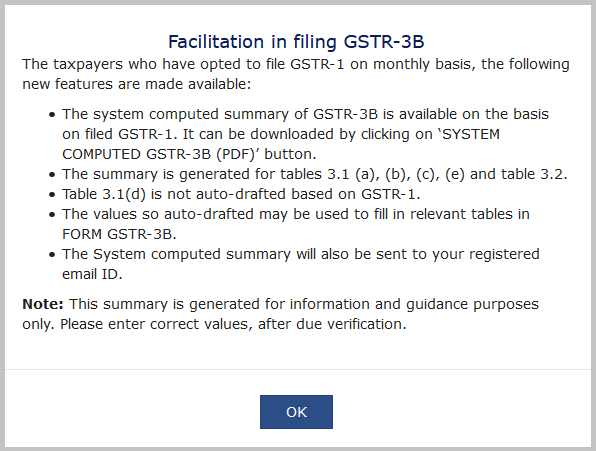

Answer: Table-3.1 & 3.2 of GSTR 3B contains the transactions of GSTR 1 filed by you. However, it does not include Table-3.1 (d), which is meant for inward supplies liable to reverse charge.

How the Input Tax Credit is auto calculated?

Answer: Input Tax credit entries are the inward supply entries of Goods or services or both. This is calculated on the basis of GSTR 1 filed by your supplier or the entries that are appearing in your GSTR 2A.

How to see auto-populated data?

Answer: The data calculated by the system is available in pdf format. This is available on the GSTR-3B dashboard. You can download it by clicking on the “System Generated GSTR-3B” tab.

How to use the auto-calculated Values of GSTR 3B?

Answer: The auto-calculated data is meant for assisting the taxpayers in filing their GSTR 3B return. Thus, it does not mean that you should compulsorily stick to the populated values.

As a taxpayer, you need to ensure the correctness of the values entered in GSTR-3B. The system will only prompt the taxpayers with an alert if the values are more than the threshold limit. For example, The input tax credit shall be availed only more than 10%, then what is available in GSTR 2A. This is further reduced to 5% from 01st January 2021.

In case the taxpayer has not filed GSTR 1 for the period, system-generated summary will display the respective values as ‘Not filed’. Similarly, if GSTR 2B is not generated for the period, system-generated summary will display the respective values as ‘Not generated’.

Further, If the taxpayer has entered & saved any values in GSTR 3B before auto-population by the system, the saved values will not be changed/over-written by the system. Also, Table 5 and 6.2 of GSTR-3B is not part of the PDF & will not be auto-populated by the system.

Related Articles

What is GSTR 3B Return?

GSTR 3B is a monthly summary of outward supplies or sales and Input tax credit availed during the month. more

GSTR 3B Due Date of Filing

The GSTR 3 due date of filing is the 20th of the next month. However, there are various dates and extensions on the basis of locations and turnover. more

Late Fees of GSTR 3B

The late fees of filing GSTR 3B is Rs. 50/- per day comprising CGST and SGST. However, there may be waivers announced by the government from time to time. more

e Invoice under GST applicability

The e-invoice is currently applicable for taxpayers whose turnover is Rs. 500 crores. Also, from 1st January 2021, it is compulsory for 100 crore turnover. more