Download the latest GST offline tool from the below table and prepare your forms, returns in the excel sheet. These tools do not require an internet connection. Thus, you can prepare the return in offline mode and generate JSON file ready to upload on the GST portal. You will learn the GST offline tool download process in simple steps, after going through this article.

GST Excel tools play a very important role in filing GST returns under the Goods and Service Tax system. Thus, one can use this offline tool and prepare the GST returns and other ITC forms without the need for an internet connection.

However, most of the taxpayers are facing issues to work with these offline utilities. This is mostly because the below tools require the latest version of windows. Also, these tools do not support other operating systems like Mac and Linux. Therefore, it is quite possible that many taxpayers are still using Windows XP and trying to do it online. This results in errors while generating a JSON file.

Below GST offline tools generate GST portal compatible JSON file ready to upload with all entered records by the taxpayer. However, due to compatibility issues, some are not able to generate this JSON file.

How to use offline Tool?

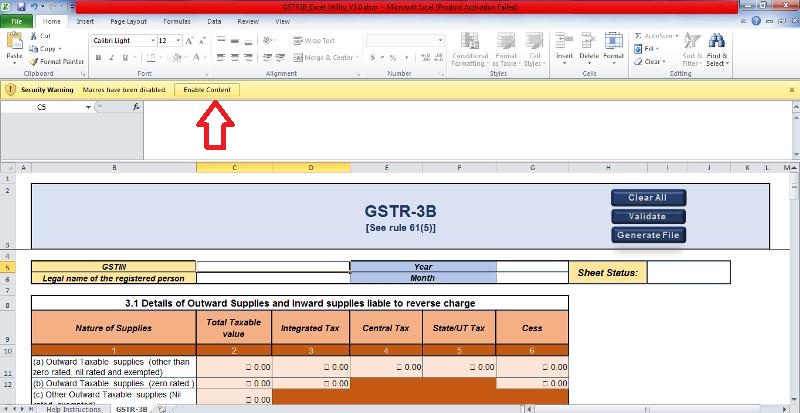

In order to use an offline tool one must have windows 7 pc with the latest updates installed, and Microsoft Excel. Besides this, one must enable the “Macros” in excel to work these tools correctly. you can enable macros by going to Options >Trust center > “Trust center settings” on the right-hand side. Thereafter, click on macro settings > Click to “Enable all macros(not recommended) potentially dangerous code can run” option.

Further click on external content > Click to select “Enable all data connections(not recommended) option. Similarly, click on “Enable automatic update for all workbook links(not recommended) option.

GST offline tool download Table

| Sr.no. | Name of offline Tool | Description | Download Link |

| 1. | GSTR 1 | GSTR 1 offline tool shall be used to enter details of outward supplies of goods or services. | Download |

| 2. | GSTR 3B | With the help of GSTR 3B offline tool taxpayer can prepare the | Download |

| 3. | GSTR 9 | Download GSTR 9 offline to file Annual GST Return. | Download |

| 4. | GSTR 9A | With the help of GSTR | Download |

| 5. | GSTR 9C | GSTR 9C is an offline tool shall be used by chartered accountants to prepare Reconciliation statement and shall be filed in support with GSTR 9 Annual return. | Download |

| 6. | TRAN 2 | If you have a large number of records in section 4 of the Tran-2 form, you can Use this template to fill in the details and generate the JSON file for upload. Secondly, If you have a | Download |

| 7. | ITC 01 | In order to claim the input tax credit in case of new registration, voluntary registration and taxpayer opting out from Composition levy or goods or services becomes taxable shall use ITC 01 Offline tool. | Download |

| 8. | ITC 04 | GST ITC-04 offline tool is an use-full tool for manufacturers and job workers for sending and receiving processed goods back. | Download |

| 9. | GSTR 4 | A composition dealer can use this excel utility to file his return in form GSTR 4. | Download |

| 10. | GSTR 11 | GSTR 11 for Inward supplies statement for persons having Unique Identification Number (UIN) | Download |

| 11. | GSTR 8 | Offline tool for filing Statement for Tax Collection at Source | Download |

| 12. | TRAN 1 | Use this tool to fill details of TRAN 1 | Download |

| 13. | ITC 03 | Excel tool to file ITC – 03 | Download |

| 14. | GSTR 6 | Enter details in GSTR 6 Return for input service distributors in offline mode | Download |

| 15. | GSTR 7 | GSTR 7 Offline tool for filing Return for Tax Deduction at Source | Download |

| 16. | GSTR 10 | Prepare GST Final return after the | Download |

GST offline Tool system requirements

In order to use above GST offline tools smoothly, ensure that you have the below computer compatibility. Here are the most important prerequisites for using GST offline tool.

- You need to have an Operating system minimum Windows 7 or above on your computer. These tools do not work on Linux and Mac. Therefore you can not use these tools on Windows XP if you are still using it.

- Browser: You need one of these browsers installed on your computer system.

- Internet Explorer 10+ [ Recommended]

- Google Chrome 49+

- Firefox 45+

- Microsoft Excel 2007 & above. GST offline tools require a minimum Microsoft excel 2007 program.

- An Uncompress file software like – WinZip or WinRAR is required to extract the downloaded tool.

Installation Video

Kindly go through the below video to download and install offline utility.

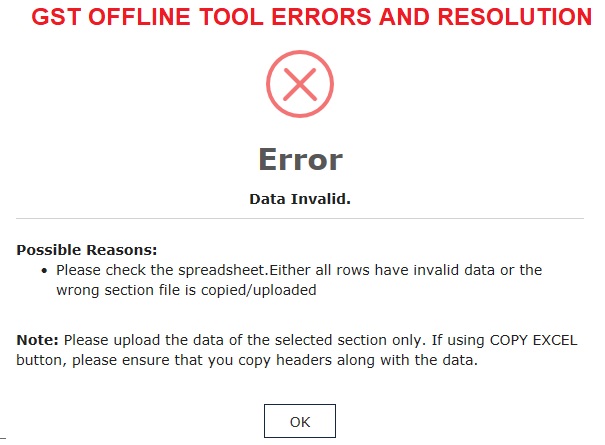

GST offline Tool Error

You may face issues like GST offline tool not working after downloading, not opening in windows 10 after installation and white screen while opening the excel template Etc. Also, Some taxpayers are facing problem on windows 7 machine.

However, we believe if you have the above system requirements on your computer then you should not face such issues.

But still, if you have issues with an offline tool then write a comment below, and we will answer it.

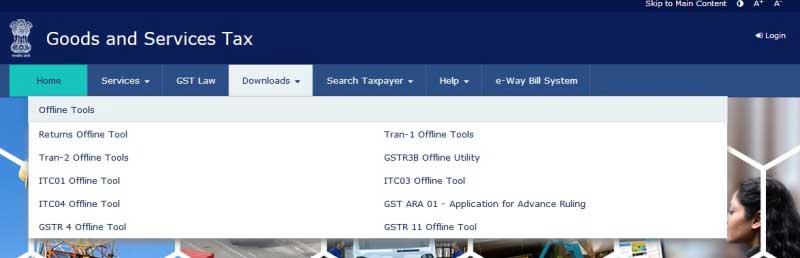

GSTR 3B Offline Tool Download from GST Portal

This guide will explain to you how to download GSTR 3b form in excel format to upload on GST portal. This GSTR 3B offline tool is provided by GSTN to facilitate users to feed the data in offline mode without the need of internet connection. You should download GST form 3b in excel format from its original source i.e GSTN Website.

How to Download GSTR 3B return format in excel form.

1. Visit GST Portal at www.gst.gov.in

2. Go to Downloads > Offline tools > GSTR3B Offline Utility > Click on Download button (No need to login)

3. After completion of downloading, Unzip the downloaded Zip file which contains the GSTR3B_Excel_Utility excel sheet.

4. Open the GSTR3B_Excel_Utility excel sheet by double-clicking on it.

Click here to File GSTR 3B offline Uploader and filing Procedure

This guide is exclusively given for the GSTR 3b return download process through the GST portal. Now you will able to get GSTR 3b download on your computer and start making entries in offline mode. Also, GSTR 3B offline Tool is very easy to use rather than making entries online.

About GST Excel Format

See the GSTR3 3B excel format download procedure from the GST portal. Also, this is known as GST form 3b in excel format or GST offline tool. This is a very easy GSTR 3b excel format download process. This process includes GSTR 3b excel utility v3.0 download or other latest tools download.

Therefore GSTRR 3b format is used for offline return filing under GST. Learn the GSTR 3b format download procedure in very simple steps from our portal. This GSTR 3b format in excel with formula helps to calculate tax automatically. You may also download GSTR 3b format in pdf from our GST forms section.

GSTR 3b in excel format with formula helps taxpayers to calculate tax automatically rather than calculating it manually. Follow these simple steps for GSTR 3b offline tools download and GSTR 3b offline utility download facilities.

General Questions & Answers

1. Download the offline tool from the GST portal at www.gst.gov.in

2. Extract the tool on your computer/laptop

3. Run the setup and complete the installation

4. Double click to open the offline tool icon

5. Prepare the return in offline mode and generate the JSON file

6. upload the JSON file on the GST portal to file the GST return

You can not update the offline Tool. However, you can check the latest version available to download on the GST portal and re-install it on your computer.

The taxpayer can prepare the GST returns in offline mode without the need of the internet by using this tool.

1. Download the offline tool from the GST portal

2. Extract the tool on your computer

3. Open the excel template for entering details of GSTR 9

4. After entering the necessary details, Generate JSON file from the main sheet.

5. Upload the JSON file on the GST portal to file the GSTR 9 return.

Related Articles

Similar Links

- GST Billing Free Software Download for Goods and Services

- Failed to Establish Connection to the Server. Kindly Restart the Emsigner

- Emsigner for GST, MCA and Traces error | Latest version download

- How to Search and verify GST Number online?

- GST Calculator: Learn How to Calculate GST Tax with Formula

- GST Payment online process and status checking with due date

Sir

I am not getting downloads on my GST Portal what shall I do

Please ensure your internet browser compatibility.. it should be minimum Internet Explorer 10+, Google Chrome 49+, Firefox 45+ and Safari 6+. You may also download it from this link..https://tutorial.gst.gov.in/offlineutilities/returns_gstr3b/GSTR3B_Excel_Utility.zip. But this link may change in future. hence you should check your browser compatibility..

GST offline tool not working after downloading, not opening in windows 10 after installation and white screen while opening

Hi chandrashekar

Please check once again if your PC meets above system requirements. Also, you may try installing it on other PC to check if it works. Offline utility works perfectly on windows 10. Let me know if you still face error.

I checked other system also, I face same issue

Ok. i can check it by accessing your PC. please inbox me below details at https://www.facebook.com/gstindianews

1. Team viewer id and password

2. Contact no.

Hi,

I’m also facing the same issue GST offline tool not working after downloading, not opening in windows 10 after installation and white screen while opening. So many times i tried but not working.

Plz, help me to solve this issues.

Hello Ashwini, I have noticed this issue. people are facing this mainly, when they are using pirated windows version. Because many pirated versions does not contain required files to run the gst offline tool. I suggest to go in the control panel >> add remove programs. Check the installed list contains the installations as in image. Click to view. These gets automatically installed while installing windows or by its auto update process. Therefore, if some are missing you may need to install another version. please check with your computer engineer.

Dear Sir , i have been facing the same issue. i have original window 10 and also an updated one. but it does work on my son’s laptop. the only problem is that i can not carry my son’s laptop in the office

i have windows 7 (32-bit)on my laptop. i was using older version of gst offline tool but today gst site asked for the latest version of gst offline tool, so i uninstalled the old version n installed the newer one but its showing blank screen without any message n i even checked on my pc too but same problem is occurring there too. plz help

Hi Reena

I believe you are using Microsoft windows & office legal version. If yes ensure that all automatic updates are on. If not, you are definitely going to face this issue. Alternatively, you may ask your computer engineer to upgrade it to windows 10 ver and check. I hope this helps.

Regards

GSTN offline tool shows starting application and then goes blank. I have updated legal windows 10

Hi Balakrishnan

kindly see the java is uptodate. Also, you may try disabling the antivirus.

regards

Hello Sir

I have downloaded gstr1 error file from portal and uploaded into offline tool then saved the contained bills. After this when i click on generate file to create JASON file it shows some activity but doesnt create any JASON file. For this reason i can not upload my pending bills GSTN server.

Please help.

Hello

Please see that your macros are enabled. check above How to use offline Tool?

regards

Hello Sir

How can i upload the pending vouchers in gstn portal.

portal is rejecting some vouchers to be uploaded through jason file. when i am trying to upload the bills manually on site then it is not saving the bill giving following error

“error gstr1 for the period to which the document pertains has not been filed. please add the document in the said period gstr1”

please help me how can i upload my pending bills.

Thanks

Hi Rajnish

kindly ensure that you are adding the invoices of previous period from 01.04.2019 on wards only. GST portal is not accepting invoices/documents with date prior to this period. You will see a similar error while uploading json file, if you try to add invoices prior to above period.

I hope this helps.

Regards

Hello sir, i am having original windows and java is also upto date but gst offline utility opens blank on starting. I have downloaded the latest utility from the gst site

Hi Mariya,

you can share your contact details to me at jgaonkar@gmail.com and i can take your pc access and check what’s wrong.

Regards

gst offline tool showing blank screen while opening.am using windows 10

Hello

kindly ensure that your windows is upto date with latest patches.

regards

I have orignal window 10. Java is updated. still gst offline tool is not working. I have tried many methods still not working.

My window is also updated and all drivers are updated still gst offline tool not working. The problem is white screen

Hello Mr. Anurag

Just go to your control panel >> ad remove programs and see if the programs are installed as shown in this image > https://gstindianews.info/wp-content/uploads/2020/04/gst-offline-tool-installation-error.png

regards

Sir, I am getting error like File Process Failed while uploading GSTR1 excel file.

Hi,

kindly ensure you download the latest version of offline tool from the GST portal before preparing the return in offline mode. Also, do not forget to enable all the macros in offline excel file.

regards

Hey sir

I am getting error like File Process Failed while uploading GSTR1 excel file.

Hi Priyanka

I believe you are uploading the JSON file and not the excel file. Secondly, ensure that you download the latest offline tool from the GST portal to generate the JSON File. This will resolve your issue.

regards

SIR I AM UNABLE TO OPEN THIS GSTR3B OFFLINE UTILITY AFTER DOWNLODING ANY ONE HELP

hello

please download WINRAR to extract the compressed file.

regards

Dear All who are facing issues in Windows 10 and GST Offline Tool (White Screen). I have after a lot of research found the culprit and the rectification. The culprit is the old NSSM bundled with the package (2014). Remedy is Go to Services and stop GSTOFFLINE64 service. Then visit https://nssm.cc/download and download 2017 version and replace this file in the GST Offline directory. Go to services again and start the GSTOFFLINE64 service.. It will work.

Dear Sir,

recently my system was updated by windows 10.

After then i have downloaded offline tool for gstr1

But while import excel in offline tool it shows date format not correct .

I have xlsx sheets and i have updated date format as dd-mmm-yyyy. but it was not working .

what should i do ?

hello,

Try entering the date in dd/mm/yyyy format and check

Thanks

Dear Sir,

I am using latest version of utility and below are the errors i have faced. I even checked all the sheets, values, numbers but still the same error repeats. Latest version – V3.1.2

Following documents contain invalid inputs:Possible Reasons:•Invalid date format provided for the inputs

•Did not provided the values for required fields

•Given 0 value for invoice number.

•Given 0 value for gross advance received(Gross Advance Received can be saved as 0 only in tool).

•Given 0 value for taxable value(Taxable value can be saved as 0 only in tool).

•Given negative value for invoice/note value or taxable value or tax amounts.

Please Check For Mandatory Fields,Validations,DateFormats(dd-mmm-yyyy) And invoice/note number

Please guide me in resolving this error.

hello,

Which return utility?. if it’s GSTR 1 then try using .csv templates instead of excel file to import the data. because I found few errors in their excel file in the past.

Regards

Gstr1 Json file generated thru gst offline tool (updated to version 3.1.2) is giving error while uploading on portal “File could not be uploaded! Download the latest version of offline tool to generate the JSON file kr ensure to validate your uploaded file against the template published at specification portal”

I tried many times by uninstalling old version, downloading new version and installation fresh. But i am getting same error

Please help

hi, try on different computer and check if it works.

Sir I Downloaded latest version of GST offline tool V3.1.3 and followed all the instruction and but I could not able to generate JSON file for B2B, it shows

Following documents contain invalid inputs:Possible Reasons:•Invalid date format provided for the inputs

•Did not provided the values for required fields

•Given 0 value for invoice number.

•Given 0 value for gross advance received(Gross Advance Received can be saved as 0 only in tool).

•Given 0 value for taxable value(Taxable value can be saved as 0 only in tool).

•Given negative value for invoice/note value or taxable value or tax amounts.

Please Check For Mandatory Fields, Validations, Date Formats(dd-mmm-yyyy) And invoice/note number, please tellme how Can I resolve this problem

hi The dummy data from the downloaded file may not not have entered correctly. Therefore, enter a single invoice entry and find where the error you are facing. Thereafter, enter rest invoices. Refer the help and master sheet for data validation.

Regards

Sir I Downloaded latest version of GST offline tool V3.1.5 and followed all the instruction and but I could not able to generate JSON file for B2B, it shows

Following documents contain invalid inputs:Possible Reasons:•Invalid date format provided for the inputs

•Did not provided the values for required fields

•Given 0 value for invoice number.

•Given 0 value for gross advance received(Gross Advance Received can be saved as 0 only in tool).

•Given 0 value for taxable value(Taxable value can be saved as 0 only in tool).

•Given negative value for invoice/note value or taxable value or tax amounts.

Please Check For Mandatory Fields, Validations, Date Formats(dd-mmm-yyyy) And invoice/note number, please tellme how Can I resolve this problem

Hi

please remove the dummy data you find in the excel template. Thereafter, try to add only 1 record to analyze the issue.

A few months back I found the dummy data is not entered correctly, so if you are proceeding to enter the data as the dummy one, you will see the error.

Similarly, do not the paste the data directly if you are doing so. instead, do it as paste as values.

regards

Sir,

While installing gst offline tool. i m getting error such as ” cannot expand pf64 constant on this window”.

How can i solve it? Please help.

Tried uploading excel on gstr 1offline too 3.1.6. everytime i upload the excel in new template, it shows file process failed. If i upload in old format, it gets through but the resulting json file when uploaded online gives an error that download latest version and then prepare. Have tried almost all the possible methods of copy pasting or csv option, but nothing seems to work.

Please guide me how to go about it

Prachi, I have tried this version on 21.08.2022 and perfectly works on win 10 and office 365. So, try uploading a sample data file that exists in the utility. if that works then you should check whether your data is entered correctly or not.

As far as CSV files are concerned, it did not work and throws an error of data invalid. I am trying to find the cause of this error and will update here as soon I find the solution. I hope this helps.

regards

macros are not enable in gstr9c. i tried many ways to enable it but not working . in piwrited excel it is working

Try it in different MS office version or on another computer..