Here are the complete GSTR 9C Format Guidelines for the successful Filing of GSTR 9C or Annual Audit report. Download GSTR 9c format in excel and pdf for free. You can Download offline utilities, notifications, and guidelines from this page. Thus, GSTR 9C is a self-sertifited statement to be filed by the taxpayer. Also, you will learn how to file and who needs to file a GSTR 9c annual return in an easy method. So let’s begin.

What is GSTR 9c Return?

GSTR 9C is a reconciliation statement between the figures shown in GSTR 9 and the reconciliation provided in the form of GSTR 9C.

What is GSTR 9C Applicability or who needs to file it?

A person whose turnover exceeds 2 crore rupees during the financial year needs to file a GSTR 9C return. In fact, the person whose turnover crosses above the limit shall get his accounts audited by the chartered accountant.

The Turnover of the complete year i.e. from 1st April 2017 to 31st March 2018 has to be considered into account for calculating the turnover. For example, if a taxpayer has a total turnover of Rs. 2.2 Cr for the period 1st April 2017 to 31st March 2018 and a turnover of Rs. 1.8 Cr for the period 1st July 2017 to 31st March 2018, then the taxpayer has to file form GSTR- 9C.

However, the government exempts the filing of GSTR 9C Return for Suppliers of OIDAR services. [Inserted vide CGST Notification No. 30/2019 Central Tax,dt. 28-06-2019. Similarly, the govt. also exempts GSTR 9C filing by Foreign airline companies vides notification no. 09/2020-Central Tax dt. 16.03.2020.

GSTR9 C of FY 2021-2022

👉 Taxpayers with a Turnover up to Rs. 5 crores need not require to file the reconciliation statement of GSTR-9C for FY 20-21 onwards.

👉Taxpayers with a Turnover above Rs. 5 crores can self-certify their reconciliation statement in GSTR-9C. This means the taxpayer can now file the return on his own without the need for a chartered/cost accountant. Refer to the CGST Rule 83(3).

Who shall prepare the GSTR 9C Reconciliation Statement?

As a taxpayer, now you can file GSTR 9C Reconciliation yourself. On the other hand, you can appoint a Chartered accountant to prepare a reconciliation and file it with certifications. However, this is not mandatory now as per CGST rule 80(3).

The offline tool or GSTR9C format in excel will be available on the GST portal. The chartered accountants or the taxpayer will be able to use this offline excel utility of GSTR 9c to file this return.

What is the difference between GSTR 9 Annual Return and GSTR 9C?

You must be aware during your statutory audit your chartered accountant makes an audit of tax payments. This is not only applicable in post-GST but in pre-GST also they used to do an audit of your vat payment, Central excise, and Service Tax.

They use to do reconciliation of the returns filed by you. Similarly, they use to match the different ledger balances of Cenvat credit/VAT credit with that of the accounts ledger. They had to do reconciliation to make these both ledgers tally.

Therefore, in the GST regime, they need to prepare similar reconciliation and highlight it in GSTR 9C. There can be some differences in figures between the GSTR 9 filed by you and the records maintained by your accounts department.

Hence, A chartered accountant has to find out the differences if any file the file GSTR 9C by certifying such conciliation.

When to file GSTR 9C Reconciliation?

The due date for filing GSTR 9C annual reconciliation statement is 31st December 2022 of FY 2021-22.

Earlier, as per the latest CGST Notification, 95/2020-Central Tax dated 30.12.2020, the last date to file GSTR 9C is 28th February 2021 for FY 2019-20. The last date to file GSTR 9C for FY 2018-19 is 31st December 2020. You may visit GSTR 9 Annual Return Extension Notification page to check the due dates of various GSTR 9 Returns.

GSTR 9C Format

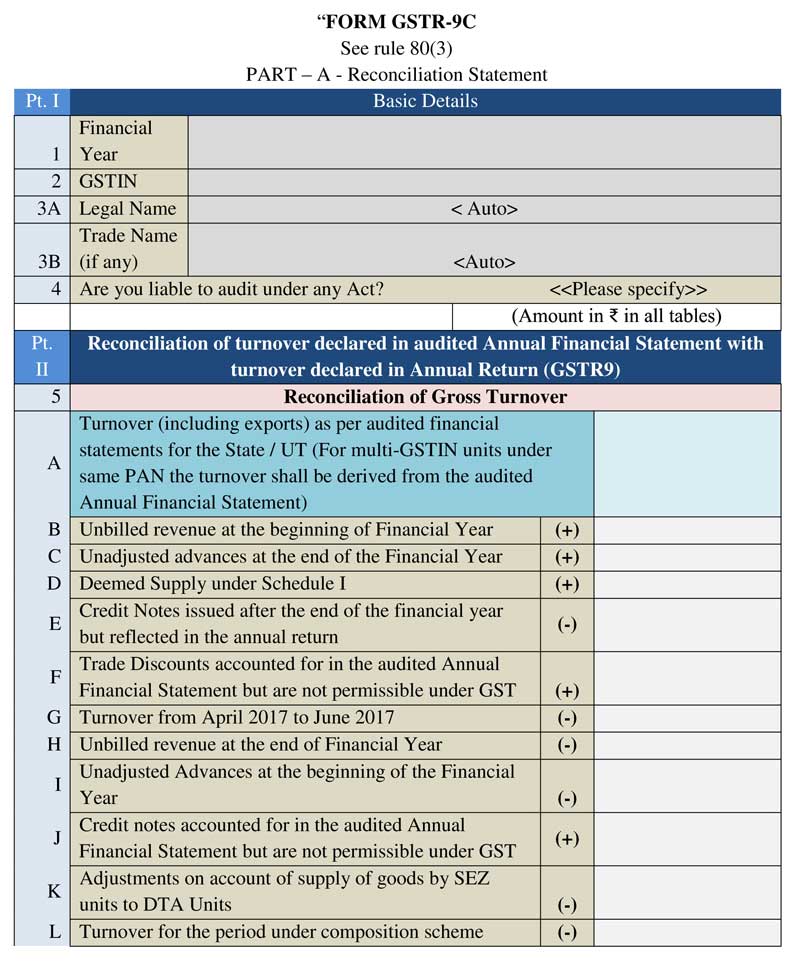

Below is the format of GSTR 9C. This format is as per GST rules. However, this format is only for reference and not to be used for actual return filing.

GSTR 9C PDF Format

You may download the latest GSTR 9C pdf format by clicking on the below button. The format is revised as per the latest GST notification No. 56/2019-Central Tax dt. 14-11-2019. Also, the format includes the Certification part.

GSTR 9C Format in Excel (Audit Format)

The GSTR 9c format in excel is now available on the GST portal. This is also, called a GST audit format in excel to be filed by a Chartered Accountant. you can download this GST audit report format in excel from the below link.

Please use the Microsoft Excel version higher than 2007 to prepare Form GSTR 9C. Please note that the revised excel utility v1.6 is ready to download from the GST portal.

How to file GSTR 9C with offline Excel utility?

Here is the video on how to file GSTR 9C in offline mode i.e with an excel file.

Kindly read the GST audit format carefully before filling in the data. This GST reconciliation format for audit in excel is meant to fill the data in offline mode. One can prepare a GST audit report without the need for an internet connection.

1.GSTR 9C Certificate format with audit

Here is the Certification format in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by the person who had conducted the audit

2.GSTR 9C Certificate format other than the auditor

Here is the Certification format in cases where the reconciliation statement (FORM GSTR-9C) is drawn up by a person other than the person who had conducted the audit of the accounts. You may also call this form a GSTR 9c reconciliation statement. Download format in pdf here.

How to fill GSTR 9C details in Excel Form?

The Excel-based Format of GSTR-9C is designed to help the auditor prepare the taxpayer’s GSTR-9C statement in offline mode.

Here are the details of the Tables in Form GSTR-9C sheet-wise statement. This can be added by the auditor using the offline Tool.

Pt. II- Reconciliation of turnover stated in audited Annual Financial Statement with turnover stated in Annual Return (GSTR9).

Pt. II(5)- Reconciliation of Gross Turnover:

Here is a live video by GST Platform to generate GSTR9C JSON and upload it on the GST portal.

5A of GSTR 9C: Turnover (including exports) as per Audited Financial Statement for the State / UT (For multi-GSTIN units under same PAN, the turnover shall as be derived from the Audited Annual Financial Statements )

Here you need to enter the turnover as per the audited Annual Financial Statement. There may be various cases where multiple GSTINs (State-wise) registrations exist on the same PAN.

This is common for persons/entities with presence over multiple States. Such persons/entities will have to internally derive their GSTIN wise turnover and fill in the same here.

This shall include export turnover (if any). Please note that reference to audited Annual Financial Statement includes the

5B of GSTR 9C: Unbilled revenue at the beginning of Financial Year.

The Unbilled revenue is the revenue that was recorded in the books of accounts on the basis of the accrual system of accounting in the last financial year and was carried forward to the current financial year.

In other words, when GST is payable during the financial year on such revenue (which was recognized earlier), the value of such revenue shall be stated here.

(For example, if rupees Nine Crores of unbilled revenue existed for the financial year 2016-17, and during the current financial year, GST was paid on rupees Three Crores of such revenue, then the value of rupees, Three Crores shall be stated here). Again only positive values are allowable in this field.

5C of GSTR 9C: Unadjusted advances at the end of the Financial Year.

The Value of all the advances rece

5D of GSTR 9C: Deemed Supply under Schedule I

The Aggregate value of deemed supplies under Schedule I of the CGST Act, 2017 shall be stated here.

Any deemed supply which is already part of the turnover in the audited Annual Financial Statement is not required to be included here. You can not enter negative figures here.

5E of GSTR 9C. Credit Notes issued after the end of the financial year but reflected in the annual return

The Aggregate value of credit notes issued after 31st of March for any supply accounted in the current financial year but such credit notes were reflected in the annual return (GSTR-9) shall be stated here.

Only positive values are allowable in this field but while calculating 5(P) this shall be treated as negative.

5F of GSTR 9C: Trade Discounts accounted for in the audited Annual Financial Statement but are not permissible under GST

Trade discounts which are accounted for in the audited Annual Financial Statement but on which GST was leviable (being not permissible) shall be stated here.

5G. Turnover from April 2017 to June 2017

The Turnover included in the audited Annual Financial Statement for April 2017 to June 2017 shall be stated here. Positive or negative values are allowable in this field.

- If positive values are entered in this field then it shall be reduced while calculating the turnover as per 5(P).

- If negative values are entered in this field then it shall be added while calculating the turnover as per 5(P)

5H. Unbilled revenue at the end of Financial Year

The Unbilled revenue which was recorded in the books of accounts on the basis of the accrual system of accounting during the current financial year but GST was not payable on such revenue in the same financial year shall be stated here.

Only positive values are allowable in this field but while calculating 5(P) this shall be treated as negative.

5I. Unadjusted Advances at the beginning of the Financial Year

The Value of all advances for which GST has not been paid but the same has been recognized as revenue in the audited Annual Financial Statement shall be stated here.

Only positive values are allowable in this field but while calculating 5(P) this shall be treated as negative

5J. Credit notes accounted for in the audited Annual Financial Statement but are not permissible under GST

The Aggregate value of credit notes which have been accounted for in the audited Annual Financial Statement but were not admissible under Section 34 of the CGST Act shall be stated here. Only positive values are allowable in this field.

5K. Adjustments on account of supply of goods by SEZ units to DTA Units

The Aggregate value of all goods supplied by SEZs to DTA units for which the DTA units have filed the

Only positive values are allowable in this field but while calculating 5(P), this field shall be treated as negative

5L. Turnover for the period under composition scheme

There may be cases where registered persons might have opted out of the composition scheme during the current financial year. Hence, their turnover as per the audited Annual Financial Statement will include turnover both as a composition taxpayer as well as the

Therefore, the turnover for which GST was paid under the composition scheme shall be stated here. Only positive values are allowable in this field but while calculating 5(P), this field shall be treated as negative

5M. Adjustments in turnover under section 15 and rules thereunder

There may be cases where the taxable value and the invoice value differ due to valuation principles under section 15 of the CGST Act, 2017 and rules thereunder.

Therefore, any difference between the turnover reported in the Annual Return (GSTR 9) and turnover reported in the audited Annual Financial Statement due to the

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be added while calculating the turnover as per 5(P).

- If negative values are entered in this field, then it shall be reduced while calculating the turnover as per 5(P)

5N. Adjustments in turnover due to foreign exchange fluctuations

Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to foreign exchange fluctuations shall be stated here.

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be added while calculating the turnover as per 5(P).

- If negative values are entered in this field, then it shall be reduced while calculating the turnover as per 5(P)

5O. Adjustments in turnover due to reasons not listed above

Any difference between the turnover reported in the Annual Return (GSTR9) and turnover reported in the audited Annual Financial Statement due to reasons not listed above shall be stated here.

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be added while calculating the turnover as per 5(P).

- If negative values are entered in this field, then it shall be reduced while calculating the turnover as per 5(P)

5P. Annual turnover after adjustments as above

This field shall be auto-calculated based on the details filled in table no 5A to 5O and the same is non-editable

5Q.Turnover as stated in Annual Return (GSTR9)

Annual turnover as stated in the Annual Return (GSTR 9) shall be stated here. This turnover may be derived from Sr. No. 5N, 10, and 11 of Annual Return (GSTR 9).

5R. Un-Reconciled turnover (Q – P)

This will be the difference between table no 5Q and 5P

Pt. II(6)- Reasons for Un – Reconciled difference in Annual Gross Turnover.

The Reasons for non-reconciliation between the annual turnover stated in the audited Annual Financial Statement and turnover as stated in the Annual Return (GSTR 9) shall be stated here

Pt. II(7)- Reconciliation of Taxable Turnover.

The table provides for reconciliation of taxable turnover from the audited annual turnover after adjustments with the taxable turnover stated in annual return GSTR-9.

7A. Annual turnover after adjustments (from 5P above)

Annual turnover as derived in Table 5P above would be auto-populated here. This field is non-editable.

7B. Value of Exempted, Nil Rated, Non-GST supplies, No-Supply turnover

The Value of

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be reduced while calculating the taxable turnover as per table no 7(E)

- If negative values are entered in this field, then it shall be added while calculating the taxable turnover as per table no 7(E)

7C. Zero-rated supplies without payment of tax

The Value of

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be reduced while calculating the taxable turnover as per table no 7(E)

- If negative values are entered in this field, then it shall be added while calculating the taxable turnover as per table no 7(E)

7D. Supplies on which tax is to be paid by the recipient on reverse charge basis

Value of reverse charge supplies on which tax is to be paid by the recipient shall be stated here. This shall be reported net of credit notes, debit notes, and amendments if any

Positive or negative values are allowable in this field.

- If positive values are entered in this field, then it shall be reduced while calculating the taxable turnover as per table no 7(E)

- If negative values are entered in this field, then it shall be added while calculating the taxable turnover as per table no 7(E)

7E. Taxable turnover as per adjustments above (A-B-C-D)

The taxable turnover is derived as the difference between the annual turnover after adjustments stated in Table 7A above and the sum of all supplies (exempted, non-GST, reverse charge,

7F. Taxable turnover as per liability stated in Annual Return (GSTR9)

Taxable turnover as stated in Table (4N – 4G) + (10-11) of the Annual Return (GSTR9) shall be stated here.

The Auditor can use the ‘system-generated summary based on GSTR 9 PDF to fill this field.

7G. Unreconciled taxable turnover (F-E)

Reasons for non-reconciliation between adjusted annual taxable turnover as derived from Table 7E above and the taxable turnover stated in Table 7F shall be stated here. This field shall be auto-calculated and non-editable

Pt. II(8)- Reasons for Un – Reconciled difference in taxable turnover.

Please provide a reason if the un-reconciled difference in taxable turnover

Pt. III- Reconciliation of tax paid

Pt. III(9)- Reconciliation of rate-wise liability and the amount payable thereon.

9A to 9O tax rates, interest, penalty, late fee, and others

The table provides for the reconciliation of tax paid as per the reconciliation statement and the amount of tax paid as stated in the Annual Return (GSTR 9). Under the head labeled “RC”, supplies where tax was paid on a reverse charge basis by the recipient (i.e. the person for whom the reconciliation statement has been prepared) shall be stated.

9P. Total amount to be paid as per tables above

The total amount to be paid as per liability stated in Table 9A to 9O is auto-populated here. This field is non-editable.

9Q. Total amount paid as stated in Annual Return (GSTR 9)

The amount payable as stated in Table 9 of the Annual Return (GSTR9) shall be stated here. It should also contain any differential tax paid on Table 10 or 11 of the Annual Return (GSTR9). The

9R. Unreconciled payment of amount (PT1)

This shall be the difference between table no 9Q and 9P

Pt. III(10)- Reasons for un-reconciled payment of amount.

Reasons for non-reconciliation between payable / liability stated in Table 9P above and the amount payable in Table 9Q shall be stated here.

Pt. III(11)- Additional amount payable but not paid (due to reasons stated under Tables 6,8 and 10 above).

Any amount which is payable due to reasons stated under Tables 6, 8, and 10 above shall be stated here.

Pt. IV- Reconciliation of Input Tax Credit (ITC)

Pt. IV(12)- Reconciliation of Net Input Tax Credit (ITC).

12A. ITC availed as per audited Annual Financial Statement for the State/ UT (For multi-GSTIN units under same PAN this should be derived from books of accounts)

ITC availed (after reversals) as per the audited Annual Financial Statement shall be stated here. There may be cases where multiple GSTINs (State-wise) registrations exist on the same PAN. This is common for persons/entities with presence over multiple States.

Such persons/

Only positive values are allowable in this field

12B. ITC booked in earlier Financial Years claimed in the current Financial Year

Any ITC which was booked in the audited Annual Financial Statement of the earlier financial year(s) but availed in the ITC ledger in the financial year for which the reconciliation statement is being filed shall be stated here.

This shall include transitional credit which was booked in earlier years but availed during Financial Year 2017-18. Only positive values are allowable in this field

12C. ITC booked in current Financial Year to be claimed in subsequent Financial Years

Any ITC which has been booked in the audited Annual Financial Statement of the current financial year but the same has not been credited to the ITC ledger for the said financial year shall be stated here.

Only positive values are allowable in this field but while calculating 12D, this shall be treated as negative

12D. ITC availed as per audited financial statements or books of account

ITC availed as per audited Annual Financial Statement or books of accounts as derived from values stated in Table 12A, 12B, and 12C above will be auto

12E. ITC claimed in Annual Return (GSTR9)

Net ITC available for utilization as stated in Table 7J of Annual Return (GSTR9) shall be stated here.

The

12F. Un-reconciled ITC

This shall be the difference between table no 12E and 12D. This field is auto-filled and non-editable

Pt. IV(13)- Reasons for un-reconciled difference in ITC.

Please provide reasons if any.

Pt. IV(14)- Reconciliation of ITC stated in Annual Return (GSTR9) with ITC availed on expenses as per audited Annual Financial Statement or books of account.

14A to 14Q

This table is for reconciliation of ITC stated in the Annual Return (GSTR9) against the expenses booked in the audited Annual Financial Statement or books of account.

The various sub-heads stated under this table are general expenses in the audited Annual Financial Statement or books of account on which ITC may or may not be available.

Further, this is only an indicative list of heads under which expenses are generally booked. Taxpayers may add or delete any of these heads but all heads of expenses on which GST has been paid/was payable are to be stated here.

Any other expenses which are not specifically covered under table no 14A to 14Q then you can click on

14R. Total amount of eligible ITC availed

Total ITC stated in Table 14A to 14Q above shall be auto-populated here and non-editable

14S. ITC claimed in Annual Return (GSTR9)

Net ITC availed as stated in the Annual Return (GSTR9) shall be stated here. Table 7J of the Annual Return (GSTR9) may be used for filing this Table. T

14T. Unreconciled ITC

This shall be the difference between 14S and 14R

Pt. IV(15)- Reasons for un-reconciled difference in ITC

Reasons for non-reconciliation between ITC availed on the various expenses stated in Table 14R and ITC stated in Table 14S shall be stated here.

Pt. IV(16)- Tax payable on un-reconciled difference in ITC (due to reasons stated in 13 and 15 above)

Any amount which is payable due to reasons stated in Tables 13 and 15 above shall be stated here.

Pt. V- Auditor’s recommendation on additional Liability due to non-reconciliation .

PART – B- Certification

Part V consists of the auditor‘s recommendation on the additional liability to be discharged by the taxpayer due to non-reconciliation of turnover or non-reconciliation of the input tax credit.

The auditor shall also recommend if there is any other amount to be paid for supplies not included in the Annual Return. Any refund which has been erroneously taken and shall be paid back to the Government shall also be stated in this table.

Lastly, any other outstanding demands which are recommended to be settled by the auditor shall be stated in this Table.

See How to solve https://127.0.0.1:1585 connection issue of DSC.

GSTR 9C Filing Procedure – Step-by-Step guide

Learn how to generate JSON file of GSTR 9c to upload it on the GST portal.

Part I

1. First of all, ensure that you download the latest version of the GSTR-9C Offline Tool from the GST portal. https://www.gst.gov.in/download/returns

2. Open the GSTR-9C Excel-based Offline Tool and navigate to a worksheet named ‘Home’

3. If you want to open the Offline tool with the previous values you entered, click “Yes” when the dialogue box prompts “Open Saved Version?”. Else clicking “No” will clear all values in all the sheets.

4. Enter your GSTIN in-home sheet. GSTIN will be validated only for the correct structure

5. Select the applicable Financial Year from the drop-down.

6. Enter details as applicable in various worksheets. The worksheet for which no details need to be mentioned can be left blank.

7. Click Validate Sheet to check the status of validation. In case of validation failure; please check for cells that have failed validation and correct errors as per the help text.

8. Click on ‘Generate JSON File to Upload ‘ to generate a JSON file and sign using DSC (Digital Signature Certificate)

While filing Part B of GSTR 9C, the Auditors shall use their membership number without prefixing ‘0’ in their membership number. Thus, If the membership number is ‘016’, then the auditor shall enter ‘16’ on the aforesaid part in the membership number field & not ‘016’.

Part II

1. Auditor shall give this signed GSTR 9C JSON file to the taxpayer for upload

2. Taxpayer shall log in to GST Portal and select ‘Returns Dashboard’

3. Select the applicable Financial Year and Tax-period. Click on Prepare Offline

4. Upload the JSON prepared using offline Tool using the upload option

5. The uploaded JSON file would be validated and processed.

6. In case of validation failure of one or more details in the uploaded JSON; an error file (returns_<Date>_R9C_<GSTIN>error Report.

7. The Taxpayer shall share this error file with t

8. The Auditor shall open the error file in the offline tool using ‘Open GSTR-9C JSON Error file downloaded from GST Portal’. All records along with errors to be populated in respective worksheets with errors descriptions in column ‘GST Portal Validation error(s)’ for the records which have an

Post correction of errors, sign the statement using DSC and generate the JSON file and send it to the taxpayer to upload the same in the GST portal.

9. After the successful upload of data on the GST portal; Taxpayer can Preview the form and file GSTR-9C.

Similar Links

GST Annual Return Extension notification

Check out the GSTR -9 annual return extension for FY 2020-21. see the GST annual return due date extension for FY 2020-21.

GSTR 9C Reconcilation format in Excel

Know the GSTR 9C turnover limit for FY 2020-21 before initiating filing the GSTR 9C reconciliation statement.

How do I file GSTR 9 annual return?

Learn how to file GSTR 9 online, understand the format, and know the applicability. Check out more about the filing of the GST Annual return.

How you can make voluntary payment in GST?

Find out how you can deposit money under GST on a voluntary basis. This process is helpful while paying the liability at the time of filing your GSTR 9. Know more about DRC 03 making payment.

Hi,

I get Error! Invalid Summary payload after uploading json file created through offline tool of gstr 9. kindly help how to solve this error.

Thanks

Hello Ramesh

You have to enter upto two decimal places only in the GSTR-9 offline utility. if you are entering 3 decimal places, you will see the above error. Therefore, kindly change the decimal places to 2 digits and re-generate the json file and upload again.