20-08-2019: Once again CBIC extends the date for blocking e way bill for non

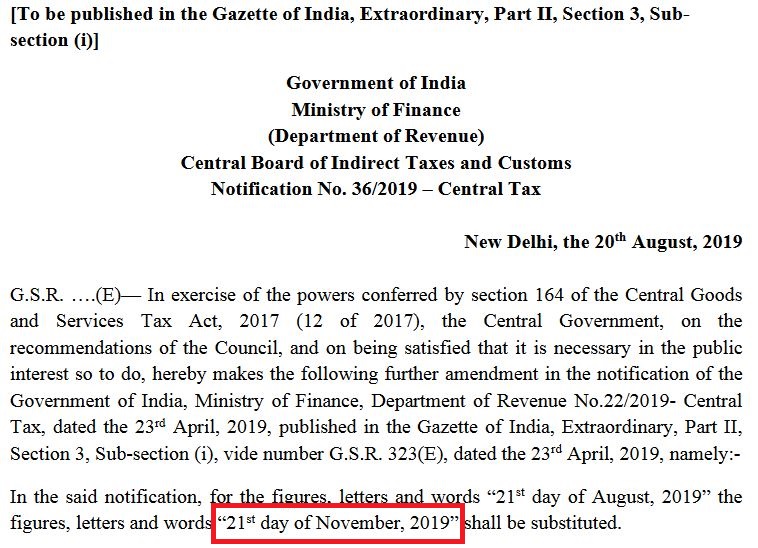

21.06.2019: The Central board of Indirect Taxes & Customs extends the date from 21st June 2019 to 21st August 2019, as the date to block e way bill generation. Earlier this date was 21st June 2019.

However, Today on 21.06.2019, the government issued a notification vide no. 25/2019-Central Tax ,dt. 21-06-2019 to extend this for another 2 months. Therefore, Taxpayers and transporters can generate e way bills till 21st August 2019, even if they did not file their previous GST Returns.

No E-way bill to Non-filers of GST Returns after June 21, 2019

Yes, The government is going to restrict e way bill generation for those taxpayers who do not file their returns on time. Therefore, if you did not file your past returns, you must complete them before 21st June 2019. Because, non-return filers will not be allowed to generate e way bills.

E way bill restriction notification and circular

Central board of indirect taxes has issued a notification vide ref.no. No.22/2019 –Central Tax dt. 23.04.2019 to bring CGST rule 138E into effect from June 21, 2019. Earlier, the government has made various changes in CGST rules vide Notification no. 74/2018-Central Tax ,dt. 31-12-2018. However, it was not brought into force immediately.

As per these rules taxpayer who do not file GST returns for two consecutive months will not be able to generate PART A of FORM GST EWB-01.

Type of Taxpayers included in this category

- Consignor

- Consignee

- Transporter

- An e-commerce operator

- Courier agencies

Secondly, the taxpayers registered under composition scheme do not file their return for two consecutive periods i.e 6 months will not be allowed to generate e way bills for intra-state movement of goods.

This measure will help the government to curb the revenue loss and tax evasion in nearby future.

Is there any exception to this rule ?

Yes, the only exception is, the jurisdictional Commissioner may allow generating such Part A of e

In this case, the taxpayer will have to approach the said commissioner in writing. Further, it is wholly on the commissioner to allow you generating an e

How to unlock E way bill Generation

You may not able to generate e way bills after 21st August if you fail to file your returns for consecutive periods. The system will automatically lock your id to generate any e

The government vide Notification no. 33/2019-Central Tax ,dt. 18-07-2019 inserted form EWB 05 to send request to unlock e way bill generation facility. Once you submit your request, the commissioner may allow you to open e way bill locking facility in Form EWB 06.

Why e waybill is required in India?

E way bill is a document generated through an online centralized system required for the movement of goods from one place to another. Now let us understand why this e way bill require in India.

I just googled a few days back and found, there is no concept of e way bill system anywhere else in the world. Transport vehicle shall carry only invoice with his truck while moving from one place to another in the rest of the world. Also, many countries do not have even invoice matching system to cross-check the movement of goods and the tax involved in every shipment. This is because the tax evasion is so much less in many countries that the government does not require to implement such a system.

However, In GST the Section 68 of the CGST ACT mandates that the Government may require the person in charge of a conveyance carrying any consignment of goods of value exceeding such amount as may be specified to carry with him such documents and such devices as may be prescribed.

Rule 138 of Karnataka Goods and Services Tax Rules, 2017 prescribes e-way bill as the document to be carried for the consignment of goods of value more than rupees fifty thousand. Government has issued a notification under rule 138 of Goods and Services Tax Rules, 2017 mandating to carry e-way bill for transportation of goods of consignment of value more than rupees fifty thousand. Hence e-way bill generated from the common portal is required to be carried.

Authors View

As far as India is a concern, there is so much tax evasion in the transport business and it ends with the generation of black money every year. Many times you must have seen that big ques of vehicles seen halted at check post for verification. Thus it is delaying the movement of goods from supplier to the receiver end.

Further, it is resulting in taking bribes and releasing the vehicles from the check post. Many times transporters prefer to give a bribe and release the vehicle instead of waiting for an unknown time.

Government has taken a decision to implement e waybill system in India, in order to keep online track of these vehicles and to overcome from the above issues. Therefore e waybill is important in India for the smooth functioning of such activities. Further, it is a big challenge in front of the government to implement e waybill system in India after GST.

u cannot add more than 1 invoice in e way bill. it is too complicated way bill .

you can use bulk e way bill generation tool from https://gstindianews.info/bulk-eway-bill-generation-tool/